PNC Bank 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 V

ERSUS

2007

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Summary Results

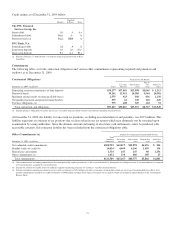

Net income for 2008 was $914 million or $2.44 per diluted

share and for 2007 was $1.491 billion or $4.32 per diluted

share.

Net Interest Income

Net interest income was $3.9 billion for 2008 compared with

$2.9 billion for 2007, an increase of $907 million, or 31%.

The 31% increase in net interest income for 2008 compared

with 2007 was favorably impacted by the $16.5 billion, or

17%, increase in average interest-earning assets and a

decrease in funding costs. The 2008 net interest margin was

positively affected by declining rates paid on deposits and

borrowings compared with the prior year. The net interest

margin was 3.37% in 2008 and 3.00% for 2007, an increase of

37 basis points.

Noninterest Income

Summary

Noninterest income was $2.4 billion for 2008 and $2.9 billion

for 2007.

Noninterest income for 2008 included the following:

• Gains of $246 million related to the mark-to-market

adjustment on our BlackRock LTIP shares

obligation,

• Losses related to our commercial mortgage loans

held for sale of $197 million, net of hedges,

• Impairment and other losses related to alternative

investments of $156 million,

• Income from Hilliard Lyons totaling $164 million,

including the first quarter gain of $114 million from

the sale of this business,

• Net securities losses of $206 million,

• A first quarter gain of $95 million related to the

redemption of a portion of our Visa Class B common

shares related to Visa’s March 2008 initial public

offering,

• A third quarter $61 million reversal of a legal

contingency reserve established in connection with

an acquisition due to a settlement,

• Trading losses of $55 million,

• A $35 million impairment charge on commercial

mortgage servicing rights, and

• Equity management losses of $24 million.

Noninterest income for 2007 included the following:

• The impact of $82 million gain recognized in

connection with our transfer of BlackRock shares to

satisfy a portion of PNC’s LTIP obligation and a

$209 million net loss on our LTIP shares obligation,

• Income from Hilliard Lyons totaling $227 million,

• Trading income of $104 million, and

• Equity management gains of $102 million.

Apart from the impact of these items, noninterest income

decreased $89 million in 2008 compared with 2007.

Additional analysis

Asset management fees totaled $686 million in 2008, a

decline of $98 million compared with 2007. The effect on fees

of lower equity earnings from BlackRock, a $12 billion

decrease in assets managed due to equity values related to

wealth management, and the Hilliard Lyons divestiture were

reflected in the decline compared with 2007. Excluding $53

billion of assets acquired on December 31, 2008 resulting

from our acquisition of National City, assets managed at

December 31, 2008 totaled $57 billion compared with $74

billion at December 31, 2007. The Hilliard Lyons sale and the

impact of comparatively lower equity markets in 2008 drove

the decline in assets managed.

Consumer services fees declined $69 million, to $623 million,

for 2008 compared with 2007. The sale of Hilliard Lyons

more than offset the benefits of increased volume-related fees,

including debit card, credit card, bank brokerage and merchant

revenues.

Corporate services revenue totaled $704 million in 2008

compared with $713 million in 2007. Higher revenue from

treasury management and other fees were more than offset by

lower merger and acquisition advisory fees and commercial

mortgage servicing fees, net of amortization.

Service charges on deposits grew $24 million, to $372 million,

in 2008 compared with 2007. The impact of our expansion

into new markets contributed to the increase during 2008.

Net gains on sales of securities totaled $106 million in 2008

compared with $1 million in 2007.

Other noninterest income totaled $263 million for 2008

compared with $412 million for 2007. Other noninterest

income for 2008 included gains of $246 million related to our

BlackRock LTIP shares adjustment, the $114 million gain

from the sale of Hilliard Lyons, the $95 million gain from the

redemption of a portion of our investment in Visa related to its

March 2008 initial public offering, and the $61 million

reversal of a legal contingency reserve referred to above. The

impact of these items was partially offset by losses related to

our commercial mortgage loans held for sale of $197 million,

net of hedges, trading losses of $55 million and equity

management losses of $24 million.

Other noninterest income for 2007 included a net loss related

to our BlackRock investment of $127 million (the net of the

two items described within the Summary section above),

trading income of $104 million, equity management

79