Public Storage 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

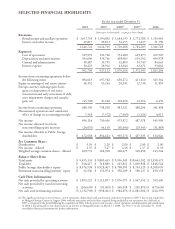

Ancillary Operations

(Amounts in millions)

Revenues Net income

2010 2009 2010 2009

Merchandise sales $ 25 $ 30 $ 7 $ 9

Tenant reinsurance premiums 65 63 55 53

Totals $ 90 $ 93 $ 62 $ 62

Merchandise sales declined for many reasons, most importantly, poor sales execution. We

are working to improve execution and pricing in 2011. Tenant reinsurance continues to

improve as a greater percentage of existing customers use this product. We expect this trend

to continue.

Dividend Policy

Since 1990, our dividend policy has been to distribute only our taxable income attributable to

common shareholders. While we may have been the first public REIT to have adopted this policy,

as discussed below, our philosophy before 1990 was quite different.

Over the last 20 years, we have paid dividends of about $30 per share and retained earnings of

$22 per share. During this period, our share price has increased from $7 to $101, so it would

appear that a dollar of retained earnings has produced more than a dollar of value. In 2010, our

REIT dividend pa4.

Our dividends will increase as a percentage of our earnings for two reasons. First, the extraordinary

tax benefits we realized from structuring the 2006, $5.5 billion Shurgard merger as taxable are

nearly gone. Second, most of our earnings come from properties we have owned a long time

and which have ever decreasing levels of depreciation. We will continue our long stated policy

of setting our dividends based on our taxable income. However, in future years we will have

less earnings to reinvest in a productive, tax efficient manner.

30th Anniversary as a Public Company

We had our 30th anniversary as a public company in 2010. In 1980, our Company, then called

Storage Equities, went public at $15 per share, raising $30 million. We were one of many entities

sponsored by the private company, Public Storage, which was founded in 1972. In 1995, we

acquired the private company and were renamed “Public Storage.”

(4) Green Street Advisors, Real Estate Securities Monthly, March 2011.