Omron 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

■

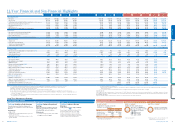

Portfolio Management Categories

■

Down-Top ROIC Tree

KPI Drivers

Sales in Focus Industries / Areas

Sales of New / Focus Products

Selling Price Control

Variable Costs Reduction, Value %

Defect Costs %

Per-head Production #

Automation %

(headcount reduction)

Inventory Turnover Months

Slow-Moving Inventory Months

Credits & Debts Months

Facilities Turnover

(1/N Automation Ratio)

Labor Costs-Sales %

Added-

Value %

Fixed

Manufacturing

Costs %

Working

Capital

Turnover

Fixed Assets

Turnover

SG&A %

R&D %

Invested

Capital

Turnover

Gross Profit

Margin

ROS

ROIC

ROIC (%)

B

Expecting

Growth

S

Investment

C

Profit

Restructuring

A

Examining

Regrowth

Sales Growth (%)

Special Feature 1: Management by ROIC 2.0

The following chart presents the ROIC formu-

la and our own interpretation. The simple logic

is this: Add the

Necessary Management Re-

sources (N)

and generate greater levels of

Value to Customers (V)

, while reducing

Loss-Making Management Resources (L)

.

Incidentally, we define loss-making resources

as those that involve

Muri, Muda, Mura

(waste,

unevenness, overburden).

sizing equipment, we limited investment, floor space

requirements, and the energy required to run the

machinery. Compared to an

“all-or-nothing”

approach to adding production capacity, we

avoided waste in terms of low utilization / turnover.

In other words, we successfully reduced our

Loss-Making Resources (L)

. At the same time, we

have enough capacity to protect against order

opportunity loss when demand rises further. From

the perspective of the customer, our adding

capacity in minimum units to meet demand in-

creases their order flexibility while reducing excess

inventory. This is a definite increase in

Value to

Customers (V)

.

This has proven to be a much more efficient

approach to investing in capital equipment for

the Electronic and Mechanical Components

Business. As one example, we have reduced

floor space requirements to one-fifth of the

space needed just 10 years ago. We are using

this 1/n reduction factor in a number of other

areas as well, including other types of capital

equipment, manufacturing, and energy usage.

Our Electronic and Mechanical Components

Business is a good case study to illustrate

ROIC Reverse Tree Management. This is a

business that involves significant capital invest-

ment in production equipment, which means

that production facilities turnover is an import-

ant performance indicator.

Production volume for relays and other me-

chanical components varies according to sea-

sonality and demand in the home electronics

market. In the past, we have had trouble match-

ing equipment investment with this changing

demand, adding equipment too late, thereby

decreasing our return on facilities ratios.

This business requires that we minimize wast-

ed investment in equipment, while responding

correctly to changes in demand. Accordingly,

we have focused on downsizing our production

equipment, or in other words, reducing produc-

tion equipment by a factor of 1/n.

Our first concern was to reduce

Necessary Man-

agement Resources (N)

, relay or switch production

equipment in this case, to the smallest unit possi-

ble to still meet the increase in demand. By down-

day-to-day duties. ROIC is a relatively easy

concept for those in our strategic, accounting,

and finance departments to relate to. For our

employees in sales or development, this

financial management concept is both unfa-

miliar and difficult to internalize. Understand-

ing this, we have decided to provide a qualita-

tive interpretation that tells the story of ROIC

in more relatable terms. This is

Management

by ROIC

2

.

0

.

ROIC Reverse Tree Formula and Interpreted Formula

■

Interpreted Formula

■

Omron’s ROIC Reverse Tree Formula

ROIC≒Necessary Management

Resources (N)

Value to Customers (Stakeholders) (V)

(Goods, Money, Time) Muri, Muda, Mura

(waste, unevenness, overburden)

Loss-Making Management

Resources (L)

+

ROIC= ×

Net Profit

Sales

Sales

Invested Capital

(Working Capital + Fixed Assets)

tics. We began Management by ROIC in earnest

three years ago, making significant ROIC gains

since that time. I am confident that, at this

point, every member of management is at least

aware of the concept of ROIC and its impor-

tance as a performance indicator at Omron.

On the other hand, I am sure there are many

who have yet to link ROIC with their own

1.Why Management by ROIC 2.0 ?

At Omron Corporation, Management by ROIC

consists of two main components: Down-Top

ROIC Tree and Portfolio Management. Return on

invested capital is the most important indicator we

use to measure progress in our business plan.

ROIC is an excellent measure for fairly as-

sessing business performance across a number

of businesses that have different characteris-

Management

by ROIC 2.0

Special

Feature 1

Takayoshi Oue

Executive Officer

Senior General Manager,

Global Finance and Accounting HQ

2. Case Study

32 OMRON Corporation Integrated Report 2015 33

About Omron Where We’re Headed Corporate Value Initiatives Corporate Value Foundation Financial Section