Progressive 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

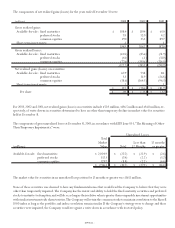

Debt includes amounts the Company has borrowed and contributed to the capital of its insurance subsidiaries or borrowed

for other long-term purposes. Market values are obtained from publicly quoted sources. Interest on all debt is payable

semiannually and all principal is due at maturity.There are no restrictive financial covenants.

The 6.25% Senior Notes,the 6.375% Senior Notes and the 6 5⁄8% Senior Notes (collectively,“Senior Notes”) may be redeemed

in whole or in part at any time,at the option of the Company,subject to a “make whole”provision.All other debt is noncallable.

Prior to issuance of the Senior Notes, the Company entered into forecasted debt issuance hedges against possible rises in

interest rates. Upon issuance of the applicable debt securities, the hedges were closed.Pursuant to SFAS 133, the Company

recognized, as part of accumulated other comprehensive income, a $5.1million unrealized gain associated with the 6.25%

Senior Notes and an $18.4 million unrealized gain associated with the 6.375% Senior Notes.In addition,in 2001,the Company

reclassified the remaining $4.2 million unrealized loss associated with the 6 5⁄8% Senior Notes from a deferred asset account,

in accordance with SFAS 80,“Accounting for Futures Contracts,”to accumulated other comprehensive income.The gain (loss)

on these hedges is recognized as an adjustment to interest expense over the life of the related debt issuances.

In May 1990,the Company entered into a revolving credit arrangement with National City Bank,which is reviewed by the

bank annually. Under this agreement, the Company has the right to borrow up to $10.0 million. By selecting from available

credit options,the Company may elect to pay interest at rates related to the London interbank offered rate,the bank’s base rate

or at a money market rate.Acommitment fee is payable on any unused portion of the committed amount at the rate of .125%

per annum.The Company had no borrowings under this arrangement at December 31,2003 or 2002.

Aggregate principal payments on debt outstanding at December 31, 2003, are $206.0 million for 2004,$0 for 2005, $100.0

million for 2006,$0 for 2007, $0 for 2008 and $1.2 billion thereafter.

- APP.-B-14 -

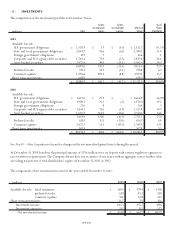

- 4 - DEBT

Debt at December 31consisted of: 2003 2002

Market Market

(millions) Cost Value Cost Value

6.60% Notes due 2004 (issued: $200.0, January 1994) $ 200.0 $ 200.3 $ 199.8 $ 208.1

7.30% Notes due 2006 (issued: $100.0, May 1996) 99.9 110.8 99.8 110.9

6.375% Senior Notes due 2012 (issued: $350.0, December 2001) 347.5 382.6 347.2 370.4

7% Notes due 2013 (issued: $150.0, October 1993) 148.8 171.0 148.7 165.5

65⁄8% Senior Notes due 2029 (issued: $300.0, March 1999) 294.0 312.5 294.0 295.8

6.25% Senior Notes due 2032 (issued: $400.0, November 2002) 393.6 408.8 393.5 432.2

Other debt 6.0 6.0 6.0 6.0

$1,489.8 $1,592.0 $1,489.0 $1,588.9