Polaris 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

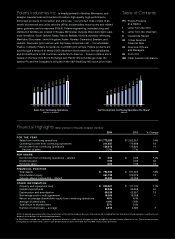

Sales

(dollars in millions) Worldwide ATV Industry

(units in thousands)

Sales

(dollars in millions) U.S. Industry

(units in thousands)

Cruisers and Touring

Sales

(dollars in millions)

$1,160

02 04

$1,043

03

$938

1,129

02 04

1,060

03

982

$74

02 04

$57

03

$34

443

02 04

419

03

399

$288

02 04

$229

03

$293

181

02 04

186

03

204

Worldwide Industry

(units in thousands)

Season ended March 31

$251

02 04

$223

03

$203

Sales

(dollars in millions) PG&A Product Mix

by Business Line

56% ATV

4% PWC

5% Victory

28% Snowmobile

7% General Merchandise

56%

28%

7%

5%

4%

2004 OVERVIEW

Approximately 181,000 units were sold worldwide by the snowmobile industry

during the season ended March 31, 2004, down three percent from the

previous season. Better snowfall and increased riding in the previous season

helped the industry begin to recover in 2004. Polaris increased sales for

2004 by 26 percent largely due to new product introductions such as the

Fusion™900 and 900 RMK™models featuring the new IQ™chassis. In addition,

lower levels of dealer inventory coming into the 2004–2005 selling season

allowed for production increases in calendar year 2004.

PRIMARY

COMPETITORS

• Arctic Cat

• Bombardier

• Yamaha

2004 OVERVIEW

Pure Polaris PG&A sales increased 13 percent in 2004 to $251 million. The

PG&A business was positively impacted by balanced growth during the year

across each product line in 2004 versus 2003. Pure Polaris operating margins

remained the highest in the Company. We anticipate 2005 to be another

good year for PG&A with all product lines expecting growth.

PRIMARY

COMPETITORS

• Parts Unlimited

(aftermarket

distributor)

• Powersports OEM’s

• Tucker Rocky

(aftermarket

distributor)

2004 OVERVIEW

The $6 billion ATV industry recorded worldwide retail sales of over 1.1 million

ATV units, up seven percent from 2003. The industry continued to grow in

2004 particularly internationally where regulation changes have made riding

ATVs more convenient and overall acceptance of ATVs continues to develop

and expand. In 2004, Polaris introduced five completely new products and

upgraded several current models for model year 2005, including: a new

limited edition 700 EFI (electronic fuel injection) XP RANGER; an 800 EFI

Sportsman; a military version ATV built for the consumer; a new Troy Lee

edition Predator 500; and the new value-priced Phoenix. In addition, we have

several limited edition models that were introduced in conjunction with our

50th Anniversary celebration in 2004.

PRIMARY

COMPETITORS

• Arctic Cat

• Bombardier

• Honda

• John Deere

• Kawasaki

• Kymco

• Suzuki

• Yamaha

2004 OVERVIEW

Motorcycle sales in the U.S. continued to expand in 2004. The cruiser and

touring segments of the United States motorcycle market, where Victory

currently participates, experienced six percent growth in 2004 over 2003 for

both segments combined. Victory continued to expand its presence through

major motorcycle shows and rallies, plus an increased number of Victory

Rider’s Association rides. Polaris’ sales increased 29 percent in 2004 over

2003, as Victory added more models to its line-up and the Victory brand

continued to gain recognition as the new American motorcycle company in

the industry.

PRIMARY

COMPETITORS

• Harley-Davidson

• Honda

• Kawasaki

• Suzuki

• Yamaha