Ryanair 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

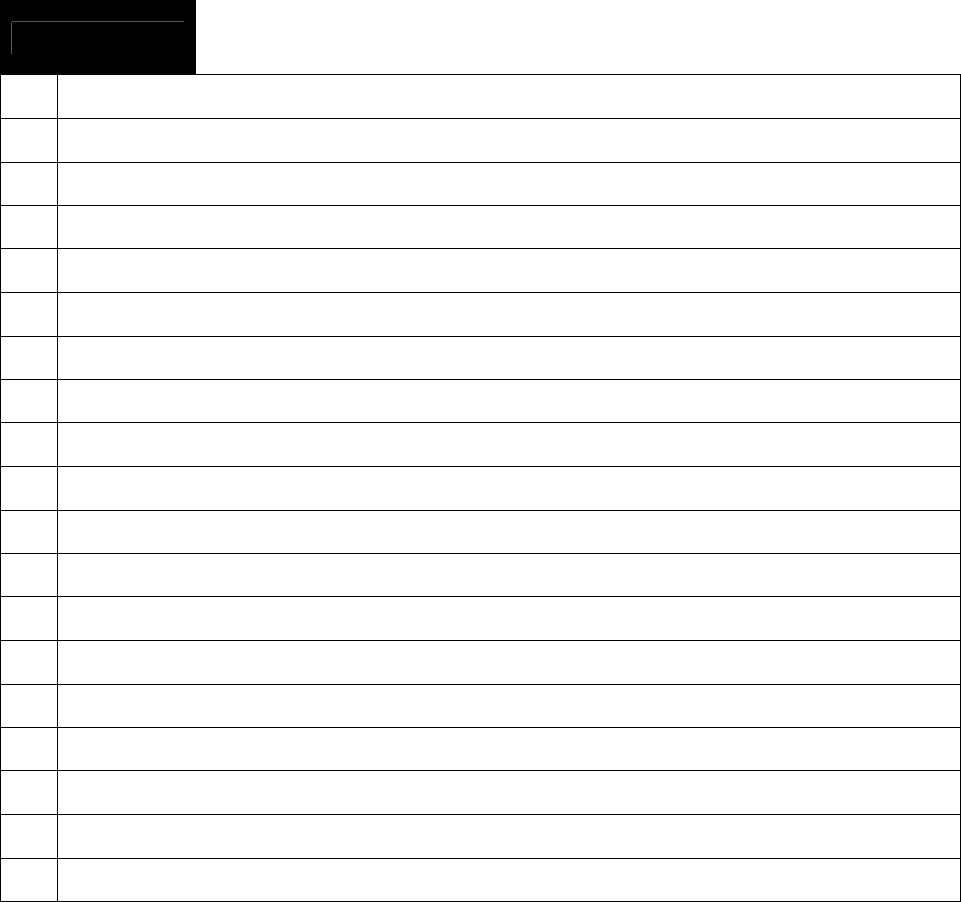

CONTENTS

2 Financial Highlights

4 Chairman’s Report

6 Chief Executive’s Report

11 Operating and Financial Review

20 Directors’ Report

29 Directors

31 Social, Environmental and Ethical Report

35 Report of the Remuneration Committee to the Board

36 Statement of Directors’ Responsibilities

38 Independent Auditor’s Report to the Members of Ryanair Holdings plc

41 Consolidated Balance Sheet

42 Consolidated Income Statement

43 Consolidated Cash Flow Statement

44 Consolidated Statement of Recognised Income and Expense

45 Notes Forming Part of the Consolidated Financial Statements

90 Company Balance Sheet

91 Company Cash Flow Statement and Statement of Recognised Income and Expense

92 Notes Forming Part of the Company Financial Statements

95 Directors and Other Information

Certain information included in these statements are forward looking and are subject to certain risks and uncertainties

that could cause actual results to differ materially. It is not reasonably possible to itemise all of the many factors and specific

events that could affect the outlook and results on an airline operating in the European economy. Among the factors that are

subject to change and could significantly impact the Group’s expected results are the airline pricing environment, the availability

and cost of fuel, competition from new and existing carriers, market places for replacement aircraft, costs of compliance with

environmental issues and emission standards, safety and security measures, actions of the Irish, UK, European Union (“EU”) and

other Governments and their respective regulatory agencies, fluctuations in currency exchange rates and interest rates, airport

access and charges, labour relations, terrorist acts, the economic environment of the airline industry, the general economic

environment in Ireland, the UK and Continental Europe, the general willingness of passengers to travel and other economic,

social and political factors.

Table of contents

-

Page 1

... aircraft, costs of compliance with environmental issues and emission standards, safety and security measures, actions of the Irish, UK, European Union ("EU") and other Governments and their respective regulatory agencies, fluctuations in currency exchange rates and interest rates, airport... -

Page 2

...tax) which arose on the sale of 6 Boeing 737-800 aircraft and an accelerated depreciation charge of 19.3m (net of tax) in relation to the agreement to dispose of aircraft at future dates in 2009 and 2010. The 2007 adjusted net profit excludes a release of 134.2m due to a prior year tax overprovision... -

Page 3

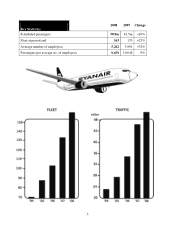

2008 Key Statistics Scheduled passengers Fleet at period end Average number of employees Passengers per average no. of employees 50.9m 163 5,262 9,679 2007 42.5m 133 3,991 10,648 Change +20% +23% +32% -9% 3 -

Page 4

...A company wide pay freeze was implemented and redundancies have been suffered at our Dublin call centre. Significant cost reductions have also been achieved on airport, maintenance, and handling contracts, and we will benefit from the addition to our fleet of cheaper and more fuel efficient aircraft... -

Page 5

... on our current fuel hedging position and fares falling by 5% we expect to record a full year result of between breakeven and a loss of 160m. We believe that higher oil prices will not signal the end of low fare air travel, but it will stimulate our growth as passengers switch to Ryanair to avoid... -

Page 6

... after tax. Passengers flock to Ryanair because only we guarantee the lowest fares, and we alone guarantee no fuel surcharges as well, not today, not tomorrow, not ever! As we enter an era of higher oil prices and economic recession, passengers can safely make bookings on Ryanair.com secure in the... -

Page 7

... seats, business lounges, frequent flyer clubs, etc. Ryanair delivers the customer service which passengers really want, namely 1. 2. 3. 4. 5. the lowest fares, the best punctuality, the fewest cancellations, the least lost bags, Europe's youngest, greenest, cleanest fleet of Boeing 737-800 aircraft... -

Page 8

... customer airlines don't want. These two airports provide an abject passenger service while increasing passenger charges by many multiples of the rate of inflation. In the last 12 months the BAA Stansted monopoly has doubled Ryanair's passenger charges. Ryanair welcomes the recent report of the UK... -

Page 9

... prices charged by our high fare competitors. The fact that Ryanair can save European consumers over 15 billion (while at the same time guaranteeing the lowest fares, no fuel surcharges) and still make a record Net Profit margin of 18%, proves yet again that in the airline industry competition works... -

Page 10

... Commission and airport regulators in the UK and Ireland. We will continue to champion the best interests of consumers at a time when they are being gouged for higher fares and unjustified fuel surcharges by our high fare flag carrier competitors. I sincerely regret that our share price over the... -

Page 11

Operating and Financial Review Consolidated Income Statement Pre Exceptional Results Mar 31, 2008 1'000 Operating revenues Scheduled revenues ...Ancillary revenues ...Total operating revenues -continuing operations Operating expenses Staff costs...Depreciation ...Fuel & oil ...Maintenance, materials... -

Page 12

... ended March 31, 2007 1000 435,600 Profit for the financial year Adjustments Accelerated depreciation on property, plant and equipment ...Loss on impairment of available for sale financial asset...Gain on disposal of property, plant and equipment...Tax adjustment for above...Release of income tax... -

Page 13

... year offset by a lower depreciation charge of 19.6m due to a revision of the residual value of the fleet to reflect current market valuations and the positive impact on amortisation of the stronger euro versus the US dollar. See note 2 to the consolidated financial statements. Fuel costs rose by 14... -

Page 14

... in the US dollar and Sterling exchange rates against the euro. Exceptional items Accelerated depreciation of 110.6m (19.3m net of tax) arose in relation to the agreement to dispose of aircraft at future dates in 2009 and 2010. Gains on disposal of property, plant and equipment of 112.1m (110... -

Page 15

... by 1436.7m reflecting the impact of the IFRS accounting treatment for derivative financial assets, pensions, available for sale financial assets, stock option grants and a share buy back. See details in note 16 to the consolidated financial statements. Capital expenditure During the year the Group... -

Page 16

... the attraction of Ryanair's guaranteed lowest fares, as consumers become more price sensitive and switch away from high fare/fuel surcharging airlines like BA. Higher oil prices will speed up the decline of high fare shorthaul travel this winter as many European airlines consolidate or go bust. We... -

Page 17

... and low fares. However, Ryanair is confident that its agreements with publicly owned airports fully comply with the market economy investor principle (MEIP), i.e. they are the same as its agreements with privately owned airports, and therefore do not constitute state aid. In 2007 and 2008, the... -

Page 18

... pilots to undergo a conversion training process to enable them to fly the new Boeing 737-800 aircraft. Starting in the autumn of 2004, Ryanair made a number of written offers to its Dublin based pilots to enable them to participate in a re-training process in order to obtain the correct type rating... -

Page 19

Treasury policy, fuel, currency and interest rate risk management Details of our principal treasury policies are set out in notes 5 and 11 to the consolidated financial statements. Additional performance measures The Group has referred to a number of additional performance measures throughout this ... -

Page 20

...to the financial function. The books of account of the Company are maintained at its registered office, Corporate Headquarters, Dublin Airport, Co. Dublin, Ireland. Staff At March 31, 2008, the Group employed 5,920 people. This compares to 4,462 staff at March 31, 2007. The increase in staff levels... -

Page 21

... 31, 2008 the free float in shares was 95% SHAREHOLDERS HELD AT 30.06.08 % OF ISSUED SHARE CAPITAL HELD AT 31.03.08 Capital Research and Management Company Fidelity Investments Gilder Gagnon Howe and Co. LCC Chieftain Capital Management Inc. Michael O'Leary Bank of Ireland Asset Management Ltd... -

Page 22

... Bonderman has a shareholding in the Company of 14,117,360 ordinary shares, equivalent to 0.95% of the issued share capital. Having considered this shareholding in light of the number of issued shares in Ryanair Holdings plc and the financial interest of the director, the Board has concluded that... -

Page 23

... management for briefing on the Group's developments and plans. Directors can only be appointed following selection by the Nomination Committee and approval by the Board and by the shareholders at the Annual General Meeting. Ryanair's Articles of Association require that all of the directors retire... -

Page 24

... Manager-Engineering, the Deputy Director - Ground Operations, the Deputy Director - Safety, the Health and Safety Officer, the Chief Engineer and the Flight Safety Manager. The Air Safety Committee meets regularly to discuss relevant issues and reports to the Board on a quarterly basis. The number... -

Page 25

... principal tasks are to consider financial reporting and internal control issues. The Audit Committee, which consists exclusively of independent non-executive directors, meets at least quarterly to review the financial statements of the Group, to consider internal control procedures and to liaise... -

Page 26

...a clearly defined organisational structure along functional lines and a clear division of responsibility and authority in the Group; • a comprehensive system of internal financial reporting which includes preparation of detailed monthly management accounts, providing key performance indicators and... -

Page 27

... at every Annual General Meeting. The directors who held office at March 31, 2008 had no interests other than those outlined in note 19 to the financial statements in the shares of the Company or Group companies. Dividend policy Due to the capital intensive nature of the business and the Group... -

Page 28

... with Section 160(2) of the Companies Act 1963, the auditor KPMG, Chartered Accountants, will continue in office. Annual General Meeting The Annual General Meeting will be held on September 18, 2008 at 10am in the Radisson Hotel, Dublin Airport, Co. Dublin, Ireland. On behalf of the Board... -

Page 29

...on the Dublin and NASDAQ stock markets in 1997. He is also a Chairman of Elan Corporation plc, and he serves as a director of a number of Irish private companies. James R. Osborne (Director) A director of Ryanair Holdings plc since August 1996, and has been a director of Ryanair Limited since April... -

Page 30

... A chemical engineer by training, after 9 years in process design and research and Development at KTI corp, he has served as an executive at KTI Group, Bain & Company, General Electric, Enel, Ducati Motor Holding and Sviluppo Italia. His previous board memberships included different companies of the... -

Page 31

Social, Environmental and Ethical Report Social The Group's aim is that employees understand the Group's strategy and are committed to Ryanair. The motivation and commitment of our people is key to our performance. The Group's policy is that training, career development and promotion opportunities ... -

Page 32

... on the environment: - Efficient seat density (189-seat, all economy configuration on a Ryanair aircraft as opposed to 162 seat, two-class configuration used by traditional network airlines- reducing fuel burn and emissions per seat kilometre flown); - High load factors (reducing fuel burn and... -

Page 33

... trading Ryanair proves that air transport can be environmentally friendly whilst continuing to deliver huge economic benefits in terms of the lowest cost air travel for consumers, increased tourism, regional and social cohesion, job creation, inward investment, etc. In terms of the environment air... -

Page 34

... Environmental controls are generally imposed under Irish law through property planning legislation specifically the Local Government (Planning and Development) Acts of 1963 to 1999, the Planning and Development Act 2000 and regulations made there under. At Dublin Airport, Ryanair operates on land... -

Page 35

...a consultancy basis on safety issues and also by way of share options. Full details are disclosed in note 19(b) and 19(d) to the consolidated financial statements. Executive director remuneration The elements of the remuneration package for the Executive director are basic salary, performance bonus... -

Page 36

... financial statements on the going concern basis unless it is inappropriate to presume that the Group and the Company will continue in business. The directors are responsible for keeping proper books of account that disclose with reasonable accuracy at any time the financial position of the Company... -

Page 37

... of the state of the Group's affairs as at March 31, 2008, and of its profit for the year then ended; and the Directors report includes a fair review of the development and performance of the business and the position of the Group together with a description of the principal risks and uncertainties... -

Page 38

... if, in our opinion, any information specified by law or the Listing Rules of the Irish Stock Exchange regarding directors' remuneration and transactions is not disclosed and, where practicable, include such information in our report. We review whether the Corporate Governance Statement reflects the... -

Page 39

... the Annual Report, and consider whether it is consistent with the audited financial statements. The other information comprises only the Chairman's and Chief Executive's report, the Operating and Financial review, the Directors' Report, the Social, Environmental and Ethical report and the Report of... -

Page 40

The net assets of the Company as stated in the Company balance sheet on page 90 are more than half of the amount of its called up share capital, and, in our opinion, on that basis, there did not exist at March 31, 2008, a financial situation which, under Section 40(1) of the Companies (Amendment) ... -

Page 41

...Current tax...Total current liabilities ...Non-current liabilities Provisions ...Derivative financial instruments...Deferred income tax ...Other creditors...Non-current maturities of debt...Total non-current liabilities ...Shareholders' equity Issued share capital...Share premium account ...Capital... -

Page 42

... operations ...Operating expenses Staff costs ...Depreciation ...Fuel & oil...Maintenance, materials & repairs ...Marketing & distribution costs ...Aircraft rentals...Route charges ...Airport & handling charges ...Other...Total operating expenses ...Operating profit - continuing operations ...Other... -

Page 43

... of property, plant and equipment...Loss on available for sale financial asset ...(Increase)/decrease in interest receivable ...Increase in interest payable...Retirement costs ...Share based payments...Income tax (paid)...Net cash provided by operating activities ...Investing activities Capital... -

Page 44

... to profit or loss ...Net movements into cash flow hedge reserve ...Net (decrease)/increase in fair value of available for sale asset ...Impairment of available for sale asset written off to the income statement...Net movements (out of)/into available for sale financial asset...Total income... -

Page 45

...Holdings plc" ("we", "our", "us", "Ryanair" or the "Company") and currently operates a low fares airline headquartered in Dublin, Ireland. All trading activity continues to be undertaken by the group of companies headed by Ryanair Limited. Statement of compliance In accordance with the International... -

Page 46

... date of the relevant share options. Any non-current assets classified as held for sale are stated at the lower of cost or fair value less costs to sell. The preparation of financial statements requires management to make judgements, estimates and assumptions that affect the application of policies... -

Page 47

... environment. In addition, during the year ended March 31, 2008, accelerated depreciation of 110.6m arose in relation to the agreement to dispose of aircraft at future dates in 2009 and 2010. Heavy maintenance An element of the cost of an acquired aircraft is attributed on acquisition to its service... -

Page 48

...0m lower combined maintenance and depreciation charge for the current year, than what the charge would have otherwise been using the historical estimation method. Basis of consolidation The consolidated financial statements comprise the financial statements of Ryanair Holdings plc and its subsidiary... -

Page 49

... flow hedges of foreign currency purchases of property, plant and equipment. Depreciation is calculated so as to write off the cost, less estimated residual value, of assets on a straight line basis over their expected useful lives at the following annual rates: Rate of Depreciation 20-33.3% 20% 33... -

Page 50

...property, plant and equipment, and are recognised net within other income in profit and loss. During the year ended March 31, 2008, accelerated depreciation of 110.6m arose in relation to the agreement to dispose of aircraft at future dates in 2009 and 2010. Aircraft maintenance costs The accounting... -

Page 51

...accounted for as described below. The fair value of interest rate swaps is computed by discounting the projected cash flows on the company's swap arrangements to present value. The fair value of forward exchange contracts and commodity contracts is their quoted market price at the balance sheet date... -

Page 52

... to acquire an aircraft to a third party and subsequently leases the aircraft back, by way of an operating lease. Any profit or loss on the disposal where the price achieved is not considered to be at fair value is spread over the period the asset is expected to be used. The profit or loss amount... -

Page 53

... using a Binomial Lattice option pricing model, which takes into account the exercise price of the option, the current share price, the risk free interest rate, the expected volatility of the Ryanair Holdings plc share price over the life of the option and other relevant factors. Non market... -

Page 54

...certain derivative financial instruments, available for sale assets, pensions and other post retirement obligations). Current tax payable on taxable profits is recognised as an expense in the period in which the profits arise using tax rates enacted or substantively enacted at the balance sheet date... -

Page 55

... users of the financial statements to evaluate the nature and financial effects of the business combination. The impact on the Group will be dependent on the nature of any future acquisition. IFRS 8 - Operating Segments was issued in November 2006 replacing IAS 14, Segmental Reporting (effective... -

Page 56

... to private operators, and how existing IASB literature should be applied to service concession arrangements. This IFRIC is not expected to have an impact on Ryanair's financial statements. IFRIC 13 - Customer Loyalty Programmes (effective July 1, 2008). This interpretation deals with accounting for... -

Page 57

... payments and options on aircraft. This amount is not depreciated. The cost and net book value also includes capitalised aircraft maintenance, aircraft simulators and the stock of rotable spare parts. Aircraft assets also include the fair value of certain foreign currency on firm commitments to buy... -

Page 58

... of 14 aircraft at future dates in 2009 and 2010. 3 Intangible assets At March 31, 2008 1000 Landing rights ...46,841 2007 1000 46,841 Landing slots were acquired with the acquisition of Buzz Stansted Limited in April 2003. As these landing slots have no expiry date and are expected to be used in... -

Page 59

... of 158.1m (2007: 1344.9m), bringing Ryanair's total holding in Aer Lingus to 29.3% (2007: 25.2%). The balance sheet value of 1311.5m reflects the market value of this investment as at March 31, 2008 (2007: 1406.1m). In accordance with the Company's accounting policy, these assets are held at fair... -

Page 60

...are primarily Sterling pounds and U.S. dollar. The Group manages this risk by matching Sterling revenues against Sterling costs. Surplus Sterling revenues are used to fund forward foreign exchange contracts to hedge U.S. dollar currency exposures that arise in relation to fuel, maintenance, aviation... -

Page 61

...one year ...Non-current liabilities Losses on fair value hedging instruments - maturing after one year ...Losses on cash flow hedging instruments - maturing after one year ...Total derivative liabilities ...Net derivative financial instrument position at year end ...10,228 10,228 10,228 2007 1000 52... -

Page 62

Foreign currency forward contracts are utilised in a number of ways: forecast Sterling pounds and euro revenue receipts are converted into U.S. dollars to hedge against forecasted U.S. dollar payments principally for jet fuel, insurance, capital expenditure and other aircraft related costs. These ... -

Page 63

... Gallileo Galilei SpA...16% 13% No other customer accounted for more than 10% of our accounts receivable balance at either March 31, 2008 or 2007. At March 31, 2008 10.7m (2007: 10.8m) of our total accounts receivable balance was past due of which 10.1m (2007: 10.2m) was impaired and provided for... -

Page 64

... asset. The Group uses derivative financial instruments, principally jet fuel derivatives, interest rate swaps and forward foreign exchange contracts to manage commodity risks, interest rate risks, currency exposures and achieve the desired profile of borrowings and leases. It is the Group's policy... -

Page 65

... been used to determine the estimated amount Ryanair would receive or pay to terminate the contracts. Discounted cash flow analyses are based on estimated future interest rates. Derivatives - currency forwards and aircraft fuel contracts: a comparison of the contracted rate to the market rate for... -

Page 66

... highly probable forecast fuel purchases. (c) Maturity and interest rate risk profile of financial assets and financial liabilities At March 31, 2008, the Group had total borrowings of 12,266.5m (2007: 11,862.1m) from various financial institutions provided primarily on the basis of guarantees... -

Page 67

... long term debt ...Debt swapped from floating to fixed...Secured long term debt after swaps Finance leases ...Total floating rate debt...Total long term debt...5.17% 5.92% 5.63% 2.70% 2008 1000 57,363 64,492 121,855 121,855 2009 1000 60,758 66,072 126,830 126,830 2010 1000 64,379 67,719 132... -

Page 68

... on a quarterly basis with finance leases repricing on a semi-annual basis. We use current interest rate settings on existing debt at each year end to calculate contractual cash flows. Fixed interest rates on financial liabilities are fixed for the duration of the underlying structures (typically... -

Page 69

... pounds and U.S. dollars) due to the international nature of its operations. The Group manages this risk by matching Sterling pound revenues against Sterling pound costs. Any unmatched Sterling pound revenues are used to fund U.S. dollar currency exposures that arise in relation to fuel, maintenance... -

Page 70

... principally from airline travel on scheduled services, car hire, inflight and related sales. Revenue is wholly derived from European routes. No individual customer accounts for a significant portion of total revenue. At March 31, 2008 10.7m (2007: 10.7m) of our total accounts receivable balance was... -

Page 71

...bank loans for the acquisition of aircraft. The Company had cash and liquid resources at March 31, 2008 of 12,169.6m (2007: 12,198.0m). During the year, the Company funded its 1937.1m in purchases of property, plant and equipment, a 1300m share buy-back programme and the acquisition of an additional... -

Page 72

... March 31, 2007 2008 1000 1000 Current income tax (assets)/liabilities Corporation tax (prepayment)/provision ...Total current tax...Deferred income tax liabilities (non-current) Origination and reversal of temporary differences on property, plant and equipment, derivatives, pensions, and available... -

Page 73

...fiscal 2008, the Irish headline corporation tax rate remained at 12.5%. Ryanair.com Limited is engaged in international data processing and reservation services. In these circumstances, Ryanair.com Limited is entitled to claim 10% corporation tax rate on profits derived from qualifying activities in... -

Page 74

..." aircraft (2007: 15) in addition to 32 in previous years. The present value of the net pension obligation before tax of 12.0m (2007: 17.0m) in Ryanair Limited. See note 21 for further details. • 15 Issued share capital, share premium account and share options (a) Share capital At March 31, 2008... -

Page 75

...,396) 34,788,609 The mid-market price of Ryanair Holdings plc's ordinary shares on the Irish Stock Exchange at March 31, 2008 was 12.80 (2007: 15.83). The highest and lowest prices at which the Company's shares traded on the Irish Stock Exchange in the year ended March 31, 2008 were 16.33 and 12.55... -

Page 76

... has accounted for its share option grants to employees at fair value, in accordance with IFRS 2, using a binomial lattice model to value the option grants. This has resulted in a charge of 110.9m (2007: 13.9m) being recognised within the income statement in respect of employee services rendered... -

Page 77

...fair value of available for sale asset ...Share based payments...Retirement benefits...Sub total Profit for the year...Balance at March 31, 2007 ...Issue of ordinary equity shares (net of issue costs) ...Repurchase of ordinary equity shares ...Creation of capital redemption reserve fund ...Effective... -

Page 78

... Year ended March 31, 2007 1000 241,990 22,972 60,079 37,063 362,104 Non-flight scheduled...Car hire ...In-flight...Internet income ... All of the Group's operating profit arises from low fares airline-related activities, its only business segment. The major revenue earning assets of the Group are... -

Page 79

... and other information Year ended March 31, 2008 1000 Directors' emoluments: -Fees ...-Other emoluments, including bonus and pension contributions ...Depreciation of property, plant and equipment...Depreciation of property, plant and equipment held under finance leases ...Auditor's remuneration... -

Page 80

... Practice PEN-11. (d) Shares and share options (i) Shares Ryanair Holdings plc is listed on the Irish, London and Nasdaq Stock Exchanges. The beneficial interests as at March 31, 2008 and 2007 of the directors and of their spouses and minor children in the share capital of the Company are as follows... -

Page 81

... funds the pension entitlements of certain employees through defined benefit plans. Two plans are operated for eligible Irish and UK employees. In general, on retirement, a member is entitled to pension calculated at 1/60th of final pensionable salary for each year of pensionable service, subject to... -

Page 82

... the Irish and UK schemes use the PMA/PFA92 mortality tables for calendar year 2020, for current employees, which include sufficient allowance for future improvements in mortality rates. Retirement ages for scheme members are 60 for pilots and 65 for staff. The current life expectancies underlying... -

Page 83

... in the consolidated income statement in respect of our defined benefit plans is as follows: Year ended March 31, 2008 1000 Included in payroll costs Service cost...Included in finance expense Interest on pension scheme liabilities ...Expected return on plan assets ...Net finance expense ...Net... -

Page 84

... asset class: Equities 8.5% (2007: 7.75%); Corporate and Overseas Bonds 6.60% (2007: 5.35%); and Other 5.0% (2007: 4.75%). Since there are no suitable euro-denominated AA rated corporate bonds, the expected return is estimated by adding a suitable risk premium to the rate available from Government... -

Page 85

...: Release of income tax overprovision ...Accelerated depreciation on property, plant and equipment ...Loss on impairment of available for sale financial asset...Gain on disposal of property, plant and equipment...Adjusted basic EPS...Adjusted diluted EPS ...Number of ordinary shares (in 000's) used... -

Page 86

... Contract ...17 117 Total... Firm Aircraft Deliveries Fiscal 2009-2012 3 136 139 Total "Firm" Aircraft 103 153 256 Basic price per aircraft (U.S.$'m) 50.885 50.916 The remaining 46 aircraft on hand at March 31, 2008 giving a total fleet of 163 aircraft - 128 owned and 35 leased - were delivered... -

Page 87

..., not taking such increases and decreases into account, will be up to U.S.$7.0 billion. (At March 31, 2007 the potential commitment was U.S.$7.53 billion to acquire 148 "firm" aircraft). a) Total future minimum payments due under operating leases At March 31, 2007 2008 1000 1000 78,210 75,322 78,210... -

Page 88

... and liquid resources exceed debt. 25 Post balance sheet events Pursuant to the share buy-back program announced in February 2008, from April 1, 2008 to July 16, 2008, the Company has repurchased 11.9 million shares at a total cost of 133m. This is equivalent to 0.8% of the issued share capital of... -

Page 89

... Dublin Airport Co Dublin Corporate Headquarters Dublin Airport Co Dublin Nature of Business Airline operator Darley Investments Limited*... August 23, 1996 (acquisition) Investment holding Company Ryanair.com Limited* ... August 23, 1996 (acquisition) International data processing services... -

Page 90

... ...At March 31, 2007 2008 1000 1000 90,263 79,338 28 Current assets Loans and receivables from subsidiaries ...29 Total assets ...Current liabilities Amounts due to subsidiaries ...Shareholders' equity Issued share capital ...Share premium account ...Capital redemption reserve ...Retained... -

Page 91

Company Cash Flow Statement Year ended March 31, 2008 1000 Operating activities Profit for the year...Net cash provided by operating activities Investing activities (Increase) in loans to subsidiaries ...Net cash used in investing activities ...Financing activities Shares purchased under share buy ... -

Page 92

... to 2006. The directors have reviewed all EU endorsed IFRSs as set forth in note 1 to the consolidated financial statements, and have concluded their adoption will not have a significant impact on the parent entity financial statements. Share based payments The Company accounts for the fair value... -

Page 93

... ended March 31, 2007 1000 35,172 35,172 At March 31, 2008, Ryanair Holdings plc had borrowings of 135,171,745 (2007: 135,171,745) from Ryanair Limited. The loan is interest free and repayable on demand. 31 Financial instruments The Company does not undertake hedging activities on behalf of itself... -

Page 94

... covered by this exemption, which are not listed as principal subsidiaries at note 26 are Airport Marketing Services Limited, FRC Investments Limited and Coinside Limited. 34 Date of approval The Consolidated and Company financial statements were approved by the Board on July 16, 2008. 94 -

Page 95

... and other Information Directors D. Bonderman M. O'Leary E. Faber M. Horgan K. Kirchberger K. McLaughlin J. Osborne P. Pietrogrande Chairman Chief Executive Secretary Registered Office J. Callaghan Corporate Headquarters Dublin Airport Co. Dublin Ireland KPMG - Chartered Accountants 1 Stokes Place... -

Page 96

96