PNC Bank 2009 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2009 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

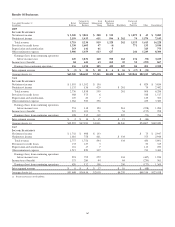

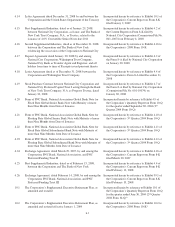

S

ELECTED

L

OAN

M

ATURITIES

A

ND

I

NTEREST

S

ENSITIVITY

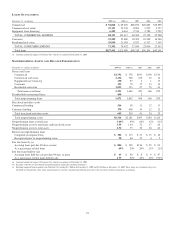

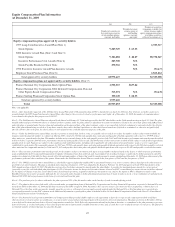

December 31, 2009

In millions

1 Year

or Less

1 Through

5 Years

After 5

Years

Gross

Loans

Commercial $18,867 $29,313 $6,638 $54,818

Real estate projects 7,082 7,845 655 15,582

Total $25,949 $37,158 $7,293 $70,400

Loans with

Predetermined rate $ 4,289 $ 7,198 $2,754 $14,241

Floating or adjustable

rate 21,660 29,960 4,539 56,159

Total $25,949 $37,158 $7,293 $70,400

At December 31, 2009, we had no pay-fixed interest rate

swaps designated to commercial loans as part of fair value

hedge strategies. At December 31, 2009, $11.8 billion notional

amount of receive-fixed interest rate swaps were designated as

part of cash flow hedging strategies that converted the floating

rate (1 month and 3 month LIBOR) on the underlying

commercial loans to a fixed rate as part of risk management

strategies.

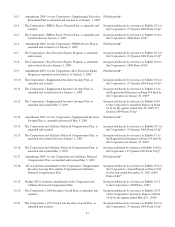

T

IME

D

EPOSITS

O

F

$100,000 O

R

M

ORE

Time deposits in foreign offices totaled $4.6 billion at

December 31, 2009, substantially all of which are in

denominations of $100,000 or more.

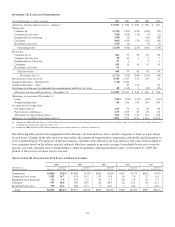

The following table sets forth maturities of domestic time

deposits of $100,000 or more:

December 31, 2009 – in millions

Domestic

Certificates

of Deposit

Three months or less $ 3,734

Over three through six months 2,130

Over six through twelve months 4,003

Over twelve months 6,001

Total $15,868

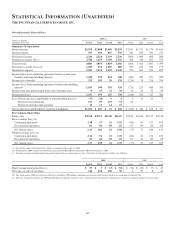

C

OMMON

S

TOCK

P

RICES

/D

IVIDENDS

D

ECLARED

The table below sets forth by quarter the range of high and

low sale and quarter-end closing prices for our common stock

and the cash dividends we declared per common share.

High Low Close

Cash

Dividends

Declared

2009 Quarter

First $50.42 $16.20 $29.29 $ .66

Second 53.22 27.50 38.81 .10

Third 48.78 33.06 48.59 .10

Fourth 57.86 43.37 52.79 .10

Total $ .96

2008 Quarter

First $71.20 $53.10 $65.57 $ .63

Second 73.00 55.22 57.10 .66

Third 87.99 49.01 74.70 .66

Fourth 80.00 39.09 49.00 .66

Total $2.61

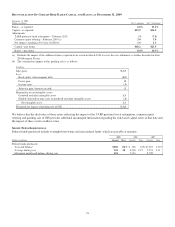

ITEM

9 – CHANGES IN AND DISAGREEMENTS WITH

ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

(a) None.

(b) None.

ITEM

9A – CONTROLS AND PROCEDURES

(a) MANAGEMENT’S REPORT ON INTERNAL

CONTROL OVER FINANCIAL REPORTING

The management of The PNC Financial Services Group,

Inc. and subsidiaries (PNC) is responsible for

establishing and maintaining adequate internal control

over financial reporting, as such term is defined in the

Exchange Act Rule 13a-15(f).

Because of inherent limitations, internal control over

financial reporting may not prevent or detect

misstatements. Also, projections of any evaluation of

effectiveness to future periods are subject to the risk that

controls may become inadequate because of changes in

conditions, or that the degree of compliance with the

policies or procedures may deteriorate.

We performed an evaluation under the supervision and

with the participation of our management, including the

Chairman and Chief Executive Officer and the Executive

Vice President and Chief Financial Officer, of the

effectiveness of PNC’s internal control over financial

reporting as of December 31, 2009. This assessment was

based on criteria for effective internal control over

financial reporting described in Internal Control-

Integrated Framework issued by the Committee of

Sponsoring Organizations of the Treadway Commission.

Based on this assessment, management concludes that

PNC maintained effective internal control over financial

reporting as of December 31, 2009.

PricewaterhouseCoopers LLP, the independent registered

public accounting firm that audited our consolidated

financial statements as of and for the year ended

December 31, 2009 included in this Report, has also

issued a report on the effectiveness of PNC’s internal

control over financial reporting as of December 31, 2009.

The report of PricewaterhouseCoopers LLP is included

under Item 8 of this Annual Report on Form 10-K.

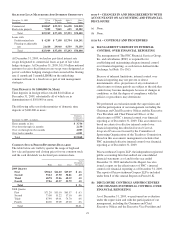

(b) DISCLOSURE CONTROLS AND PROCEDURES

AND CHANGES IN INTERNAL CONTROL OVER

FINANCIAL REPORTING

As of December 31, 2009, we performed an evaluation

under the supervision and with the participation of our

management, including the Chairman and Chief

Executive Officer and the Executive Vice President and

175