Olympus 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

O LYMPUS 20 05 7

> Today and Tomorrow

in the Medical Systems

Business, the Life

Science Business, and

the Industrial Systems

Business

first time O lympus has had to reduce personnel, with exception to

those times during the aftermath of the Second W orld W ar.

O lympus is fully aware of the extremely important obligation o f

management to assure stable employment. However, if actio n is no t

taken now, further reductions in personnel may become necessary

in the future. W hile this was a very difficult decision for O lympus to

make, it was unavoidable under the circumstances.

In addition, O lympus aims to reduce costs by ¥10 billion annu-

ally by shortening invento ry turnover by 0.5 months, reducing the

amount of partly finished products and sharing molds. Including the

personnel reductions, we plan to lower costs by a total of ¥13 bil-

lion. W ith contributions fro m the aforementioned new product sales

and cost reductions, we believe a return to profitability is possible

in the second half of fiscal 2006.

O lympus is formulating a management vision that brings forward

medium-term targets for restructuring, including a review of the

Imaging Systems Business portfolio. O ur basic direction is to

emphasize earnings o ver sales or market share. Lessening the

reliance of our earnings structure on endoscopes has been a long-

standing management issue. From this point of view as well, we are

making every effort to achieve a recovery in earnings in the

Imaging Systems Business.

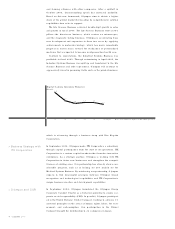

As the earnings foundation of Olympus, the Medical Systems

Business centers o n our gastroenterological endoscopes, which

hold an approximate 70% share of the world market. Every year,

endoscopes are expected to perform greater roles in helping to

improve diagnostic accuracy, minimally invasive treatment, and

patients’ quality of life. The Medical Systems Business attained

growth in sales and profits during fiscal 2005 amid pressures to

slash medical expenses across the medical industry.

From its overwhelming competitive advantage in gastroentero-

logical endoscopes, O lympus believes there is significant room for

business expansion in fields related to endoscopes, such as surgi-

cal products and endo-therapy devices. As a comprehensive sup-

plier o f endoscopes, Olympus is taking an aggressive stance

toward increasing its market share in fields other than gastroen-

terological endoscopes.

W e believe that key measures to increasing our market share are

expanding sales personnel, reinfo rcing the marketing structure,

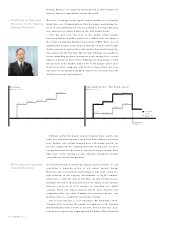

15 .5 15 .2 1 4.8 13.2

Worldwide Digital Camera Market

(Thousands of units)

48 ,60 0

60 ,28 0

72 ,00 0

28 ,38 0

03 04 05 06 (estimate)

O lympus unit share

Source: Camera & Imaging Pro ducts Associatio n

Worldwide