Public Storage 1996 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1996 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

P

UBLIC

S

TORAGE

, I

NC

. 1996 A

NNUAL

R

EPORT

upgraded our credit rating, reducing our cost

of new capital. The merger significantly

reduced internal conflicts inherent in the

separate advisor/property manager format.

Institutional investor interest in our corpora-

tion has improved. We believe we experi-

enced numerous positives from the merger

throughout 1996 and expect this direction to

be maintained in the future.

C

APITALIZING

O

N

E

STABLISHED

C

OMPETITIVE

S

TRENGTHS

We believe that Public Storage possesses

strengths which are difficult for our competi-

tors to reproduce. These include:

•Strong operating business

•Financial strength

•Trade name

•Market share

•Geographic diversification

•Management

Strong operating business.

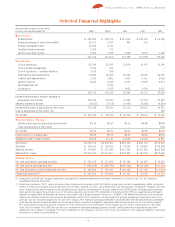

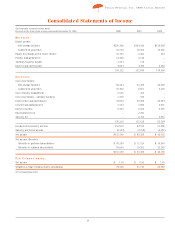

Funds from

operations (FFO) per common share is con-

sidered a key measure of the performance of

Public Storage. FFO per common share

advanced 14 percent, from $1.73 per share for

the year ended December 31, 1995, to $1.98

per share for the year ended December 31,

1996. We are adding to shareholder value by

practicing a conservative approach to distri-

butions. Retaining a substantial portion of

funds from operations (after funding Public

Storage’s distributions and capital improve-

ments) enables us to acquire and develop

properties and reduce debt using internal

cash resources. In this regard, Public Storage

differs significantly from its competitors, a

difference we believe is a favorable factor in

our long-term business plans. We distributed

44 percent of FFO per common share for

1996 and 52 percent for 1995. Through our

relatively moderate payout ratio in 1996

we retained $71 million of free capital to

purchase and develop properties.

Occupancy levels have historically repre-

sented one of the simplest but most efficient

windows into the strength and success of our

business. They show the balance between the

forces of supply and demand and the effects

of our promotional activities. For the year

ended December 31, 1996, occupancy at the

self-storage properties on a Same Store

basis averaged 91.2 percent, compared

to 90.1 percent one year earlier. Same

Stores are the 951 mini-warehouses that

Public Storage has had an interest in since

January 1, 1993.

The amount of rent Public Storage collects

bears an important connection to occupancy

trends. To the extent feasible we try to

generate rising or high occupancy levels and

rising rental rates. Same Store average

annual realized rent represents the actual

revenue earned per occupied square foot

and is a more relevant measure than posted

rental rates. Same Store average annual

realized rent was $8.76 per square foot for

the year ended December 31, 1996, com-

pared to $8.40 per square foot for the same

period of 1995, an increase of 4.3 percent.

Same Store revenues equaled $445.6 million

for the year ended December 31, 1996, com-

pared to $422.9 million for the same period

one year earlier, an increase of 5.4 percent.

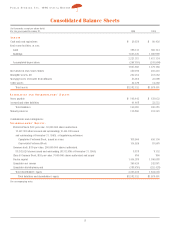

Financial strength.

We have a strong bal-

ance sheet. Total assets, total debt, and total

shareholders’ equity are barometers of our

balance sheet strength. As of December 31,

1996, Public Storage’s assets totaled approx-

imately $2.6 billion, a $635 million increase

from approximately $1.9 billion one year

earlier. Public Storage’s debt-to-equity ratio

was reduced from approximately 10 per-

cent at December 31, 1995 to 5 percent at

December 31, 1996. Low debt leverage in

conjunction with our access to capital should

position us to respond to investment oppor-

tunities in our industry. Shareholders’ equity

equaled $2.3 billion as of December 31, 1996,

approximately 41 percent greater than the

$1.6 billion reported one year earlier.

Public Storage’s common stock achieved

all-time highs during 1996. Public Storage

responded to its strong financial position dur-

ing 1996 by completing two separate pre-

ferred stock offerings, raising $260 million,

and two common stock offerings,

raising approximately $129 million.

In March 1997, Public Storage com-

pleted a common stock offering that

raised approximately $127 million.

Since January 1, 1993, Public

Storage has issued approximately

$1.022 billion of equity capital, the

proceeds of which were used to

reduce debt and acquire interests in

self-storage properties.

Public Storage completed eight merger

transactions with affiliates in 1996, acquiring

105 properties.

In December 1996, Public Storage and two

affiliates, Public Storage Properties XIV, Inc.,

and Public Storage Properties XV, Inc.,

agreed, subject to certain conditions, to

merge. Requirements for the mergers include

the approval by the shareholders of each of

the affiliates. If approved, the mergers are

expected to be completed during the first half

of 1997. These affiliates collectively own 31

self-storage properties and two business

parks. Public Storage currently owns about

one-third of the capital stock of each of these

affiliates and manages the properties. We are

continuing to evaluate transactions with

other affiliates whose properties are man-

aged by Public Storage.

From January 1, 1994 through Decem-

ber 31, 1996, Public Storage acquired, in

cash tender offers, limited partnership inter-

ests in partnerships of which Public Storage

is a general partner for an aggregate pur-

chase price of approximately $86 million.

These acquisitions are intended to reduce

minority interest in the long-term and increase

Public Storage’s ownership interest in its

current property portfolio.

Trade name.

Public Storage’s 1,064 self-

storage or self-storage/ business park combi-

nations operate under the most recognized

trade name in the self-storage industry. We

believe that this enables us to provide conti-

nuity from one rental experience to the next,

customers being able to expect the same

level of quality and professionalism regard-

less of which Public Storage property they

The industry’s most enduring icon.

Stock Performance

(1)

The value of the Company’s common stock

has increased, reflecting in part growth

opportunities in the Company’s business.

STOCK PRICE RANGE

High Low Close

1996

1st quarter $21

7

⁄

8

$18

7

⁄

8

$20

3

⁄

8

2nd quarter 21

1

⁄

2

19

3

⁄

8

20

5

⁄

8

3rd quarter 22

5

⁄

8

19

7

⁄

8

22

5

⁄

8

4th quarter 31

3

⁄

8

22

1

⁄

4

31

1995

1st quarter $17

1

⁄

8

$13

1

⁄

2

$17

2nd quarter 17

1

⁄

8

15

1

⁄

4

16

3

⁄

8

3rd quarter 18

3

⁄

4

16

3

⁄

8

18

5

⁄

8

4th quarter 19

3

⁄

4

17

3

⁄

8

19

(1) The common stock has been listed on the New

York Stock Exchange since October 19, 1984.

The ticker symbol is PSA.