O'Reilly Auto Parts 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

O’REILLY AUTOMOTIVE 2014 ANNUAL REPORT

3

As the average age a high quality vehicle can stay on the road

grows, so does the miles driven and required maintenance

on these vehicles, supporting continued strong demand in

our industry.

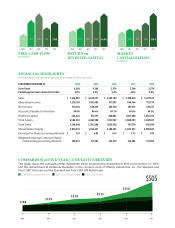

Sustainable, protable top-line growth by itself is simply not

enough, and another important O’Reilly culture value is

the relentless practice of expense control. At Team O’Reilly,

expense control goes beyond scrutinizing our expenditures;

instead, it is a laser-focus on deploying our shareholders’ in-

vestments in activities which will ultimately improve service

levels to our customers and enhance their experience each

time they walk into or call one of our stores. We take a long-

term perspective when it comes to expense control, and our

commitment to consistently-superior customer service has

been rewarded with industry-leading comparable store sales.

Our expense control focus has translated our consistent top-

line growth into bottom line prots, and we once again set a

company record, high-operating prot margin of 17.6% of

sales in 2014.

Our priorities for the use of our capital remain unchanged:

our primary focus is reinvestment in our business by main-

taining and enhancing our existing store base and distribu-

tion network, expanding our footprint through greeneld

store openings and consolidating the market by acquiring

existing auto parts chains and converting them to our mod-

el. 2014 was another great year in execution of this playbook

with the successful opening of 200 net, new stores across

38 dierent states, including our rst store in Pennsylvania,

and the opening of three new DCs. e single biggest factor

to the success of a new store is the quality of the store team,

and we aggressively identify and develop knowledgeable

and enthusiastic Professional Parts People who are eager to

provide unsurpassed customer service in each new store.

We are able to successfully instill the O’Reilly culture to new

store teams across the U.S. because of the vast aermarket

experience we have amassed throughout our company and

our dedication to promoting new leaders from within our

ranks. We have been very pleased with the performance of

our new store openings over the past several years and are

very condent we will replicate this success in the additional

205 new stores we plan to open in 2015, supported by our 26

regional distribution centers, including the three we opened

in 2014. Our ability to bring additional DC capacity online

eectively, without missing a beat in providing exceptional

service to our stores, is a huge driver to our success. At the

end of 2014, our distribution system had the capacity to

support an additional 800 stores across our footprint, and

we are well positioned to continue our record of protable

growth. While we did not make a signicant strategic ac-

quisition in 2014, we continually monitor the landscape for

potential acquisition targets and will pursue opportunities

that can achieve the appropriate return on our investment

and drive our long-term protable growth.

Supported by the strength and stability of the long-term

drivers for demand in the automotive aermarket and

driven by our relentless focus on protable long-term

43

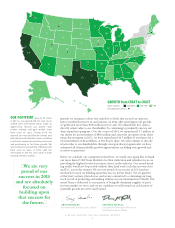

States with

O’Reilly stores

O’Reilly stores

4,366

26

O’Reilly

distribution

centers

O’Reilly

Team Members

more than

67 000

,

FROM GROUND BREAKING TO GRAND OPENING Before breaking ground, we strategically select sites for new stores by considering,

among other factors, local population density and demographics, as well as local registered vehicles and automotive repair facilities. Our stores are

generally freestanding buildings or prominent end caps situated on or near major trac thoroughfares, which oer ample parking, easy customer access

and average approximately 7,200 square feet. Our store design features high ceilings, convenient interior layouts, in-store signage, bright lighting, and

dedicated counters to serve our professional service provider customers. After construction is completed, our stores are stocked with an average of

23,000 SKUs, which includes a wide selection of nationally recognized, well-advertised, premium name brand products, as well as proprietary private label

products for domestic and imported automobiles.

OUR DISTRIBUTION NETWORK is a robust, regional,

tiered distribution model that provides our stores with industry-

leading parts availability. Our distribution centers are strategically

located close to our stores which allows us to service them ve

nights a week.

DC 22, Phoenix, AZ, taken by O’Reilly Team Member Rick Rowen, Systems Analyst.

O’REILLY AUTOMOTIVE 2014 ANNUAL REPORT

2

Photos provided by O’Reilly Store Installations team

to purchase a part is availability; if we do not have the part

a customer needs, or if we cannot get the part to a customer

faster than our competitors, we risk losing the business.

A key to our success has been our sustained competitive

advantage in parts availability, an advantage built through

our robust, tiered, regional supply chain network, which

provides our store teams with access to the right part faster

than our competitors. We stock each of our stores with

robust inventories consisting of high-quality parts tailored

to the needs of the market served by each individual store.

Each one of our store’s inventories is customized based on

numerous factors including vehicle registration data, market

demographic information, and local customer purchasing

patterns. In addition to individually-tailored store level

inventories, most of our store teams also have same-day

access to a larger assortment of hard-to-nd parts through

our hub store network made up of 283 strategically-located

stores that stock larger inventories, which average 41,000

SKUs, and, for our stores located in markets surrounding

one of our 26 strategically-deployed distribution centers

(DC), directly from one of our DCs, which average 146,000

SKUs. Our stores also receive ve-night-a-week inventory

replenishment from our DCs. is frequent and exible

replenishment model allows us to stock a larger breadth of

store level inventory, increasing the chance we will either

have a part in stock at the store for immediate fulllment

of our customer’s needs or have the part quickly available.

Our ability to customize and rapidly deploy inventory is a

powerful resource when a do-it-yourself customer walks

into one of our stores or a professional service provider

customer calls needing that hard-to-nd part. We are not

satised, however, with resting on our laurels, and we

continually evaluate methods which will enhance our ability

to strategically and eectively deploy our inventory invest-

ment, allowing us to maintain our competitive advantage

and extend our tradition of providing unsurpassed levels of

service to our customers.

Our 22 consecutive years of protable growth is a testament

to our ability to successfully execute our proven model

during both strong and dicult macroeconomic conditions,

and we remain very condent in the long-term drivers of

demand in the automotive aermarket. e primary driver

of demand in our industry is the total number of miles

driven in the U.S. Supported by improving employment lev-

els, through November of 2014, the number of miles driven

in the U.S. in 2014 increased 1.4%. While temporary eco-

nomic conditions can incrementally pressure miles driven

over short periods of time, we believe the long-term outlook

for miles driven growth remains solid and will continue to

provide a strong foundation for demand in our industry. As

we have seen for several years now, the higher quality of

new cars manufactured and sold over the past two decades

has also benetted the automotive aermarket. With proper

maintenance, these high-quality vehicles can be reliably

driven at higher mileages, resulting in stable scrappage rates

and, coupled with solid new car sales, an increase in the

total U.S. vehicle population and the average age of vehicles.