Polaris 2008 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2008 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 Polaris Industries Inc. 2008 Annual Report

• Victorybusiness: The overall motorcycle market slowed,

and we were no exception. Victory sales to dealers were

down 17 percent, and although we did gain market

share, our retail sales to consumers declined in 2008.

It put a slight damper on Victory’s 10th anniversary year,

but our motorcycle has proved to be a viable contender

in the American-made market, and that is something

worth celebrating. For the fifth consecutive year, we

are the industry leader in ownership satisfaction. We

have a focused plan to deliver an even stronger value

proposition to riders in the future, including offering an

unprecedented five-year warranty for a limited time on

any new Victory motorcycle.

• Creditcrisis: Our performance was not immune from the

credit crisis that hit the world economy in 2008. Our income

from financial services was down 53 percent. But we

reacted quickly to limit the impact on our customers and

sales. More than 50 percent of consumer loan applications

in 2008 were approved, and 39 percent of customers in the

United States financed their Polaris products through either

HSBC or GE, our retail credit partners. Both metrics were

improved from the prior year. Also beginning in 2009, we

added an additional retail credit provider, Sheffield Financial,

to provide another source of financing for customers.

• Volatilecommodityprices: The commodity cost

environment was a challenge for most of 2008. We faced

significant commodity cost increases at the peak escalation

point in 2008. However, we were able to mitigate some of

the cost increases of our commodity exposure. During the

2008 fourth quarter, commodity costs fell precipitously and

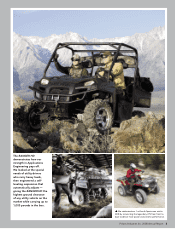

Product Innovation Is Front-end Advantage

Over the years, Polaris has become synonymous with product innovation. We’re

proud of that reputation and do all we can to nurture it. Our state-of-the-art Wyoming

R&D facility, opened in 2005, helps us reduce time to market with new ideas and

improve quality at the same time. Our biggest challenge is to outdo ourselves each

year, and in 2008 we did by announcing the biggest product launch in our history.

Our model year 2009 lineup includes off-road vehicle innovations that cater to every

type of rider, including the fast-growing youth market. Our entire Victory cruiser

line received enhancements to lighting, drivetrain, fuel pump, fuel tank and engine.

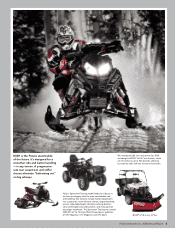

And in snowmobiles, we expanded selection of our high-value Shift models and

introduced an enhanced utility sled. For model year 2010, we introduced the terrain-

dominating RUSH snowmobile

—

a taste of what to expect from Polaris in the future.

p

To mark the 10-year anniversary of Victory —

the first new American-made motorcycle company

in nearly 60 years — we introduced this limited-

edition touring model. All 100 bikes were spoken

for within minutes using an electronic application

process, proof of Victory’s loyal following.

A Letter from the CEO and COO (cont.)

we expect lower costs in 2009. Additionally, a few of the

innovative new products we introduced in 2008 came in at

higher cost levels than what we had targeted; they will be

a cost reduction opportunity for us in 2009.

• Netmarginperformance: Although our gross profit

percentage increased 80 basis points to 22.9 percent in a

tough economic environment, we did not extend that gain

to our net income margin. It declined 30 basis points from

2007 to 2008. We can and will do better.

STRATEGIES FOR 2009 AND BEYOND

Since joining the business in September as CEO, I have

had the opportunity to meet with many Polaris stakeholders,

from our dedicated employees and strong dealers to

shareholders, suppliers, political leaders and others who care

about Polaris. These meetings reinforced the importance of

innovation to this company, not only to attract customers but

also to keep employees motivated. Polaris has a culture built

on employees’ passion for performance. In tough years as

2009 is expected to be, it becomes apparent how much our

dedicated employees and culture contribute to our success.

We expect to continue leading the industry in 2009 and

beyond, based on an exciting vision and strategy that

focus on five key themes to drive growth, profitability and

shareholder value:

• BestinPowersportsPlus: We are proud of our powersports

standing and heritage, and are committed to product

leadership in every market we serve. To continue our

leading off-road position, we recently consolidated our