Ryanair 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 4

Chairman’s Report

Dear Shareholders,

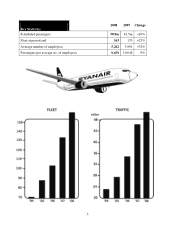

I am very pleased to report a 20% increase in adjusted net profit after tax to a record 1481m. This

has been achieved despite higher fuel prices and significantly increased airport charges particularly at

our largest bases at Stansted and Dublin.

During this year we achieved a number of significant milestones:

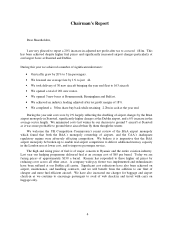

• Our traffic grew by 20% to 51m passengers.

• We lowered our average fare by 1% to just 144.

• We took delivery of 30 new aircraft bringing the year end fleet to 163 aircraft.

• We opened a total of 201 new routes.

• We opened 3 new bases at Bournemouth, Birmingham and Belfast.

• We achieved an industry leading adjusted after tax profit margin of 18%.

• We completed a 1300m share buy back while retaining 12.2bn in cash at the year end.

During the year unit costs rose by 2% largely reflecting the doubling of airport charges by the BAA

airport monopoly in Stansted, significantly higher charges at the Dublin airport, and a 6% increase in the

average sector length. We minimised costs last winter by our decision to ground 7 aircraft at Stansted

as it was more profitable to ground these aircraft than fly them though the winter.

We welcome the UK Competition Commission’s recent review of the BAA airport monopoly

which found that both the BAA’s monopoly ownership of airports, and the CAA’s inadequate

regulatory regime were adversely effecting competition. We believe it is imperative that the BAA

airport monopoly be broken up to enable real airport competition to deliver additional runway capacity

in the London area at lower cost, and to improve passenger service.

The high and rising price of fuel is of major concern to Ryanair and the entire aviation industry.

Last year our hedging programme delivered fuel at an average cost of $65 per barrel. Today we are

facing prices of approximately $130 a barrel. Ryanair has responded to these higher oil prices by

reducing costs across all other areas. A company wide pay freeze was implemented and redundancies

have been suffered at our Dublin call centre. Significant cost reductions have also been achieved on

airport, maintenance, and handling contracts, and we will benefit from the addition to our fleet of

cheaper and more fuel efficient aircraft. We have also increased our charges for baggage and airport

check-in as we continue to encourage passengers to avail of web check-in and travel with carry on

luggage only.