Ryanair 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

European Regulatory Failure

The European Union’s discriminatory passenger compensation legislation (which applies only to

airlines but not to competing ferry, train or bus travel), continues to increase the cost of air travel for

consumers with no perceptible benefit for the vast majority of passengers. This legislation has proven

totally ineffective – as we predicted – in reducing the cases of denied boarding for European passengers.

If the European Union was really serious about denied boarding, they would simply outlaw the practice

of overbooking as Ryanair has advocated. Instead we have a ludicrous and discriminatory

compensation regime under which airlines are obliged to pay compensation and/or overnight expenses

to passengers who are disrupted due to factors which have nothing to do with the airline such as bad

weather, strikes, or the repeated ATC (Air Traffic Control) failures. Airlines should not have to pay

these unjustified expense or compensation claims while the ferries, trains and buses are totally exempt.

The European Commission’s repeated failure to take any action against the blatant abuses of the

state aid rules in the cases of Air France, Lufthansa, Olympic and Alitalia, proves yet again that the

European Commission cannot be trusted to apply its own rules fairly or impartially in the case of flag

carrier airlines. The annual state aid bail-out of Alitalia’s extraordinary losses have become a joke. Air

France continues to receive hundreds of millions annually in unlawful state aid through discounted

airport charges on French domestic routes. Lufthansa continues to benefit from unlawful state aid

through the annual losses incurred by the state owned, state subsidised, loss making Terminal 2 at

Munich. The Greek government continues to bail out Olympic’s annual losses with not so much as a

murmur of action from the European Commission while Alitalia continues to fly despite in recent weeks

receiving another entirely unlawful state aid “loan” of 1300m from the Italian government which has

been miraculously “transformed” into equity in the company.

Conclusion

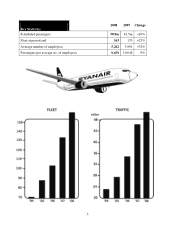

Ryanair remains committed to continuing to revolutionise air travel across Europe. In the coming

year we expect to grow to almost 60 million passengers by guaranteeing our passengers the lowest fares

and no fuel surcharges. Over the past ten years our traffic has grown from under 4 million passengers to

over 50 million. During that time our average fare has fallen from 152 to just 144 today. No other

airline or transport provider can demonstrate this decade long commitment to competition and lower

fares. Ryanair will continue to pursue lower costs and pass on these savings in the form of lower air

fares. We will continue to challenge monopoly abuses by Dublin and Stansted Airports, we will

continue to fight anti-competitive and anti-consumer regulation from the European Commission and

airport regulators in the UK and Ireland. We will continue to champion the best interests of consumers

at a time when they are being gouged for higher fares and unjustified fuel surcharges by our high fare

flag carrier competitors.

I sincerely regret that our share price over the last 12 months has fallen significantly from its

previous high, but as one of Ryanair’s largest shareholders, I am determined to grow your company and

remain confident that our earnings and share price will rebound strongly when the irrational exuberance

which currently effects the oil market settles down, as it inevitably will. This coming winter will be a

challenging one for Ryanair and the wider European airline industry, but Ryanair is well positioned to

exploit the opportunities which will undoubtedly arise from the significant capacity reductions and

consolidations which these turbulent times will deliver.

Yours sincerely,

Michael O’Leary