Polaris 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 Polaris Industries Inc. 2008 Annual Report

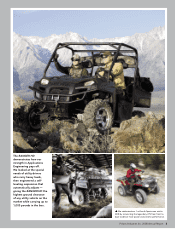

ATV and side-by-side divisions into one off-road vehicle

division that leverages synergies, eliminates redundancies

and improves productivity. To maintain our competitive

position in motorcycles, we are revamping how we go

to market. You will see new selling tools and marketing

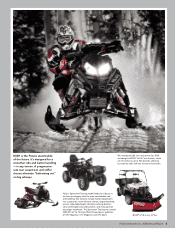

initiatives in 2009. With snowmobiles, our focus is on

dominating every kind of terrain, so customers can expect

a smooth, powerful ride no matter what they encounter.

Our new RUSH, (featured on Page 5), sets the tone

for Polaris snowmobiles from here on out. The dealer

experience is a key part of the powersports experience.

While we have a competitive advantage with our strong

dealer network, we will continue to enhance our dealer

support. By maintaining our lead in powersports, we

expect to generate annual compounded organic sales

growth of 5 to 8 percent over the next five years.

• Adjacencies: Winning in our core businesses is not enough.

Eventually, those markets mature and become saturated.

To be successful long term, we must expand both inside

and outside of powersports, into adjacent markets that

are a good fit for our core strengths. (See Core Strengths

featured story on Page 2.) The military market is a good

example. Another is a recent partnership with Bobcat

to provide them with differentiated private-label work

vehicles that will be sold through the Bobcat distribution

channel. We expect to generate $100 million to $300 million

in sales growth from adjacencies in the next five years.

• Internationalgrowth: Our success in Europe is a

harbinger of things to come. We are working to replicate

that success in Asia, Latin America, the Middle East and

Operational Excellence Is

Back-end Advantage

Polaris employees want to lead in every aspect of the powersports business,

and operations are no exception. In 2008, we improved our speed to market

by 15 percent. We shaved months off the time it takes to get a vehicle from

design to a customer’s garage. In the two years since we started our Operational

Excellence initiative, we’ve become 36 percent faster.

Contributing to our speed is a pilot dealer program called Maximum Velocity

Program, with improved front-end dealer processes. The program includes numerous

changes to how we and our dealers interact with the consumer and run our

businesses. For example, dealers using MVP will place orders twice a month versus

the previous twice a year. This shorter order cycle allows dealers to order products

that consumers are asking for versus what’s in inventory, which allows Polaris to

respond quickly to market changes and trends. To accommodate a faster turnaround,

we reduced supplier lead time on components, and produce mixed models on the

assembly line, thanks to our flexible manufacturing capability. The result is increased

market share and lower inventory levels among the 175 participating dealers. We

expect to expand the Maximum Velocity Program penetration in 2009.

RANGER RZR

A Letter from the CEO and COO (cont.)

Africa. We expect international sales to grow to represent

over 25 percent of the company’s total sales over the

next five years.

• OperationalExcellence: Our strategy to improve quality,

cost and speed has become a significant competitive

advantage. By applying various lean-manufacturing

philosophies, such as Kaizen, to our operations, we are

leveraging the creativity, skill and dedication of Polaris

employees to deliver greater value to both customers

and shareholders. We expect operating-margin expansion

in excess of 200 basis points in the next five years as a

result. (For more, see Operational Excellence featured

story below.)

• Financialoutperformance: Profitable growth is the

mantra, with continued focus on sustainable earnings-

per-share growth, driven by a robust combination of

revenue growth and net margin expansion.

We are confident in our strategy, and equally confident in our

ability to execute it and create a bright future for all Polaris

stakeholders. A very important part of the future is 2009.

We have already begun taking action to deal with what will

likely be one of the most challenging years in our history.

Effective leaders make the most of adversity and that

is exactly what we will do at Polaris. We will relentlessly

focus on executing our strategy and maintaining credibility

with all our stakeholders. While we do not expect sales to

grow in 2009, we expect to leverage our performance and

innovation to gain market share, and will strive to show

net margin expansion.