Public Storage 2008 Annual Report Download - page 8

Download and view the complete annual report

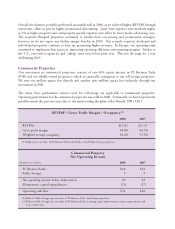

Please find page 8 of the 2008 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We expect a challenging commercial property market in 2009 as a result of lower “asking” rents, increased

concessions and more customer failures. We have the management team to deal with these challanges and to

improve our competitive position.

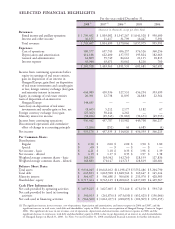

Summary of Operating Results

Overall, our operating results were satisfying in 2008 across all portfolios. We continued to refine our

marketing, pricing and operating strategies, as well as our personnel. As with most good companies, we

continually try to “raise the bar,” so there are always opportunities. We have a solid operating

management team, but I think we can improve over the course of 2009. Despite the challenging

economic environment, we are stepping up our investment in technology, operating systems and people

in 2009. We hope to expand upon our competitive advantages while some of our competitors are

struggling.

Capital Markets

In prior letters I have explained our rationale for “leveraging” our company with perpetual preferred

stock instead of debt. I have also explained its principal attributes: a permanent fixed rate

structure, we can call it after five years without penalty and no financial covenants. Like debt,

preferred stock has a fixed return, but no recourse against the Company’s assets and no maturity

date. Accordingly, for purchasers of preferred stock it is riskier than debt and they demand a higher

return (coupon rate) than if they purchased debt.

Let’s assess the wisdom of this financial strategy in the context of the dramatic changes in the global

capital markets this year. To understand the turbulent change in the cost of capital, it is important to

put things in context. In the first quarter of 2007, by any measure, the real estate industry reached a

zenith. Our Company’s stock traded above $110 per share, while the newspapers headlined Blackstone

Group’s $30 billion acquisition of Equity Office Properties (the largest REIT in America at the time)

at record high prices with Blackstone’s concurrent re-sale of some properties at even higher prices.

Real estate in the public and private markets was “selling” at sub 4% yields, while ten-year U.S.

Treasuries were yielding about 5%. What was happening in the housing market—buy today, finance

100% with easy terms and low rates, sell tomorrow at a profit—was happening in the commercial real

estate market.

Commercial mortgage debt could be issued at 40 to 50 basis points over ten-year swap treasuries,

historical lows. Convertible debt, a funding source not typically utilized by REITs, was issued at

rates of 1%-2%. Logically, companies took advantage of the abundant supply of inexpensive

capital. They in turn deployed this cheap capital into an already over-heated commercial real estate

market, bidding prices ever higher with each deal. For the really aggressive, they deployed capital into

property development and large “land banks,” double leveraging their investments with joint

venture equity and additional leverage inside the joint venture, i.e., turbo leverage. Similar to

private equity sponsors, various fees were charged to these structures, which rolled into income