National Grid 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

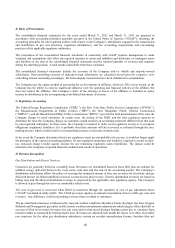

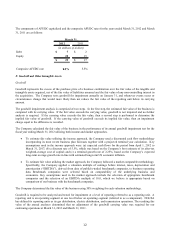

Intangible Assets

Intangible assets represent finite-lived assets that are amortized over their respective estimated useful lives and, along

with other long-lived assets, are evaluated for impairment periodically whenever events or changes in circumstances

indicate that their related carrying amounts may not be recoverable. During the year ended March 31, 2012, the

Company recorded a non-cash impairment charge of $102 million to reduce the net carrying value of its Management

Services Agreement (“MSA”) LIPA contract intangible asset to a fair value of zero, which was determined using an

income-based approach, as discussed in Note 5, “Goodwill and Other Intangible Assets.”

G. Impairment of Long-Lived Assets

The Company evaluates long-lived assets, including property, plant and equipment and finite-lived intangibles, when

events or changes in circumstances indicate that the carrying value of such assets may not be recoverable. In evaluating

long-lived assets for recoverability, the Company uses its best estimate of future cash flows expected to result from the

use of the asset and its eventual disposition. If the estimated future undiscounted net cash flows attributable to the asset

are less than the carrying amount, an impairment loss is recognized equal to the difference between the carrying value of

such asset and its fair value. Assets to be disposed of and for which there is a committed plan of disposal are reported at

the lower of carrying value or fair value less costs to sell. At March 31, 2011, the Company recorded an impairment of

$70 million as discussed in Note 4, “Property, Plant, and Equipment.”

H. Cash and Cash Equivalents

The Company classifies short-term investments that are highly liquid and have maturities of three months or less at the

date of purchase as cash equivalents. Cash and short-term investments are carried at cost which approximates fair value.

I. Restricted Cash

Restricted cash consists of deposits held by the New York Independent System Operator (“NYISO”) and ISO New

England, Inc. (“ISO-NE”).

J. Gas in Storage and Materials and Supplies

Gas in storage is stated at cost, determined on an average weighted cost basis, and is expensed when delivered to

customers. Existing rate orders allow the Company to pass through the cost of gas purchased directly to the rate payers

along with any applicable authorized delivery surcharge adjustments. Accordingly, the value of gas in storage does not

fall below the cost to the Company. Gas costs passed through to the rate payers are subject to periodic regulatory

approvals and are reported periodically to the appropriate regulatory agencies.

Materials and supplies are stated at the lower of cost or market, with cost being determined on an average weighted cost

basis, and are expensed as used or capitalized into specific capital additions as utilized. The Company's policy is to write

off obsolete inventory. For the years ended March 31, 2012 and March 31, 2011 these write offs were not material.

K. Income and Other Taxes

Federal and state income taxes are recorded under the current accounting provisions for the accounting and reporting of

income taxes. Income taxes have been computed utilizing the asset and liability approach that requires the recognition of

deferred tax assets and liabilities for the tax consequences of temporary differences by applying enacted statutory tax

rates applicable to future years to differences between the financial statement carrying amounts and the tax basis of

existing assets and liabilities. NGHI files consolidated federal tax returns including all of the activities of its subsidiaries.

NGUSA is treated as a separate member and calculates its consolidated tax expense or benefit based on the combination

of current and deferred tax expense or benefit of each of its subsidiaries, including NGUSA which is treated as a separate

member. Each member settles its current tax liability or benefit each year directly with NGHI pursuant to a tax sharing

agreement between NGHI and its members. Benefits allocated by NGHI are treated as capital contributions.

Deferred income taxes reflect the tax effect of net operating losses, capital losses and general business credit

carryforwards and the net tax effects of temporary differences between the carrying amount of assets and liabilities for