Ryanair 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

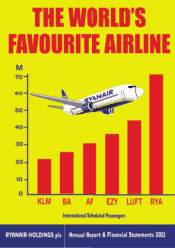

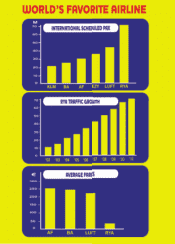

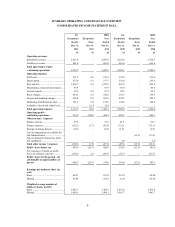

Over the past year Ryanair accommodated 72.1m passenger bookings, at an average fare of 139. These

passengers have saved an average of 17bn over the high fares being charged by our higher fare competitors incl.

easyJet, Aer Lingus, Air France, British Airways and Lufthansa.

Our people

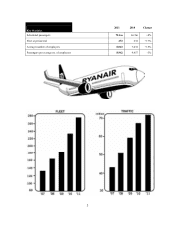

Over the past year, average employment numbers in Ryanair rose by 15% from 7,032 to 8,063. Within

this number, more than 350 people were promoted as Ryanair’s growth created new opportunities for career

development and progression. Ryanair’s people know that they can advance their careers by taking advantage of

our commitment to promote from within wherever possible. I am pleased that after two years of pay freezes, we

were able to grant our people a small pay increase in April with an average 2% rise in basic pay, subject to

performance, across most grades. In addition, Ryanair continues to improve our rosters in order to maximise our

people’s productivity while they are at work, while also maximising their time off.

Our shareholders

Unlike other airlines, Ryanair continues to put our shareholders and their interests at the front and

centre of our activity. Unlike other airlines, the Board and Management team in Ryanair have a significant stake

in the company. We think and act over the short and medium and long term, like shareholders, because we are

substantial shareholders.

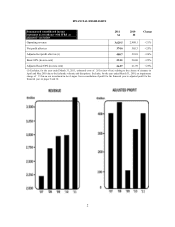

Our 2011 net profit after tax of 1401m ($565m) makes Ryanair the world’s most profitable low fares

airline as highlighted by Air Transport World in July 2011.

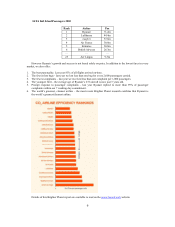

The World’s Leading Value Airlines - Net Profit

Rank Airline $’000

1 Ryanair $565,000

2 Southwest Airlines $459,000

3 AirAisa Berhad $346,501

4 easyJet $191,627

5 Cebu Pacific $158,482

6 WestJet $136,720

7 Gol $128,570

8 IndiGo Airlines $122,211

9 JetBlue Airways $97,000

10 Air Arabia $84,303

Over the past year, Ryanair paid a dividend of over 1500m to shareholders. This brings total funds

returned to shareholders (through share buybacks and dividends) to almost 1850m over the past three years. We

are extremely proud that we have returned more funds to shareholders, than the total net equity funds raised

from them since we floated in 1997.

As a capital intensive company, in a very cyclical industry, it would be wrong for shareholders to

expect a continuous dividend stream. We intend to continue to build up cash, so that we can avail of

opportunities including aircraft purchases, or acquisitions that will enhance Ryanair’s profitability and our

returns to shareholders. Shareholders may rest assured that since the Board and Management of Ryanair

continue to be significant shareholders in the company, our interests and theirs remain at one.