PNC Bank 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

2A

CQUISITIONS AND

D

IVESTITURES

P

ENDING

S

ALE OF

PNC G

LOBAL

I

NVESTMENT

S

ERVICING

On February 2, 2010, we entered into a definitive agreement

to sell PNC Global Investment Servicing Inc. (GIS), a leading

provider of processing, technology and business intelligence

services to asset managers, broker-dealers and financial

advisors worldwide, for $2.3 billion in cash. We currently

anticipate closing the transaction in the third quarter of 2010.

Completion of the transaction is subject to regulatory

approvals and certain other closing conditions.

Results of operations of GIS are presented as income from

discontinued operations, net of income taxes, on our

Consolidated Income Statement for all years presented.

Income taxes related to discontinued operations for 2009

include $18 million of deferred income taxes provided on the

difference in the stock investment and tax basis of GIS, a US

subsidiary.

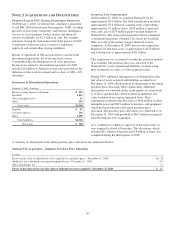

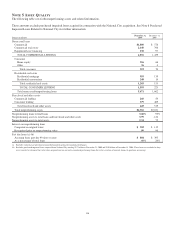

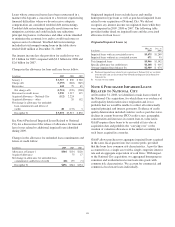

Investment in Discontinued Operations

December 31, 2009 – In millions

Interest-earning deposits with banks $ 255

Goodwill 1,243

Other intangible assets 51

Other 359

Total assets $1,908

Deposits $93

Accrued expenses 266

Other 1,009

Total liabilities $1,368

Net assets $ 540

N

ATIONAL

C

ITY

C

ORPORATION

On December 31, 2008, we acquired National City for

approximately $6.1 billion. The total consideration included

approximately $5.6 billion of common stock, representing

approximately 95 million shares, $150 million of preferred

stock and cash of $379 million paid to warrant holders by

National City. The transaction required no future contingent

consideration payments. National City, based in Cleveland,

Ohio, was one of the nation’s largest financial services

companies. At December 31, 2008, prior to our acquisition,

National City had total assets of approximately $153 billion

and total deposits of approximately $101 billion.

This acquisition was accounted for under the purchase method

of accounting. The purchase price was allocated to the

National City assets acquired and liabilities assumed using

their estimated fair values as of the acquisition date.

During 2009, additional information was obtained about the

fair value of assets acquired and liabilities assumed as of

December 31, 2008 which resulted in adjustments to the initial

purchase price allocation. Most significantly, additional

information was obtained on the credit quality of certain loans

as of the acquisition date which resulted in additional fair

value writedowns on acquired impaired loans. These

adjustments resulted in the allocation of $446 million to other

intangible assets and $891 million to premises and equipment

which had been reduced in the initial purchase price

allocation. The purchase price allocation was completed as of

December 31, 2009 with goodwill of $647 million recognized

from the National City acquisition.

As a condition for regulatory approval of the transaction, we

were required to divest 61 branches. This divestiture, which

included $4.1 billion of deposits and $.8 billion of loans, was

completed during the third quarter of 2009.

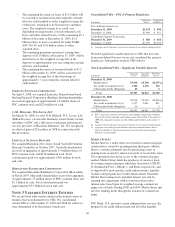

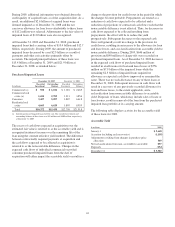

A summary of adjustments to the initial purchase price allocation are summarized below.

National City Acquisition – Summary Purchase Price Allocation

In billions

Excess of fair value of adjusted net assets acquired over purchase price – December 31, 2008 $(1.3)

Additional fair value marks on acquired impaired loans – December 31, 2008 1.8

Other adjustments, net .1

Excess of purchase price over fair value of adjusted net assets acquired – December 31, 2009 $ .6

103