Polaris 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 ANNUAL REPORT 1

A LETTER FROM THE CEO AND COO

DEAR FELLOW SHAREHOLDERS:

2005 was a good year for Polaris — better than any in our history by most measures — but the results fell

somewhat short of our expectations.

• Sales grew by $97 million to a record $1.87 billion, an increase of 5 percent.

• Net income from continuing operations also increased 5 percent to $144.3 million, extending our earnings

growth streak to 24 consecutive years.

• Earnings per share from continuing operations increased by 8 percent to $3.29 per share.

• Return on shareholders’ equity was 39 percent, while our debt-to-total-capital ratio remained a very

comfortable 5 percent.

• After two years of more than 50 percent price appreciation, our share price fell off its historic highs and

finished 26 percent lower than at the start of the year, resulting in a total annual return to investors in 2005

of a negative 25 percent. Our five-year total return remains a respectable 23 percent per year.

Thomas C.Tiller – Chief Executive Officer Bennett J. Morgan – President and Chief Operating Officer

SUMMARY OF 2005

We anticipated that 2005 would be tough, but the year proved even

more challenging than we had planned. We were squeezed from

two directions: the market slowed and our costs escalated. As usual,

during the last year there were some significant accomplishments,

as well as some disappointments:

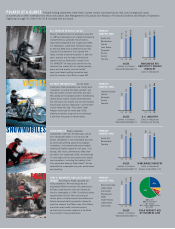

Victory broke through. Entering the motorcycle business was a big

undertaking for Polaris, and at times, the progress has been slow.

But in recent years, Victory has been building tangible momentum.

Each year the bikes have gotten better looking and more reliable,

at a lower cost, and the brand has gained higher awareness. Victory

customers love their motorcycles, and the powerful word-of-mouth

referrals have brought people into the Victory family. Financially,

while the numbers were improving, it wasn’t until 2005 that we broke

through. The motorcycle business delivered a profitable fourth quarter

in 2005, and we anticipate a profitable full year in 2006. Not only

has the brand turned the corner, the business is now making money.

This is significant because we expect the rapid, profitable growth

of Victory to continue into the next decade.

RANGERs

and international sustained double-digit growth. Our largest

business, ATVs, consists of three parts: traditional ATVs sold in

North America, the

RANGER

utility vehicle business and international

sales. While the North American market slowed, we delivered solid

growth in both

RANGER

and ATV sales outside of North America,

particularly in Europe. Our deliberate, country-by-country approach to

international markets continues to build steam. In 2005, we grew

international sales 20 percent, and international sales accounted for

over 12 percent of total company revenue, compared to 6 percent

just a few years ago.

Parts, garments and accessories (PG&A) delivered solid performance.

We introduced new Lock & Ride™accessories like the

RANGER

cab

that don’t just personalize vehicles — they transform them. This

business posted revenue gains, high margins and good execution

across the board.