Public Storage 1996 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1996 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P

UBLIC

S

TORAGE

, I

NC

. 1996 A

NNUAL

R

EPORT

19

ships and common stock in eight affiliated REITs. Such interests consist of ownership interests ranging from 15% to 45% and are accounted for using

the equity method of accounting. Accordingly, earnings are recognized by the Company based upon the Company’s ownership interest in each of the

partnerships and REITs. Provisions of the governing documents of the partnerships and REITs provide for the payment of preferred cash distribu-

tions to other investors (until certain specified amounts have been paid) without regard to the pro rata interest of investors in current earnings.

Equity in earnings of real estate entities for 1996 and 1995 principally consists of the Company’s pro rata share of earnings for those interests

acquired in the PSMI Merger. During 1996 and 1995, the Company recognized earnings from its investments of $22,121,000 and $3,763,000,

respectively, and received cash distributions totaling $27,326,000 and $5,580,000, respectively. Included in equity in earnings of real estate enti-

ties for 1996 and 1995 is the Company’s share of depreciation expense ($9,556,000 and $926,000, respectively) and environmental costs ($510,000

in 1995, none in 1996) of the real estate entities. In addition, equity in earnings of real estate entities includes amortization totaling $7,894,000 in

1996 and $1,119,000 in 1995 (from date of the PSMI Merger through the end of the year) representing the amortization of the Company’s cost basis

over the underlying book value of the Company’s equity interest in each of the entities. At December 31, 1996, the unamortized excess of the

Company’s investment over its equity in the underlying net assets of these real estate entities at the date of acquisition was approximately

$154.5 million.

Summarized combined financial data (based on historical cost) with respect to those real estate entities in which the Company had an owner-

ship interest at December 31, 1996 are as follows:

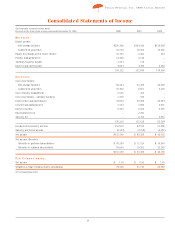

Year ended December 31,

(In thousands) 1996 1995

Rental income $180,197 $172,675

Total revenues 182,036 175,150

Cost of operations 65,417 62,542

Depreciation 27,332 27,368

Net income 75,937 69,467

Total assets, net of accumulated depreciation 834,695 839,775

Total debt 89,349 95,305

Total equity 710,118 708,768

6. M

ORTGAGE

N

OTES

R

ECEIVABLE

F

ROM

A

FFILIATES

At December 31, 1996, mortgage notes receivable of $25,016,000 bear interest at stated rates ranging from 7.4% to 14.0% and are secured by

13 self-storage facilities owned by affiliates of the Company.

During 1996, the Company acquired a $1,970,000 mortgage note receivable from a third party (secured by a self-storage facility) and provided

loans totaling $1,739,000 to affiliated limited partnerships. During 1995, in connection with the PSMI Merger, the Company acquired mortgage notes

receivable totaling $6,667,000 which are secured by self-storage facilities owned by affiliated entities.

The Company canceled mortgage notes with a net carrying value of $700,000 and $16,435,000 during 1996 and 1995, respectively, as part of

the acquisition cost of the underlying real estate facilities securing the mortgage notes (Note 4).

7. R

EVOLVING

L

INE OF

C

REDIT

As of December 31, 1996, the Company had no borrowings on its unsecured credit agreement with a group of commercial banks. On February 25,

1997, the credit agreement was amended (the “Credit Facility”) to increase the available borrowings to $150.0 million and extend the expiration

date to July 31, 2001. The expiration date may be extended by one year on each anniversary of the credit agreement. Interest on outstanding

borrowings is payable monthly. At the option of the Company, the rate of interest charged is equal to (i) the prime rate or (ii) a rate ranging from

the London Interbank Offered Rate (“LIBOR”) plus 0.40% to LIBOR plus 1.10% depending on the Company’s credit ratings and coverage ratios, as

defined. In addition, the Company is required to pay a quarterly commitment fee of 0.250% (per annum) of the unused portion of the Credit Facility.

The Credit Facility allows the Company, at its option, to request the group of banks to propose the interest rate they would charge on specific bor-

rowings not to exceed $50 million. However, in no case may the interest rate proposal be greater than the amount provided by the Credit Facility.

Under covenants of the Credit Facility, the Company is required to (i) maintain a balance sheet leverage ratio of less than 0.40 to 1.00, (ii) main-

tain net income of not less than $1.00 for each fiscal quarter, (iii) maintain certain cash flow and interest coverage ratios (as defined) of not less

than 1.0 to 1.0 and 5.0 to 1.0, respectively and (iv) maintain a minimum total shareholders’ equity (as defined). In addition, the Company is limited

in its ability to incur additional borrowings (the Company is required to maintain unencumbered assets with an aggregate book value equal to or

greater than three times the Company’s unsecured recourse debt) or sell assets. The Company was in compliance with the covenants of the Credit

Facility at December 31, 1996.