Pioneer 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 Pioneer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pioneer Corporation Annual Report 2011

02

–7.3

–17.5–54.5

–1.6

+7.5

+32.7 +15.8

+2.0

Impact from

Currency

Exchange

Impact

of the

Great

East Japan

Earthquake

Higher

Profit

Due to

Increased

Net Sales

Improvement

in Gross

Profit Margin

Decreased

SG&A

Expenses

FY2010

Operating

Loss

FY2009

Operating

Loss Improvement of 33.3 Billion Yen

FY2011

Operating

Income

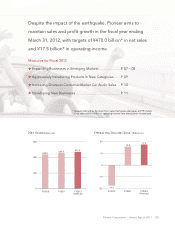

Bolstered by its growth strategy,

Pioneer recorded profi ts both in operating income and

net income for the fi scal year ended March 31, 2011.

Results of Fiscal 2011 and Measures for Fiscal 2012

Operating Income (Loss) Structure Breakdown (Billion yen)

Notable Achievements in Fiscal 2011

X

Growth Strategy Led to Turnaround in Profi tability

Achieved operating profi tability for the fi rst time in three years and

recorded fi rst net profi t in seven years

XSteady Growth in Each Business

Increased consumer-market car audio share

in the United States and Western Europe

Sales growth and return to profi tability in optical disc business through joint venture

with Sharp Corporation

XAlliance with NTT Docomo, Inc.

Launched a new car navigation business for smartphones from April 2011

XSignifi cant Improvement in Financial Position

Redeemed 60.0 billion yen of convertible bonds at maturity using cash on hand

Average share: United States FY2010: 18%; FY2011: 22%

Western Europe FY2010: 10%; FY2011: 12%

()