National Oilwell Varco 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

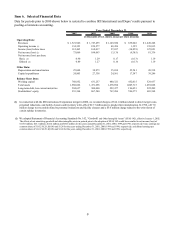

Contractual Obligations Total

Less than 1

year 1-3 years 4-5 years After 5 years

Long Term Debt 594,637$ -$ 244,637$ -$ 350,000$

Operating Leases 63,625 17,658 30,450 6,943 8,574

Total contractual obligations 658,262$ 17,658$ 275,087$ 6,943$ 358,574$

Commercial Commitments Total

Less than 1

year 1-3 years 4-5 years After 5 years

Line of Credit 326,698$ -$ 326,698$ -$ -$

Standby Letters of Credit 61,432 41,635 19,797 - -

Total commercial commitments 388,130$ 41,635$ 346,495$ -$ -$

Amount of Commitment Expiration per Period

Payments Due by Period

We intend to pursue additional acquisition candidates, but the timing, size or success of any acquisition effort and

the related potential capital commitments cannot be predicted. We expect to fund future cash acquisitions primarily

with cash flow from operations and borrowings, including the unborrowed portion of the credit facility or new debt

issuances, but may also issue additional equity either directly or in connection with acquisitions. There can be no

assurance that acquisition funds will be available at terms acceptable to us.

Inflation has not had a significant impact on National Oilwell’s operating results or financial condition in recent

years.

Market Risk Disclosure

We are exposed to changes in foreign currency exchange rates and interest rates. Additional information concerning

each of these matters follows:

Foreign Currency Exchange Rates

We have operations in foreign countries, including Canada, Norway and the United Kingdom, as well as operations

in Latin America, China and other European countries. The net assets and liabilities of these operations are exposed

to changes in foreign currency exchange rates, although such fluctuations generally do not affect income since their

functional currency is the local currency. For operations where our functional currency is not the local currency,

such as Singapore and Venezuela, the net asset or liability position is insignificant and, therefore, changes in

foreign currency exchange rates are not expected to have a material impact on earnings.

Some of our revenues in foreign countries are denominated in US dollars, and therefore, changes in foreign

currency exchange rates impact our earnings to the extent that costs associated with those US dollar revenues are

denominated in the local currency. In order to mitigate that risk, we may utilize foreign currency forward contracts

to better match the currency of our revenues and associated costs. We do not use foreign currency forward contracts

for trading or speculative purposes. The counterparties to these contracts are major financial institutions, which

minimizes counterparty credit risk.

The impact of foreign currency exchange rates has not materially affected our results of operations in any of the last

three years. We do not believe that a hypothetical 10% movement in these foreign currencies would have a material

impact on our earnings.

14