Polaris 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Polaris Industries Inc.2

Every international region posted strong growth. The fast-growing international ATV market and European

introduction of the street-legal quadricycle helped offset slower domestic ATV market growth. A few years ago,

sales outside of North America were 6 percent of our total; today they are 11 percent.

Our 50th Anniversary was a home run. I doubt there was a company in America that combined more fun and

performance in 2004. In July 2004, we concluded our 50th anniversary with a tremendous weekend celebration in

St. Paul, Minn. It was a special opportunity to thank all our customers, dealers, employees and suppliers — and to

recognize the loyal riders, individuals and business partners particularly responsible for our success over the years.

More than 25,000 people showed up, and we saw the heart of our great company.

There were a few disappointments in 2004 as well.

The exit from the marine business was a tough but necessary decision. It was a difficult decision to exit the marine

business, but the reality is we are a stronger company as a result. Given our new vision and a declining personal

watercraft market, it wasn’t sensible to invest in the marine business when we could apply the same resources to other

investment opportunities to build an even stronger Company.

We faced higher prices for raw materials. Higher oil prices boosted the cost of transportation, plastics and energy

for our products and plants. The cost of important raw materials like steel and aluminum also increased significantly

throughout the year. Despite these increases, because of our sustained productivity efforts and favorable currency

swings, we were still able to expand our gross margin percentage modestly.

The competitive climate remained challenging. Like most industries, ours is highly competitive. Every year there

are shorter product development cycles, ever higher expectations from consumers, tougher emissions regulations,

and new entrants. 2004 was no exception.

We lost market share in snowmobiles. While our other three businesses grew at or above the market rate,

we did not in our heritage business. That was a significant disappointment.

Enough about the past. Let’s focus on what is really important — the future.

Our game plan for the next five years: Dominant in Powersports

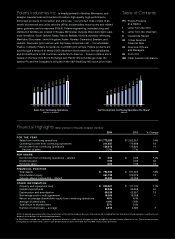

After 23 consecutive years of earnings growth, nearly seven straight years of quarterly sales and earning per share

growth, and a total return to shareholders of over 400 percent over the past seven years, there should be little doubt

that our business approach delivers very dependable performance for investors over the long haul. But after such

a good, long ride, many shareholders might wonder — how much upside could possibly be left?

I’m convinced Polaris can achieve a great deal more.

In 2004, we set out to define what success might look like in five years. We started with today’s core assets,

products and capabilities, and took a clean sheet of paper to envision the Company’s future. As our chairman, Greg

Palen describes in his letter, the Board played a very active role in examining and debating our strategic alternatives,

along with the senior management team. Ultimately, we concluded that the best course was to sharpen our focus

on areas where we have a realistic chance to win big — and to step up our pursuit of innovative products with high

quality and low cost operations.

Our goal is clear. Over the next five years, Polaris will drive to become the best in the world at what we do —

to become Dominant in Powersports. Becoming Dominant in Powersports is not about being the biggest

powersports company in the world. It means becoming the best. It means becoming the preferred choice in the

minds of riders, dealers and people who work in the powersports industry. It means having the highest quality

products, the best dealer network and the strongest brand. And it means delivering financially.

Specifically, we’ve set the following goals:

•Grow sales to $3 billion by 2009. That means growing the top line by an average of 12 percent per year.

We grew by 14 percent in 2004.

•Expand net income to 9 percent of sales by 2009. Achieving this objective requires that earnings per share grow

at an average of 15 percent per year. In 2004, earnings per share grew by 14 percent.

•Build a dominant brand with industry-leading quality and distribution.

We plan to achieve this vision through a dual strategy of product innovation and growth initiatives. And in the

process, attain our goals for growth, profitability and brand preference.