Polaris 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 1

LETTER FROM THE CEO

By most measures, 2004 was another very good year for our company — maybe our best year ever:

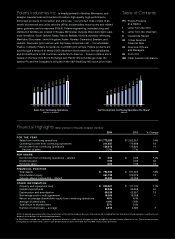

• Sales from continuing operations grew by $221 million, or 14 percent, to a record $1.773 billion.

• Net income from continuing operations grew by 14 percent to $137 million. Earnings have increased

for 23 consecutive years, and for the last 27 consecutive quarters, we’ve reported sales and EPS growth.

• Earnings per share from continuing operations increased by 14 percent to $3.04.

• Return on shareholders’ equity continued strong at 40 percent, and our debt to total capital ratio remained

at a very low 5 percent.

• With the stock price finishing 54 percent higher than the previous year, our total yield to investors was 57 percent,

compared to 11 percent for the S&P 500 and 18 percent for the Russell 2000. This is the second straight year

Polaris shareholders enjoyed a greater than 50 percent return.

• Our market capitalization grew from just under $2 billion to approximately $3 billion.

• We thanked our customers, dealers, suppliers, employees, communities, and shareholders for a great first 50 years.

• We laid out a clear plan to take the company to the next level of performance over the next five years,

which I will describe in detail in this letter.

Summary of 2004

We delivered balanced top line growth, with every business growing at least 10 percent. In 2004, as in past years,

our growth was driven by great new products. Every business delivered outstanding innovations to the market,

and the market responded favorably.

ATVs, our largest business, led the way. We introduced the Sportsman MV, a military-tough vehicle for consumers;

the world’s biggest and baddest ATV, the Sportsman 800 Twin EFI; and the full-featured entry-level Phoenix 200.

RANGER continued its phenomenal success in the utility segment. Competitors are copying it — a sure sign we’re

ahead of the pack.

Snowmobiles produced terrific sales growth — up 26 percent — but not as much momentum as we expected from

the new IQ platform. This advanced chassis has won rave reviews, but nothing drives sled sales like fresh snowfall.

Entering its seventh model year, Victory is shaping up as a real business. In 2004 we continued to upgrade our

dealer network, improved quality, and introduced the 100 cubic inch, fat-tire Hammer, another step in our plan to

methodically build Victory’s position as the New American Motorcycle.

Parts, garments and accessories (PG&A) growth is solidly on track. The revolutionary new Lock & Ride™system

integrates accessory and vehicle design, making our accessories the easiest to install by the dealer— or the consumer.

We continued to close the dealer gap. We’re shrinking the performance differences among dealers by raising

standards for stores inside and out, funding 35 new upgrades through capital assistance grants and introducing the

ATV Experience Center to help dealers sell more productively. We signed about 160 fully engaged new dealers who

are selling at five times the average of the 175 low-performing dealers that departed.

2004 — another record year for Polaris.

Thomas C. Tiller – President and Chief Executive Officer