National Oilwell Varco 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Products and Technology

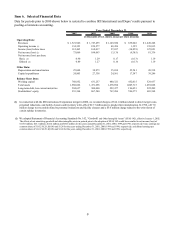

Products and Technology revenues in 2002 were $203.6 million (18%) lower than the previous year as moderate oil

and gas prices failed to sustain the 2001 levels of market activity in all product areas. Capital equipment revenues

were down $72 million while related spare parts and expendable parts were lower than 2001 by $38 million. Sales

and rentals of downhole motors and fishing tools decreased by approximately $74 million, impacted by its strong

dependence on the North American market. Operating income fell $44 million in 2002 when compared to the prior

year, impacted by the margin reduction due to the significantly lower volume. The absence of amortization of

goodwill in 2002, as required per the new accounting guidance, favorably impacted operating income by $10.4

million. Reductions in compensation expense also contributed approximately $11.0 million in operating income

when compared to the prior year. Revenues from the mid-December 2002 acquisition of Hydralift ASA, and the

consolidation of our Chinese joint venture, each contributed $8.0 million in revenues and $0.3 million and $2.2

million in operating income, respectively.

Revenues for the Products and Technology segment in 2001 increased by $437.4 million (64 %) from 2000 as

virtually all products experienced significant revenue growth. Capital equipment revenues were up $285 million,

drilling spares up $35 million, expendable pumps and parts were higher by $47 million and downhole tools

increased $75 million. As a result of this robust revenue growth, operating income in 2001 increased by $110.0

million from the prior year. Revenues from acquisitions completed in 2001 under the purchase method of

accounting contributed $34 million in incremental revenues.

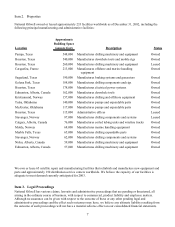

Backlog of the Products and Technology capital products was $364 million at December 31, 2002, $385 million at

December 31, 2001 and $282 million at December 31, 2000. Backlog at December 31, 2002 includes $170 million

acquired in late December through the purchase of Hydralift ASA. Substantially all of the current backlog is

expected to be shipped by mid-year 2004.

Distribution Services

Distribution Services revenues fell $21.6 million, or 3%, from the 2001 level as this segment’s strategy to create

strategic alliances and expand its international presence made significant market penetration during a difficult

market. North American revenues fell approximately 16% due to the lower activity level while shipments in the

international market almost doubled. Sales of our own-make products increased almost 12% while maintenance,

repair and operating (“MRO”) supplies fell almost 5%. Operating income in 2002 was $10.4 million lower than the

prior year. Margin reduction, due to the lower volume and project bidding pressures, contributed to approximately

80% of the operating income shortfall with the remainder due to significant infrastructure growth.

Distribution Services revenues in 2001 increased $186.5 million from the 2000 level with all areas and products

participating in the upswing that lasted until the middle of the 4th quarter 2001. U.S. revenues of MRO supplies

were up 44% while Canadian revenues were 13% higher than the prior year. Operating income in 2001 increased

by $15.6 million from the prior year due to the higher revenue volume and cost efficiencies linked to the new global

operating system. Revenues from acquisitions completed in 2001 under the purchase method of accounting

contributed $24 million in incremental revenues.

Corporate

Corporate charges represent the unallocated portion of centralized and executive management costs. Year 2002

costs of $10.8 million reflect certain corporate-led marketing initiatives and general overhead incurred to support a

larger company. Year 2001 costs of $10.2 million represents a 10% reduction from the prior year as various e-

strategy and e-commerce initiatives became operational. Year 2003 corporate charges are expected to approximate

$12 million due to recent acquisitions.

11