North Face 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

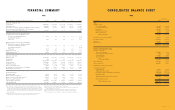

In thousands except per share amounts 2011

Net income $ 890,393 , ,

Adjustments to reconcile net income to cash provided by operating activities:

Impairment of goodwill and intangible assets – , ,

Depreciation 127,203 , ,

Amortization of intangible assets 41,708 , ,

Other amortization 29,824 , ,

Stock-based compensation 76,739 , ,

Provision for doubtful accounts 12,490 , ,

Pension contributions under (over) expense 46,346 (,) (,)

Deferred income taxes (10,867) (,) ,

Other, net 32,665 , (,)

Changes in operating assets and liabilities, net of acquisitions:

Accounts receivable (154,487) (,) ,

Inventories (7,509) (,) ,

Other current assets (18,449) (,) ,

Accounts payable (32,898) , (,)

Accrued compensation 2,448 , (,)

Accrued income taxes 16,009 (,) ,

Accrued liabilities (10,834) , (,)

Other noncurrent assets and liabilities 40,590 , (,)

Cash provided by operating activities 1,081,371 ,, ,

Capital expenditures (170,894) (,) (,)

Business acquisitions, net of cash acquired (2,207,065) (,) (,)

Trademarks acquisition (58,132) – –

Software purchases (20,102) (,) (,)

Other, net (3,840) (,) (,)

Cash used by investing activities (2,460,033) (,) (,)

Increase (decrease) in short-term borrowing 250,824 (,) (,)

Payments on long-term debt (2,738) (,) (,)

Proceeds from long-term debt 898,450 – –

Payment of debt issuance and hedging settlement costs (55,536) – –

Purchase of Common Stock (7,420) (,) (,)

Cash dividends paid (285,722) (,) (,)

Proceeds from issuance of Common Stock, net 134,012 , ,

Tax benets of stock option exercises 33,153 , ,

Acquisitions of noncontrolling interest (52,440) – –

Other, net (338) () ()

Cash provided (used) by nancing activities 912,245 (,) (,)

15,406 (,) ,

(451,011) , ,

— 792,239 , ,

— $ 341,228 , ,

|

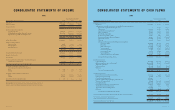

In thousands except per share amounts 2011

$ 9,365,477 ,, ,,

93,755 , ,

9,459,232 ,, ,,

Cost of goods sold 5,128,602 ,, ,,

Marketing, administrative and general expenses 3,085,839 ,, ,,

Impairment of goodwill and intangible assets – , ,

8,214,441 ,, ,,

1,244,791 , ,

()

Interest income 4,778 , ,

Interest expense (77,578) (,) (,)

Miscellaneous, net (7,248) , ,

(80,048) (,) (,)

1,164,743 , ,

274,350 , ,

890,393 , ,

()

(2,304) (,) ,

$ 888,089 , ,

Basic $ 8.13 . .

Diluted 7.98 . .

Basic 109,287 , ,

Diluted 111,288 , ,

$ 2.61 . .

|

Basis of presentation: VF operates and reports using a 52/53 week fiscal year ending on the Saturday closest to December

31 of each year. For presentation purposes herein, all references to periods ended December 2011, December 2010 and

December 2009 relate to 52 week fiscal periods ended December 31, 2011, January 1, 2011 and January 2, 2010, respectively.