National Oilwell Varco 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

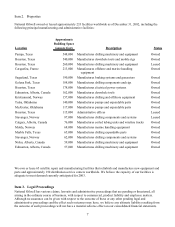

Special Charge

During 2000, we recorded a special charge, net of a $0.4 million credit from previous special charges, of $14.1

million ($11.0 million after tax, or $0.14 per share) related to the merger with IRI International. Components of the

charge were (in millions):

Direct transaction costs $ 6.6

Severance 6.4

Facility closures 1.5

14.5

Prior year reversal (0.4)

$14.1

The cash and non-cash elements of the charge approximated $13 million and $1.1 million, respectively. All direct

cash outlays have been spent. Facility closure costs consisted of lease cancellation costs and impairment of a closed

manufacturing facility that is classified with “Property held for sale” on our balance sheet. All of this charge is

applicable to the Products and Technology business segment.

Interest Expense

Interest expense in 2002 totaled $24.1 million, an increase of $1.3 million from the prior year. All of this increase is

a direct result of our mid-November 2002 sale of $200 million of 5.65% unsecured senior notes. Our average

borrowing cost during 2002 of 6.4% remained the same as 2001. We expect our interest expense in 2003 to increase

by at least $10 million as a result of our higher senior debt level.

Despite continual borrowing rate declines during 2001, interest expense increased approximately $5.5 million over

2000 due to our higher debt level to support the working capital associated with the robust business climate. In

March 2001, we sold $150 million of 6 ½% unsecured senior notes which increased our total senior debt to $300

million. Year 2001 average monthly debt, including the senior notes, was $334 million or $118 million (54%)

greater than the 2000 level.

Income Taxes

National Oilwell is subject to U.S. federal, state and foreign taxes and recorded a combined tax rate of 35% in

2002, 38% in 2001 and 51% in 2000. The 2000 effective tax rate was impacted by certain transaction costs

associated with the IRI merger and the inclusion of pre-merger IRI capital losses due to pooling-of-interests

accounting that may not be deductible. Excluding the impact of merger-related costs and capital losses, our

combined effective tax rate for 2000 was 36%. We expect our tax rate in 2003 to approximate 34%.

We have net operating loss carryforwards in the United States that could reduce future tax expense by up to $4.2

million. They expire at various dates through 2017. Additional loss carryforwards in Europe could reduce future

tax expense by $10.3 million and reduce goodwill $9.4 million if realized in the future. Due to the uncertainty of

future utilization of these loss carryforwards, $2.8 million of the potential benefits in the U.S. and $9.6 million in

Europe have been fully reserved.

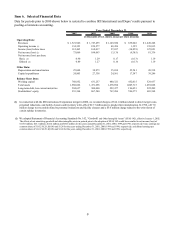

Liquidity and Capital Resources

At December 31, 2002, National Oilwell had working capital of $768.9 million, an increase of $137.6 million from

December 31, 2001. The addition of Hydralift ASA and consolidation of the Chinese joint venture accounted for

$123.3 million of this increase, including $78 million of the increase in cash. After considering the Halco

acquisition in January 2002 and the change in current deferred taxes, the rest of the company reduced our need for

working capital during 2002. Due to a new revolving three-year credit facility put in place during July 2002, all of

our debt is of a long-term nature.

12