National Oilwell Varco 2002 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2002 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Total capital expenditures were $24.8 million during 2002, $27.4 million in 2001 and $24.6 million in 2000.

Additions and enhancements to the downhole rental tool fleet and information management and inventory control

systems represent the majority of these capital expenditures. Capital expenditures are expected to approximate

$35 million in 2003, which should also approximate depreciation expense in that year, with continued emphasis on

rental tools and information technology. We believe we have sufficient existing manufacturing capacity to meet

currently anticipated demand through 2003 for our products and services.

In November 2002, we sold $200 million of 5.65 % unsecured senior notes due November 15, 2012. Proceeds were

used to acquire Hydralift ASA. Interest is payable on May 15 and November 15 of each year. In March 2001, we

sold $150 million of 6.50 % unsecured senior notes due March 15, 2011, with interest payable on March 15 and

September 15 of each year. In June 1998, we sold $150 million of 6.875 % unsecured senior notes due July 1, 2005,

with interest payments due annually on January 1 and July 1.

On July 30, 2002, we replaced the existing credit facility with a new three-year unsecured $175 million revolving

credit facility. This facility is available for acquisitions and general corporate purposes and provides up to $50

million for letters of credit, of which $22.0 million were outstanding at December 31, 2002. Interest is based upon

prime or Libor plus 0.5% subject to a ratings based grid. In securing this new credit facility, we incurred

approximately $0.9 million in fees which will be amortized to expense over the term of the facility.

The senior notes contain reporting covenants and the credit facility contains financial covenants and ratios

regarding maximum debt to capital and minimum interest coverage. We were in compliance with all covenants

governing these facilities at December 31, 2002.

We also have additional credit facilities totaling $223 million that are used primarily for acquisitions, general

corporate purposes and letters of credit. Recently acquired Hydralift ASA represents $152 million of these

facilities. These multi-currency Hydralift committed facilities are secured by a guarantee, contain financial

covenants and expire in 2006. Borrowings against these additional credit facilities totaled $93 million at December

31, 2002 and an additional $39 million had been used for letters of credit and guarantees.

We believe cash generated from operations and amounts available under our credit facilities and from other sources

of debt will be sufficient to fund operations, working capital needs, capital expenditure requirements and financing

obligations. We also believe any significant increase in capital expenditures caused by any need to increase

manufacturing capacity can be funded from operations or through debt financing.

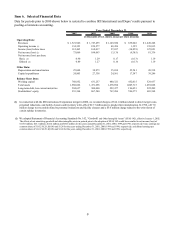

We have not entered into any transactions, arrangements, or relationships with unconsolidated entities or other

persons which would materially affect liquidity, or the availability of or requirements for capital resources. A

summary of our outstanding contractual obligations and other commercial commitments at December 31, 2002 is as

follows (in thousands):

13