Progressive 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

- APP.-B-4 -

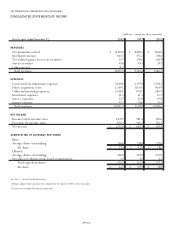

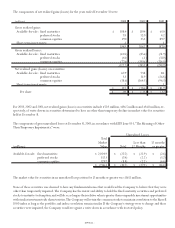

For the years ended December 31, 2003 2002 2001

RETAINED EARNINGS

Balance, Beginning of year $ 2,796.0 $2,497.4 $2,220.4

Net income 1,255.4$1,255.4 667.3$667.3 411.4$411.4

Cash dividends on Common Shares ($.100, $.096

and $.093 per share, split effected) (21.7) (21.1) (20.6)

Tre a s u r y s hares purchased (297.5) (200.7) (112.5)

Capitalization of stock split — (147.0) —

Other, net (2.4) .1 (1.3)

Balance, End of year $ 3,729.8 $ 2,796.0 $ 2,497.4

ACCUMULATED OTHER COMPREHENSIVE

INCOME (LOSS), NET OF TAX

Balance, Beginning of year $ 169.3 $ 125.9 $ 64.7

Changes in:

Unrealized appreciation 255.8 40.9 52.0

Net unrealized gains on forecasted transactions (1.0) 2.5 9.2

Foreign currency translation adjustment .9 — —

Other comprehensive income 255.7 255.7 43.4 43.4 61.2 61.2

Balance, End of year $ 425.0 $ 169.3 $ 125.9

Comprehensive Income $ 1,511.1 $ 710.7 $ 472.6

COMMON SHARES, $1.00 PAR VALUE

Balance, Beginning of year $ 218.0 $ 73.4 $ 73.5

Stock options exercised 2.8 1.2 .8

Tre a s u r y shares purchased1(5.0) (3.6) (.9)

Restricted stock issued, net of forfeitures .6 — —

Capitalization of stock split — 147.0 —

Balance, End of year $216.4 $218.0 $ 73.4

PAID-IN CAPITAL

Balance, Beginning of year $ 584.7 $ 554.0 $ 511.2

Stock options exercised 47.2 21.4 25.2

Tax benefits on stock options exercised 44.0 19.3 24.4

Tre a s u r y s hares purchased (14.3) (10.0) (6.8)

Restricted stock issued, net of forfeitures 26.7 — —

Balance, End of year $ 688.3 $ 584.7 $ 554.0

UNAMORTIZED RESTRICTED STOCK

Balance, Beginning of year $ — $— $—

Restricted stock issued, net of forfeitures (37.3) — —

Restricted stock market value adjustment (2.6) — —

Amortization of restricted stock 11.0 — —

Balance, End of year $ (28.9) $ — $ —

To t a l Shareholders’ Equity $ 5,030.6 $ 3,768.0 $ 3,250.7

1The Company did not split treasury shares. In 2002,the Company repurchased 136,182 Common Shares prior to the stock

split and 3,471,916 Common Shares subsequent to the stock split.

There are 20.0 million Serial Preferred Shares authorized; no such shares are issued or outstanding.

There are 5.0 million Voting Preference Shares authorized; no such shares have been issued.

See notes to consolidated financial statements.

(millions – except per share amounts)

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY