National Grid 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

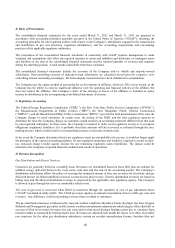

revenues are subject to weather related demand fluctuations. As a result, fluctuations from normal weather may have a

significant positive or negative effect on the results of these operations.

The Revenue Decoupling Adjustment Factor (“RDAF”) requires Narragansett, Massachusetts Electric, Nantucket,

Boston Gas, Colonial Gas, Niagara Mohawk, Brooklyn Union, and KeySpan Gas East to adjust semi-annually its base

rates to reflect the over or under recovery of the Company’ s targeted base distribution revenues from the prior season.

Revenue decoupling is a rate-making mechanism that breaks the link between the Company's base revenue requirement

and sales. This mechanism allows the Company to offer various energy efficiency measures to its customers without any

financial detriment to the Company resulting from reductions in electric and gas usage.

Transmission revenues are based on a formula rate that recovers the Company's actual costs plus a return on investment.

Stranded cost recovery revenues are collected through a contract termination charge (“CTC”), which is billed to former

wholesale customers of the Company in connection with the Company's divestiture of its electricity generation

investments. These billings were completed in December 2011.

Additional electric revenues are derived from billings to LIPA for the electric generation capacity and, to the extent

requested, energy from our existing oil and gas-fired generating plants as discussed in Note 10, "Commitments and

Contingencies" under "Electric Services and LIPA Agreements".

Other Revenues

Revenues earned for service and maintenance contracts associated with small commercial and residential appliances are

recognized as earned or over the life of the service contract, as appropriate.

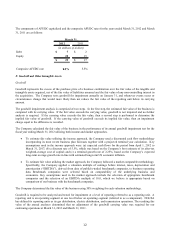

E. Property, Plant and Equipment

Property, plant and equipment are stated at original cost. The cost of additions to property, plant and equipment and

replacements of retired units of property are capitalized. Costs include direct material, labor, overhead and allowance for

funds used during construction (“AFUDC”). The cost of renewals and betterments that extend the useful life of property,

plant and equipment are also capitalized. The cost of repairs, replacements and major maintenance projects, which do not

extend the useful life or increase the expected output of the asset, are expensed as incurred. Depreciation is computed

over the estimated useful life of the asset using the composite straight-line method. Depreciation studies are conducted

periodically to update the composite rates and, for regulated entities, are approved by the applicable state regulatory

authorities. Whenever property, plant and equipment are retired, the original cost, less salvage, is charged to accumulated

depreciation.

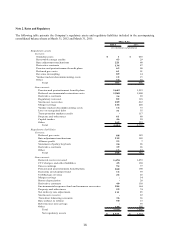

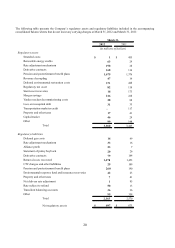

The composite rates and weighted average life for the years ended March 31, 2012 and March 31, 2011 are as follows:

2012

2011

2012

2011

2012

2011

Composite rates 2.7% 2.9% 2.8% 2.8% 4.9% 5.3%

Weighted average life

38 years

35 years

36 years

36 years

21 years

19 years

Common

March 31,March 31,

Electric Gas

March 31,

The Company’ s depreciation expense includes estimated costs to remove property, plant and equipment, which is

recovered through the rates charged to our customers. At each of the years ended March 31, 2012 and March 31, 2011,

NGUSA had costs recovered in excess of costs incurred totaling $1.5 billion. These amounts are reflected as regulatory

liabilities in the accompanying consolidated balance sheets.

In accordance with applicable regulatory accounting guidance, the Company records AFUDC, which represents the

estimated debt and equity costs of capital funds necessary to finance the construction of new regulated facilities. The

equity component of AFUDC is a non-cash amount within the consolidated statements of income. AFUDC is capitalized

as a component of the cost of property, plant and equipment, with an offsetting credit to other income and deductions for

the equity component and other interest expense for the debt component in the accompanying consolidated statements of

income. After construction is completed, the Company is permitted to recover these costs through inclusion in the rate

base and the corresponding depreciation expense for its regulated entities.