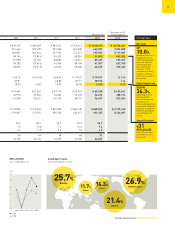

Nikon 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

we received positive feedback on the system’s

performance at the Kumagaya Plant. We thus

believe that we have a foothold that will enable

us to develop an offensive business strategy.

Meanwhile, in the area of LCD scanners, there

was a rise in sales of 5th- and 6th-generation

systems for small to medium-sized high-definition

panels. The 38 units sold, up from the 32 in the

fiscal year ended March 2012, were an indication

of the continued firm market for smartphones and

tablet computers. By contrast, Nikon sold just one

system in the 7th generation and beyond, compared

with 17 units sold in the fiscal year ended March

2012, since prices for large-screen televisions

remained low. Be that as it may, Nikon managed to

maintain its 80% market share for LCD scanners.

Next-generation ArF Immersion Scanners for

450 mm Wafers Give Nikon an Advantage over

the Competition

We expect the harsh market conditions for IC

steppers and scanners to continue through the

first half of 2013 and, for the market as a whole,

full-year unit sales to decline to around

200 units from 222 units in 2012. However,

we foresee a resumption in capital investments

among semiconductor manufacturers from the

second half of 2013, and so expect a recovery in

sales to around 230 units by the fiscal year ending

March 2016. For the fiscal year ending March 2014,

we expect Nikon’s sales to increase from 40 units

(including refurbished equipment) in the fiscal year

ended March 2013, as a result of greater product

competitiveness and other factors.

Product competitiveness is key to boosting sales

of IC steppers and scanners, for which reason

it is important to focus on three aspects of their

performance: higher resolution, overlay accuracy

and throughput. Nikon’s leading ArF immersion

scanners already surpass competing systems in

several aspects of their performance. By exploiting

this advantage, we hope to increase to 30% our

share of the market for ArF immersion scanners by

the fiscal year ending March 2016.

This 30% goal is a step on our way to the position

of industry leader. Beyond that we are preparing

for a transition to next-generation systems for 450

mm wafers. At the start of calendar year 2013, Nikon

received its first formal order for a prototype ArF

immersion scanner for 450 mm wafers. Further,

in July 2013 we announced the receipt of an order

for this prototype scanner from the U.S. research

13

NIKON CORPORATION A N N U A L R E P O R T 2 0 13

80

60

40

20

0

2011 2012 2013

57

84 80

60

40

20

0

57

86

2011 2012 2013

40 43

(Units)

100

(Units)

100

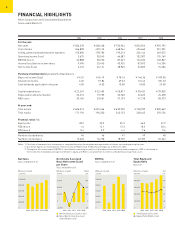

IC Steppers and Scanners,

Unit Sales by Technology

Years ended March 31

LCD Steppers and Scanners,

Unit Sales by Generation

Years ended March 31

■ 7G and above ■ 5G/6G ■ 4G

■ ArF

immersion

■ ArF ■ KrF

■ i-line

Note:

Unit sales figures for the fiscal year

ended March 2011 is for new

products only. Figures from the

fiscal year ended March 2012 include

refurbished equipment.

18

28

35

3

28

1

12

16

13

3

16

8

37

32

17

4

38

1

16

11

30

ArF Immersion Scanner

NSR-S622D