PNC Bank 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

LACK

R

OCK

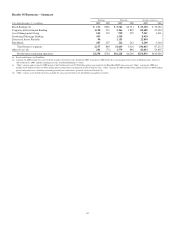

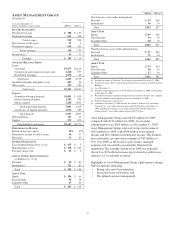

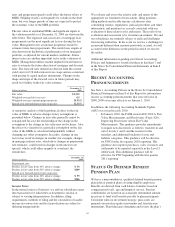

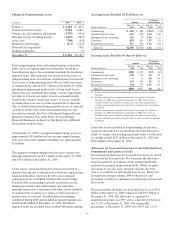

Information related to our equity investment in BlackRock

follows:

2009 2008

Business segment earnings

(in millions) (a) $207 $207

PNC’s share of BlackRock earnings (b) 23% 33%

Carrying value of PNC’s investment in BlackRock

(in billions) (b) $ 5.8 $ 4.2

(a) Includes PNC’s share of BlackRock’s reported GAAP earnings and additional

income taxes on those earnings incurred by PNC.

(b) At December 31.

B

LACK

R

OCK

/B

ARCLAYS

G

LOBAL

I

NVESTORS

T

RANSACTION

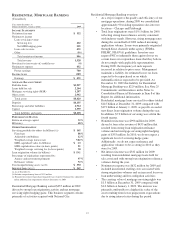

On December 1, 2009, BlackRock acquired BGI from

Barclays Bank PLC in exchange for approximately $6.65

billion in cash and 37,566,771 shares of BlackRock common

and participating preferred stock.

In connection with the BGI transaction, BlackRock entered

into amendments to stockholder agreements with PNC and its

other major shareholder. These amendments, which changed

certain shareholder rights, including composition of the

BlackRock Board of Directors and share transfer restrictions,

became effective upon closing of the BGI transaction. Also in

connection with the BGI transaction, BlackRock entered into a

stock purchase agreement with PNC in which we purchased

3,556,188 shares of BlackRock’s Series D Preferred Stock at a

price of $140.60 per share, or $500 million, to partially

finance the transaction. On January 31, 2010, the Series D

Preferred Stock was converted to Series B Preferred Stock.

Upon closing of the BGI transaction, the carrying value of our

investment in BlackRock increased significantly, reflecting

our portion of the increase in BlackRock’s equity resulting

from the value of BlackRock shares issued in connection with

their acquisition of BGI. PNC recognized this increase in

value as a $1.076 billion pretax gain in the fourth quarter of

2009. At December 31, 2009, our percentage ownership of

BlackRock common stock was approximately 35%.

B

LACK

R

OCK

LTIP P

ROGRAMS AND

E

XCHANGE

A

GREEMENTS

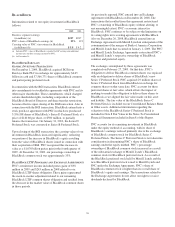

PNC’s noninterest income included pretax gains of $98

million in 2009 and $243 million in 2008 related to our

BlackRock LTIP shares obligation. These gains represented

the mark-to-market adjustment related to our remaining

BlackRock LTIP common shares obligation and resulted from

the decrease in the market value of BlackRock common shares

in those periods.

As previously reported, PNC entered into an Exchange

Agreement with BlackRock on December 26, 2008. The

transactions that resulted from this agreement restructured

PNC’s ownership of BlackRock equity without altering, to

any meaningful extent, PNC’s economic interest in

BlackRock. PNC continues to be subject to the limitations on

its voting rights in its existing agreements with BlackRock.

Also on December 26, 2008, BlackRock entered into an

Exchange Agreement with Merrill Lynch in anticipation of the

consummation of the merger of Bank of America Corporation

and Merrill Lynch that occurred on January 1, 2009. The PNC

and Merrill Lynch Exchange Agreements restructured PNC’s

and Merrill Lynch’s respective ownership of BlackRock

common and preferred equity.

The exchange contemplated by these agreements was

completed on February 27, 2009. On that date, PNC’s

obligation to deliver BlackRock common shares was replaced

with an obligation to deliver shares of BlackRock’s new

Series C Preferred Stock. PNC acquired 2.9 million shares of

Series C Preferred Stock from BlackRock in exchange for

common shares on that same date. PNC accounts for these

preferred shares at fair value, which offsets the impact of

marking-to-market the obligation to deliver these shares to

BlackRock as we aligned the fair value marks on this asset

and liability. The fair value of the BlackRock Series C

Preferred Stock is included on our Consolidated Balance Sheet

in Other assets. Additional information regarding the

valuation of the BlackRock Series C Preferred Stock is

included in Note 8 Fair Value in the Notes To Consolidated

Financial Statements included in Item 8 of this Report.

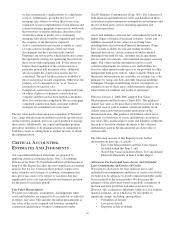

PNC accounts for its remaining investment in BlackRock

under the equity method of accounting, with its share of

BlackRock’s earnings reduced primarily due to the exchange

of BlackRock common stock for BlackRock Series C

Preferred Stock. The Series C Preferred Stock is not taken into

consideration in determining PNC’s share of BlackRock

earnings under the equity method. PNC’s percentage

ownership of BlackRock common stock increased as a result

of the substantial exchange of Merrill Lynch’s BlackRock

common stock for BlackRock preferred stock. As a result of

the BlackRock preferred stock held by Merrill Lynch and the

new BlackRock preferred stock issued to Merrill Lynch and

PNC under the Exchange Agreements, PNC’s share of

BlackRock common stock is higher than its overall share of

BlackRock’s equity and earnings. The transactions related to

the Exchange Agreements do not affect our right to receive

dividends declared by BlackRock.

58