National Grid 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

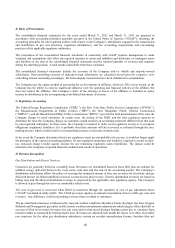

B. Basis of Presentation

The consolidated financial statements for the years ended March 31, 2012 and March 31, 2011 are prepared in

accordance with accounting principles generally accepted in the United States of America (“GAAP”), including the

accounting principles for rate-regulated entities with respect to the Company’ s subsidiaries engaged in the transmission

and distribution of gas and electricity (regulated subsidiaries), and the accounting requirements and rate-making

practices of the applicable regulatory authorities.

The preparation of the consolidated financial statements in conformity with GAAP requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses

during the reporting periods. Actual results could differ from those estimates.

The consolidated financial statements include the accounts of the Company and its wholly and majority-owned

subsidiaries. Non-controlling interests of majority-owned subsidiaries are calculated based upon the respective non-

controlling interest ownership percentages. All intercompany transactions have been eliminated in consolidation.

The Company uses the equity method of accounting for its investments in affiliates, which are 50% or less owned, as the

Company has the ability to exercise significant influence over the operating and financial policies of the affiliates but

does not control the affiliates. The Company’ s share of the earnings or losses of the affiliates is included as equity

income in subsidiaries in the accompanying consolidated statements of income.

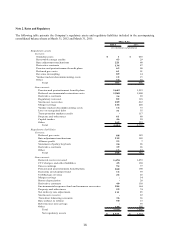

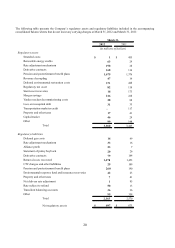

C. Regulatory Accounting

The Federal Energy Regulatory Commission (“FERC”), the New York State Public Service Commission (“NYPSC”),

the Massachusetts Department of Public Utilities (“DPU”), the New Hampshire Public Utilities Commission

(“NHPUC”), and the Rhode Island Public Utility Commission (“RIPUC”) provide the final determination of the rates the

Company charges its retail customers. In certain cases, the actions of the FERC and the state regulatory agencies to

determine the rates the Company charges its customers would result in an accounting treatment different from that used

by non-regulated companies. In these cases, the Company is required to defer costs (regulatory assets) or to recognize

obligations (regulatory liabilities) if it is probable that these amounts will be recovered or refunded through the rate-

making process, which would result in a corresponding increase or decrease in future rates.

In the event the Company determines that its net regulatory assets are not probable of recovery, it would no longer apply

the principles of the current accounting guidance for rate-regulated enterprises and would be required to record an after-

tax, non-cash charge (credit) against income for any remaining regulatory assets (liabilities). The impact could be

material to the Company’ s reported financial condition and results of operations.

D. Revenue Recognition

Gas Distribution and Electric Services

Customers are generally billed on a monthly basis. Revenues are determined based on these bills plus an estimate for

unbilled energy delivered between the cycle meter read date and the end of the accounting period. The Company’ s

distribution subsidiaries follow the policy of accruing the estimated amount of base rate revenues for electricity and gas

delivered but not yet billed (unbilled revenues), to match costs and revenues. Electric distribution revenues are based on

billing rates and the allowed distribution revenue, as approved by the applicable state regulatory agency. The Company

is allowed to pass through for recovery commodity-related costs.

The cost of gas used is recovered when billed to customers through the operation of cost of gas adjustment factor

(“CGAF”) included in utility tariffs. The CGAF provision requires an annual reconciliation of recoverable gas costs and

revenues. Any difference is deferred pending recovery from or refund to customers.

The gas distribution business is influenced by seasonal weather conditions. Brooklyn Union, KeySpan Gas East, Niagara

Mohawk and Narragansett gas utility tariffs contain weather normalization adjustments which largely offset shortfalls or

excesses of firm net revenues (revenues less gas costs and revenue taxes) during a heating season due to variations from

normal weather as measured by heating degree days. Revenues are adjusted each month the clause is in effect. Gas utility

rate structures for the other gas distribution subsidiaries contain no weather normalization feature; therefore their net