Polaris 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

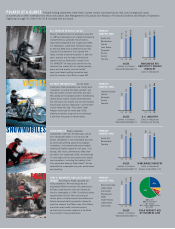

$1.89

02

$1.70

01

$1.52

00

$1.42

99

$1.27

9897

$3.04

$3.29

96 03 05

$2.07

$2.66

04

$2.36

$1,327

02

$1,245

01

$1,106

00

$948

99

$985

9897

$1,773

$1,870

96 03 05

$1,427

$1,552

04

$1,468

SALES

FROM CONTINUING OPERATIONS

(dollars in millions)

NET INCOME

FROM CONTINUING OPERATIONS

PER SHARE(1)

(dollars)

THE SCORECARD 2005 represents the 24th consecutive year of record earnings per share from continuing operations in a challenging

economic and industry environment. Polaris has consistently delivered increasing shareholder value through strong cash flow generation and

high returns on shareholder equity. The Company’s balance sheet remains strong with minimal debt, ample borrowing capacity and access to

the capital markets to fund our growth initiatives.

48%

02

53%

01

49%

00

47%

99

52%

9897

40%

39%

96 03 05

44%

40%

04

43%

RETURN ON AVERAGE SHAREHOLDER EQUITY

FROM CONTINUING OPERATIONS

Historic strong sales performance in ATVs, utility vehicles and

snowmobiles, along with related PG&A, have fueled

shareholder returns that are well above the industry average.

21.7%

02

20.6%

01

19.3%

00

20.6%

99

19.5%

9897

23.9%

22.3%

96 03 05

21.5%

23.4%

04

22.6%

GROSS MARGIN PERCENTAGE

FROM CONTINUING OPERATIONS

Polaris’ productivity strategies have resulted in consistent

gross margins. The 2005 gross margin decline was due to increased

commodity costs and lower snowmobile gross margins.

–24.7%

4.9%

Polaris

4.5%

S&P

500

–14.7%

Russell

2000

1.7%

Recreational

Vehicles

Index

Dow

Jones

2.1%

Nasdaq

178.8%

2.8%

Polaris

48.5%

S&P

500

58.5%

Russell

2000

10.4%

Recreational

Vehicles

Index

Dow

Jones

–8.9%

Nasdaq

TOTAL RETURN TO SHAREHOLDERS – POLARIS VS. MARKET INDICES

One-Year Total Return

(2005)

Five-Year Total Return

(2001–2005)

$0.44

02

$0.40

01

$0.36

00

$0.32

99

$0.30

9897

$0.92

$1.12

96 03 05

$0.50

$0.62

04

$0.56

$129

02

$120

01

$109

00

$100

99

$96

9897

$201

$208

96 03 05

$150

$178

04

$174

DIVIDENDS PER SHARE

(dollars)

In January 2006, Polaris announced an 11% increase

in the regular quarterly dividend.

CASH FLOW PROVIDED

FROM CONTINUING OPERATIONS(1,2)

(dollars in millions, before changes in current

operating items and deferred taxes)

2.4

02

3.0

01

2.2

00

2.9

99

1.0

9897

1.4

2.4

96 03 05

2.2

2.5

04

2.4

$40

02

$52

01

$38

00

$40

99

$14

9897

$67

$132

96 03 05

$49

$73

04

$76

SHARES REPURCHASED

Since inception of the share repurchase program in 1996, approximately 22.3 million shares

have been repurchased at an average price of $26.01 per share.

(shares in millions) (dollars in millions)

(1) In 1998, Polaris entered into a settlement agreement related

to a trade secret infringement claim brought by Injection

Research Specialists, Inc. The one-time provision for litigation

loss of $61.4 million, or $0.77 per diluted share, has been

excluded from the 1998 financial data presented.

(2) A reconciliation of the Company’s calculation of Cash Flow

Provided to the most directly comparable cash flow measure,

as required by Regulation G, appears on page 19 of this

Annual Report.

NOTE: All periods presented reflect the classification of the

marine products division’s financial results, including the loss

from discontinued operations and the loss on disposal of the

division, as discontinued operations.