Polaris 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

POLARIS INDUSTRIES INC. is headquartered in Medina, Minnesota, and

designs, manufactures and markets innovative, high-quality, high-performance motorized

products for recreation and utility use. •Our product lines consist of all-terrain recreational

and utility vehicles (ATVs); snowmobiles; motorcycles; and related parts, garments and

accessories (PG&A). Polaris engineering, manufacturing and distribution facilities are located

in Roseau and Wyoming, Minnesota; Osceola, Wisconsin; Spirit Lake, Iowa; Vermillion, South

Dakota; Passy, France; Ballarat, Victoria, Australia; Winnipeg, Manitoba, Canada; Gloucester,

United Kingdom; Askim, Norway; Östersund, Sweden; and Hudson, Wisconsin (joint venture

with Fuji Heavy Industries, Ltd.). •Our wholesale finance company, Polaris Acceptance, is

a 50/50 joint venture. •We have a 25 percent investment in Austrian motorcycle manufacturer

KTM Power Sports AG •Polaris products are sold through a network of nearly 1,700 dealers

in North America, five subsidiaries and 40 distributors in 126 countries outside North America.

•Polaris common stock trades on the New York Stock Exchange and Pacific Stock Exchange

under the symbol PII, and the Company is included in the S&P SmallCap 600 stock price index.

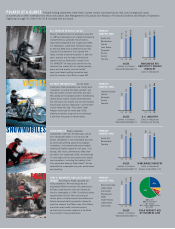

FINANCIAL HIGHLIGHTS

(dollars and shares in thousands, except per share data)

2005 2004 % Change

FOR THE YEAR

Sales from continuing operations $ 1,869,819 $1,773,206 5%

Operating income from continuing operations 214,786 211,637 1

Net income from continuing operations 144,285 136,813 5

Percent of sales 7.7% 7.7%

PER SHARE

Net income from continuing operations (diluted) $ 3.29 $ 3.04 8%

Dividends paid 1.12 0.92 22

Net book value 8.42 8.03 5

FINANCIAL POSITION

Total assets $ 768,956 $ 792,925 – 3%

Stockholders’ equity 369,657 361,732 2

Average shares outstanding (diluted) 43,881 45,035 – 3

OTHER INFORMATION

Property and equipment (net) $ 222,336 $ 200,901 11%

Capital expenditures 89,770 88,836 1

Depreciation and amortization 67,936 59,339 14

Borrowings under credit agreement 18,000 18,000 —

Return on average shareholder equity 39% 40%

Average dividend yield 1.9% 1.6%

Average number of employees 3,645 3,616 1

TABLE OF CONTENTS

IFC Polaris Products at a Glance

1Letter from the CEO and COO

4Letter from the Chairman

5Operations Review

18 11-Year Selected Financial Data

20 Directors, Officers and Managers

21 Form 10-K

IBC Other Investor Information

14%

Snowmobiles

66%

ATVs 15%

PG&A 5%

Victory

Motorcycles

PERCENTAGE OF SALES BY PRODUCT LINE

$1.870 BILLION

IN 2005 SALES

Polaris sales reflect a

diversified mix of

powersports products

for work and recreation

in all climates and

seasons.

11%

Canada

77%

United States 12%

International

PERCENTAGE OF SALES BY GEOGRAPHIC AREA

WORLDWIDE

OPPORTUNITIES

While the United

States is the world’s

largest market for

Polaris products,

international markets

represent a significant

growth opportunity.

NOTE: All periods presented reflect the classification of the marine products division’s financial results, including the loss from discontinued operations and the loss on disposal

of the division, as discontinued operations.