Omron 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

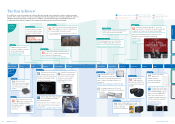

Portfolio Management Categories

ROIC (%)

B

Expecting

Growth

S

Investment

C

Profit

Restructuring

A

Examining

Regrowth

Sales Growth (%)

1. Management of a Portfolio of 100 Businesses

Omron consists of six business segments

made up of nearly 100 distinct business units.

We consider these business units to be our

portfolio of investments. So, how do we

measure the results of our portfolio? First, we

create an index with return on invested capital

(ROIC) as the X axis and revenue growth as

the Y axis. Next, we categorize each of our

businesses under one of four headings: S, A,

B, or C. Businesses we consider to be an S

demonstrate promise for strong, sustainable

growth. These are the businesses to which

we give priority investment. We pay close

attention to these businesses to drive even

more growth where we see the opportunity

for robust, ongoing earnings.

Some businesses we categorize as C

(target for profit restructuring). For these

businesses, we focus on creating and exe-

cuting plans to restructure their revenue

bases. In some cases, we pull out from the

business entirely. Over the past few years,

we have been active in exiting businesses,

closing factories, or otherwise restructuring

businesses that fall under this category.

Not every one of our business units is nec-

essarily large. As a matter of fact, you could

say that Omron is a collection of many small-

and medium-sized businesses. The important

take-away here is that Omron produces highly

competitive products based on sensing and

control technologies, marketed globally in

nearly 100 different business sectors. This

large number of businesses is precisely why

we have to exercise effective portfolio man-

agement. The type of detailed portfolio control

we conduct allows us to optimize the alloca-

tion of our resources to create more strength

within each business unit, leading to higher

levels of corporate value.

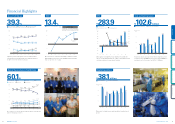

2. Growth through Investment

As part of our strategy to rapidly grow in

emerging economies, Omron acquired NS

Industria de Aparelhos Medicos Ltda. in

October 2014. NS is a top manufacturer of

nebulizers in Brazil, and this acquisition has

vaulted our Healthcare Business to the top

share of the global nebulizer market. At the

same time, this new sales channel within

Brazil took us to the number one share for

blood pressure monitors in that market

during fiscal 2014. Prior to our investment,

the Brazilian market had presented challeng-

es in marketing our blood pressure monitors.

We have increased the pace of investment

in our Backlights Business to win a greater

share of growing demand. Our EARTH-1

STAGE (FY2014–FY2016) defined the estab-

lishment of a self-driven growth structure as

the medium-term goal for our company. To

achieve this goal, management has budgeted

¥100 billion in growth investments for the

Company as a whole, and we intend to contin-

ue to invest in our future for sustained growth.

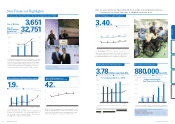

3. Improving Shareholder Return

Between October and November 2014, we

took the opportunity to address shareholder

return and our capital structure by buying

back almost 2.82 million shares of stock for a

total of nearly ¥15 billion. In December, we

retired approximately 9.72 million shares of

new and existing treasury stock, leaving us

with a balance of approximately 140,000

treasury shares.

In terms of dividends, we committed in our

EARTH-1 STAGE plan to increase our divi-

dend payout ratio to 30% by FY2016. We

are happy to announce that we have moved

the timing up by one year, with a scheduled

30% payout ratio for FY2015. While we

have not changed our basic stance in placing

the highest priority on growth investments,

we believe offering stronger shareholder

return is another way to make efficient use

of our capital.

30 OMRON Corporation Integrated Report 2015 31

About Omron Where We’re Headed Corporate Value Initiatives Corporate Value Foundation Financial Section