Public Storage 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Funds from operations (“FFO”) is a term defined by the National Association of Real Estate Investment Trusts, generally

defined as net income before depreciation expense and gains and losses on sale of real estate. Operating earnings represents

FFO earned at our consolidated real estate locations, combined with FFO before EITF D-42 benefits from our equity

investments (primarily PSB and Shurgard Europe). We believe that FFO is helpful to investors, because net income includes

the impact of depreciation, which assumes that real estate declines in value predictably over time, while we believe that real

performance or our ability to pay dividends.

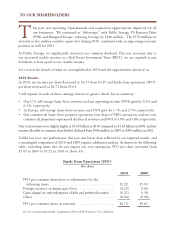

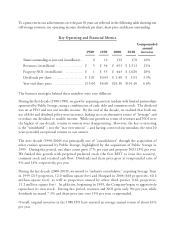

Supplemental Non-GAAP Disclosures (unaudited)

Reconciliation of Net Income to FFO

For the year ended December 31,

(Amounts in thousands, except per share amounts) 2010 2009 2008

Net income: $ 696,114 $ 790,456 $ 973,872

Depreciation and amortization, including equity

earnings, unconsolidated real estate investments and

discontinued operations 415,496 404,438 488,866

Gain on sale, includes our equity share of PSB and

discontinued operations (10,302) (40,119) (336,545)

Net cash provided by operating activities 1,101,308 1,154,775 1,126,193

Preferred unitholders, based upon distributions paid

and redemptions (6,330) 62,545 (21,612)

Other noncontrolling equity interests in subsidiaries (19,585) (20,231) (21,904)

Funds from operations 1,075,393 1,197,089 1,082,677

Less - allocations (to) from:

Preferred shareholders, based upon distributions paid

and redemptions (240,634) (226,213) (205,870)

Restricted share unitholders (2,645) (3,285) (3,263)

Equity Shares, Series A, based upon distributions paid

and redemptions (30,877) (20,524) (21,199)

FFO allocable to our common shareholders $ 801,237 $ 947,067 $ 852,345

Weighted average common shares for purposes of

computing fully-diluted FFO per common share 169,772 168,768 168,675

FFO per common share $ 4.72 $ 5.61 $ 5.05

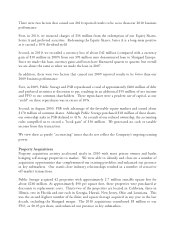

Reconciliation of Operating Earnings to Net Income

For the year ended December 31,

(Amounts in thousands) 2010 2009

Operating earnings $ 1,213,240 $ 1,196,774

Interest and other income excluding Shurgard Europe 3,896 4,981

Depreciation and amortization / includes equity in earnings (415,116) (402,237)

General and administrative expense (38,487) (35,735)

Interest expense (30,225) (29,916)

Equity share of EITF D-42, acquisition costs and real estate disposition gain for PSB (943) 16,959

Real estate disposition and early debt retirement gain, and asset impairment charges (1,505) 37,540

Foreign currency exchange (loss) gain (42,264) 9,662

Discontinued operations 7,518 (7,572)

Net income $ 696,114 $ 790,456