Progressive 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- APP.-B-6 -

- 1 - REPORTING AND ACCOUNTING POLICIES

NATURE OF OPERATIONS The Progressive Corporation,an insurance holding company formed in 1965,owns 68 subsidiaries

and has 1mutual insurance company affiliate and 1reciprocal insurance company affiliate (the Company) as of December 31,

2003.The insurance subsidiaries and affiliates provide personal automobile insurance and other specialty property-casualty

insurance and related services throughout the United States.The Company’s Personal Lines segment writes insurance for

private passenger automobiles and recreation vehicles through both an independent agency channel and a direct channel.

The Company’s Commercial Auto segment writes insurance for automobiles and trucks owned by small businesses primarily

through the independent agency channel.

BASIS OF CONSOLIDATION AND REPORTING The accompanying consolidated financial statements include the accounts of

The Progressive Corporation, its subsidiaries and affiliates.All of the subsidiaries and the affiliates are wholly owned or

controlled.All intercompany accounts and transactions are eliminated in consolidation.

ESTIMATES The Company is required to make estimates and assumptions when preparing its financial statements and

accompanying notes in conformity with accounting principles generally accepted in the United States of America (GAAP).

Actual results could differ from those estimates.

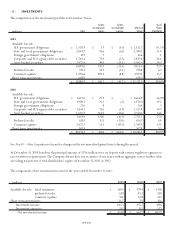

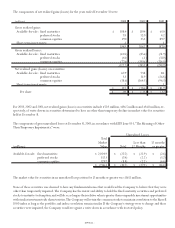

INVESTMENTS Available-for-sale: fixed maturity securities are debt securities, which may have fixed or variable principal

payment schedules, may be held for indefinite periods of time, and may be used as a part of the Company’s asset/liability

strategy or sold in response to changes in interest rates,anticipated prepayments,risk/reward characteristics,liquidity needs

or similar economic factors.These securities are carried at market value with the corresponding unrealized appreciation or

depreciation,net of deferred income taxes,reported in accumulated other comprehensive income.Market values are obtained

from a recognized pricing service or other quoted sources.The asset-backed portfolio is accounted for under the retrospective

method; prepayment assumptions are based on market expectations.For interest only and non-investment-grade asset-backed

securities,the prospective method is used in accordance with the guidance prescribed by Emerging Issues Task Force Issue

(EITF) 99-20,“Recognition of Interest Income and Impairment on Purchased and Retained Beneficial Interest in Securitized

Financial Assets.”

Available-for-sale: equity securities include common equities and nonredeemable preferred stocks and are reported at

quoted market values.Changes in the market values of these securities,net of deferred income taxes,are reflected as unrealized

appreciation or depreciation in accumulated other comprehensive income.Changes in value of foreign equities due to foreign

currency exchange rates are limited by foreign currency hedges; unhedged amounts are not material and changes in value

are recognized in income in the current period.The Company held no foreign equities or foreign currency hedges during

2003 or 2002.

Trading securities are securities bought principally for the purpose of sale in the near term and,when not material to the

Company’s financial position, cash flows or results of operations, are reported at market value within the available-for-sale

portfolio.The Company had no trading securities at December 31,2003; derivatives used for trading are discussed below.In

prior years,the net activity in trading securities was not material to the Company’s financial position or cash flows; the effect

on results of operations is separately disclosed in Note 2 - Investments.To the extent the Company has trading securities,changes

in market value would be recognized in income in the current period.

Derivative instruments may include futures, options,forward positions,foreign currency forwards and interest rate swap

agreements and may be used in the portfolio for risk management or trading purposes or to hedge the exposure to: changes

in fair value of an asset or liability (fair value hedge); foreign currency of an investment in a foreign operation (foreign currency

hedge); or variable cash flows of a forecasted transaction (cash flow hedge).These derivative instruments would be recognized

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2003, 2002 and 2001