Progressive 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Clearly, the consumer demand generation objective

of a brand is essential and, in 2009, we were served well,

but for me there is an even bigger contribution to our

customer care culture that has been served by our brand-

building efforts. Employees at every level identify with

Flo, and with the positive brand characteristics she

demonstrates to customers and shoppers —even her

quirkiness. When we challenge ourselves with the ques-

tion —“Who does the customer expect to answer the

phone or settle a claim?,” the immediate answer is clear

and, while common sense suggests it will not be Flo, the

expectations are unchanged.

Our customer-focused agenda has been a source of

some pride for us over the past several years but the

model of brand ambassadorship exhibited by Flo, and

accepted by all employees with similar enthusiasm,

ensures the critical congruence of brand messaging

and brand execution.

Late in the second quarter, and continuing through the

second half of the year, we saw the emergence of stronger

new application growth in our Agency business. This was a

very positive sign we had not seen for some time.While net

growth in Agency auto policies in force for the year was

slight, it reversed a multi-year declining trend. We always

have theories on the pricing adequacy of our competitors

and were not surprised when some increased rates in

amounts that outstripped our estimates of loss-cost trends.

Relative positioning on price is an important consideration

in the Agency business and being comfortable with our rate

level when others need additional rate is a position we like

to be in. We have also taken additional measures to present

our rates to agents such that they can ensure the consumer

is offered the best options we can make available.

We consider our access to consumers via independent

agents and directly, now primarily via the Internet, to be a

significant strategic advantage over many in our space.

The strategies are largely the same in each channel and,

although our advertising is designed to incent consumers

to shop with us directly, our recognition and support of

consumer choice is unwavering. Agents have consis

-

tently expressed support for, and excitement about, our

brand-building efforts and the positive reflection it has

on their business.

Our Agency business remains the larger portion of our

Personal Lines business and the dominant part of our

Commercial Auto production. The Direct business, which

perhaps reflects consumers’ changing buying habits, is

now substantial. Against the relatively flat growth in cus-

tomers in Agency, Direct grew 13% for the year and is now

about 43% of our personal auto policies in force. Both busi-

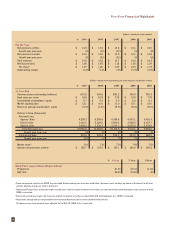

nesses produced combined ratios between 93 and 94 for

personal auto for the year. Of some note is that the annual

trend in average written premium is relatively flat

for the

Agency business,

and still quite negative for Direct, at-4%,

tempering Direct’s top line growth to 11%.

Aggregate measures of combined ratio ultimately are

most important, and our goal of an aggregate companywide

96 in any calendar year is unchanged. With room for some

debate, the Agency auto business, along with the special

lines and Commercial Auto businesses, are best thought of

as variable cost acquisition businesses for which calendar-

year combined ratio is an accurate assessment.

The key to controlling the Direct business is having a

very clear understanding of target margins during the life

of a policy, based on an accepted recognition period for

acquisition costs, and an ability to predict policy life ex-

pectancy by consumer segment with some reliability. With

a substantial base of renewal business in the Direct book,

our calendar combined ratios have been consistently

below 96. However, under certain high growth new busi-

ness scenarios, we would be happy to see the reported

monthly and calendar-year combined ratios go above 96

for our Direct business, as long as our new and renewal

business consistently meets predefined targets that ensure

a lifetime result at or below 96.

Surpassing aggregate written premium of $14 billion

in 2009 was welcomed, but it’s not the first time we have

We respect the environment and are mindful of the

impact of our actions, as evidenced by our offer to

fund the planting of a tree in a U.S. National Forest

on behalf of each of the first one million customers

who chose to go paperless by receiving their policy

documents online.