Progressive 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

With few exceptions, we held our preferred stock posi-

tions throughout the year, and benefited as financial

institutions improved and, in some cases, added equity to

their capital structure providing greater support for our

positions. The dramatic recovery from low levels distorts

single-year reporting, but the decision to hold was well

considered, with more upside than down, and proved to

be a good one. Notwithstanding, we expect to hold fewer

preferred stocks in the future and have changed our guide-

lines to require that outcome but with no requirement to

take actions counter to our best judgment to attain that

position in an artificial time frame.

While our preferred stock position was the focus of most

of our attention, it was not the only asset sector that war-

ranted significant attention. Our active management of

the fixed-income portfolio allows us to have a thoughtful

thesis on our selections, even within sectors that are sub-

ject to additional macro market risk— municipal bonds

and commercial real-estate bond structures are two easy

examples for the year. We were pleased with our perform-

ance in each sector for 2009 and, although the portfolio still

has a higher proportion of lower-risk treasuries than we

may hold through 2010, we plan to be very prudent but

purposeful in assuming additional risk.

With comprehensive income in positive territory, the

mechanics of our variable dividend policy were very much

back in play. Applying the 20% target established by the

Board to our after-tax underwriting income of $764 mil-

lion and further adjusting by the companywide Gainshare

factor of.71, a shareholder dividend of16.13 cents per share

was declared. We’re pleased with our variable dividend

approach and, while not satisfying to have declared no div-

idend for 2008, it was exactly the right approach to capital

management at the time.

The 2009 dividend, while only one way to facilitate a

return of capital to shareholders, represents the largest

regular dividend we have paid to date. For 2010, the Board

of Directors has proposed an increased target of 25% of

after-tax underwriting income. Consistent with our long-

standing and continuing position on capital management—

to repurchase shares when our capital balances, view of

the future, and the company’s stock price make it attrac-

tive to do so—we repurchased

11.1

million shares in the open

market mostly during the latter part of the year. Repur-

chase activity was moderate compared to historic levels,

reflecting in part our view of required capital adequacy for

2009 and volatility in the equity markets.

Book value at year end increased by 37% to $8.55 per

share (post dividend accrual) and our debt-to-total capital

ratio was back in line with our guideline at 27.5%.

Investments

Last year in this letter I editorialized that I had trouble

typing the $1.4 billion we had recognized in net realized

losses, including other-than-temporary impairments. This

year I have no such trouble. We attained a 12.5% fully tax-

able equivalent return for 2009, but as the mirror analogy

suggests, this too needs greater context.

Was last year as poor as the numbers suggested? Possibly

not. Accounting guidance that exists now from the Finan-

cial Accounting Standards Board would have changed the

accounting for last year had it been in place. While impor-

tant, it’s not the context that matters.

We think a better context is to use what I have referred

to as the more consistent “all-in” economic data point of

comprehensive income, a measure combining income

statement results with balance sheet recognition of changes

in unrealized gains or losses. We believe strongly that this

measure takes out any timing issues of asset impairment

or asset disposition and values assets at market, best

reflecting the health of the company.

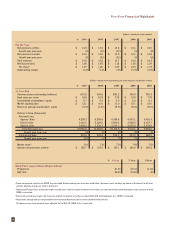

Based on that belief, we added a table of comprehensive

income to our monthly disclosures and hope that it is in-

sightful for readers. Comprehensive income for 2009 was

$1.75 billion (I had no trouble typing that) or $2.61/share

versus a comprehensive loss of $615 million in 2008. We

ended 2009 with a net unrealized gain of nearly

$700

million, a significant swing from last year’s position of

more than $100 million in unrealized losses.

With all appropriate adjustments to the fair value of

assets, we started the year with a little less than $6.4 bil-

lion in capital. During the first quarter, we hit a low point

closer to $6.3 billion, still, as we reported, several hundred

million above the sum of our statutory capital requirement

and our self-constructed extreme contingency reserve.

While our capital had been greatly diminished in 2008

and early 2009, our capital management practices allowed

us the luxury of managing through the effects of reduced

asset valuations and we were not forced to sell securities at

low values or turn to external sources to restore capital bal-

ances. We had continued belief that the assets we held, and

specifically our financial preferred stocks, would be far more

likely to appreciate from our now re-established book values

than they were to fall further. Our preferred stock portfolio

ended 2009 with net unrealized gains of $533 million and

received nearly $150 million of dividends during the year.

Our confidence in holding these positions stemmed from

three reasons:we were very forthright in recognizing their

changed fair value and expected no surprises to our capital

position even without recovery; we were effective in “de-risk-

ing” the portfolio to protect the company’s ongoing operations;

and performance from insurance operations was strong.