National Grid 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

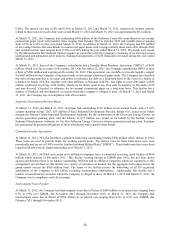

rate, preferred stock (Class F), having par value of $0.10. The fixed rate on these shares is 8.5%.

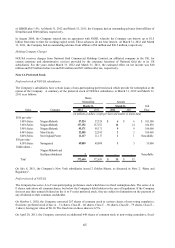

A summary of preferred stock of NGUSA at March 31, 2012 and March 31, 2011 is as follows:

March 31,

March 31,

March 31,

Series

2012

2011

2012

2011

2012

2011

$0.10 par value -

Series A

51

51

-

$

-$

400

$

400$

Series B

40

40

-

-

315

315

Series C

96

96

-

-

750

750

Series D

76

76

-

-

616

616

Series E

1

1

-

-

10

10

Series F

648

-

-

-

5,368

-

Total

912

264

-$

-$

7,459$

2,091$

(in millions of dollars, except per share and number of shares data)

Shares

Outstanding Amount (par) Amount (additional paid-in capital)

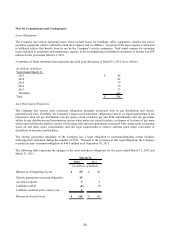

Note 13. Discontinued Operations and Other Dispositions

Other Dispositions

On April 13, 2010, a purchase agreement was signed between KeySpan and Home Service USA Corp. (“HSUSA”)

pertaining to KeySpan's sale of the service contracts portion of its National Grid Energy Services ("NGES") business.

Under terms of the agreement, HSUSA has agreed to acquire the service contract business for $74 million, with $30

million (net of working capital) paid at closing and an additional $44 million (net present value) of estimated royalties

earned and paid over a ten year period. Projected royalties represent 10% of revenues that HSUSA achieves through the

sale of its products, subject to adjustment, in years two through ten following the closing. This transaction was

completed on August 11, 2010. The installation business of NGES has not been sold. Instead, we are in the process of

discontinuing the installation portion of the business after completing all currently contracted work.

In addition, in September 2010, the Company sold National Grid Development Holding's 52.1% interest in Honeoye

Storage Corporation for $15 million to Consolidated Edison Development Inc. A gain of $11 million is reflected as gain

on sale of investments in the accompanying consolidated statements of income.

Discontinued Operations

On December 8, 2010, NGUSA and Liberty Energy entered into a stock purchase agreement which was subsequently

amended and restated on January 21, 2011, pursuant to which NGUSA will sell and Liberty Energy will purchase all of

the common stock of Granite State and EnergyNorth. The parties received FERC approval in July 2011 and NHPUC

approval in May 2012. The Company was sold on July 3, 2012 as discussed in Note 14, “Subsequent Event.”

On September 23, 2011, National Grid Development Holdings Corp., a wholly-owned subsidiary of KeySpan, entered

into a purchase agreement to sell all of its outstanding membership interest in Seneca to PDC Mountaineer, LLC. The

sale was completed on October 3, 2011 for proceeds of $163 million with a related gain on sale of investment of $99

million included in the accompanying consolidated statements of income.