Nikon 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

For the year

Net sales

Cost of sales

SG&A expenses

Operating income

Income (loss) before income taxes and minority interest

Net income (loss)

Per share of common stock (Yen and U.S. dollars):

Basic net income (loss)

Diluted net income

Cash dividends applicable to the year

Capital expenditures

Depreciation and amortization

R&D costs

At year-end

Total assets

Shareholders’ equity

Notes: 1. Per share of common stock is computed based on the weighted average number of shares outstanding during the year.

2. U.S. dollar figures are translated for reference only at ¥105.69 to U.S. $1.00, the exchange rate at March 31, 2004.

3. Diluted net income per share for the year ended March 31, 2003 and 2002 is not disclosed because of the Company's net loss position.

Diluted net income per share for the year ended March 31, 2001 and 2000 is not disclosed because it was anti-dilutive.

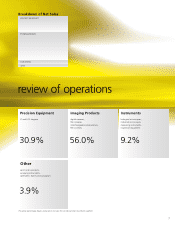

OPERATING ENVIRONMENT

In the fiscal year ended March 31, 2004, upward momentum in the market for semiconductors spurred gradual revitalization in capital

investment, while the digital camera market continued to expand.

With regard to Nikon Group business segments, basic recovery in the semiconductor market drove new product launches and increased

sales of existing products in Precision Equipment. Brisk business was also seen in Imaging Products as expansion in the digital camera market

prompted the introduction of new products. In contrast, the ongoing downturn in the semiconductor market in the United States had

a negative impact on sales in Instruments, where harsh business conditions continued to prevail.

Precision Equipment

Share of net sales

Imaging Products

Share of net sales

Instruments

Share of net sales

Other

Share of net sales

Total

(Elimination)

Consolidated

Net Sales by Industry Segment

Years ended March 31, 2004 and 2003

Thousands of

U.S. Dollars

2004

$4,791,163

3,282,220

1,474,172

34,771

89,787

22,802

$0.06

0.06

0.04

$210,681

191,249

285,413

$5,738,605

1,619,776

2000

¥371,801

247,473

105,894

18,434

11,479

7,770

¥21.01

5.00

¥13,881

17,251

17,798

¥502,175

166,495

2001

¥483,957

301,759

120,775

61,423

29,827

20,911

¥56.53

8.00

¥25,996

16,007

22,794

¥593,454

186,119

2002

¥482,975

306,793

153,943

22,239

2,755

(6,004)

¥(16.23)

4.00

¥33,546

17,917

27,313

¥561,276

176,961

2003

¥468,959

307,503

157,269

4,187

(11,128)

(8,143)

¥(22.03)

¥20,226

20,435

27,506

¥576,912

162,464

2004

¥506,378

346,898

155,805

3,675

9,490

2,410

¥6.52

6.02

4.00

¥22,267

20,213

30,165

¥606,513

171,194

Millions of Yen

Thousands of

U.S. Dollars

2004

$1,495,449

2,693,845

454,087

375,091

$5,018,472

(227,309)

$4,791,163

2003

¥133,102

28.4%

271,956

58.0

49,872

10.6

41,875

8.9

¥496,805

(27,846)

(5.9)

¥468,959

2004

¥158,054

31.2%

284,713

56.2

47,992

9.5

39,643

7.8

¥530,402

(24,024)

(4.7)

¥506,378

Millions of Yen, %

five-year summary

NIKON CORPORATION AND CONSOLIDATED SUBSIDIARIES

YEARS ENDED MARCH 31

management’s discussion and analysis of operations