National Grid 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

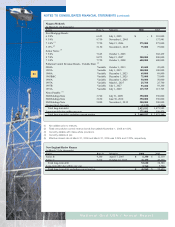

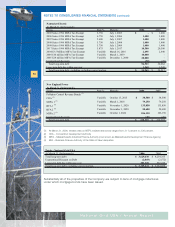

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Pension Benefits

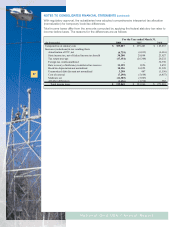

The Company’s net periodic benefit cost for the fiscal years ended March 31, 2006, 2005, and

2004 included the following components:

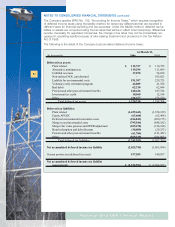

The following table provides a reconciliation of the changes in the plans’ fair value of assets for the

fiscal years ended March 31, 2006 and 2005:

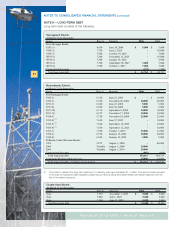

The following table provides the changes in the Company’s pension plans’ benefit obligations, rec-

onciliation of the benefit obligation, funded status and the amounts recognized in the balance

sheet at March 31:

55

National Grid USA / Annual Report

(in thousands) 2006 2005 2004

Service cost 55,412$ 51,346$ 47,989$

Interest cost 155,779 150,249 152,851

Expected return on plan assets (161,944) (165,347) (160,892)

Amortization of unrecognized prior service cost 4,913 3,310 2,660

Amortization of unrecognized loss 64,067 54,401 44,371

Net periodic benefit costs before settlements

and curtailments 118,227 93,959 86,979

Settlement and curtailment loss - 185 23,144

Special termination benefits - - 91,855

Net periodic benefit cost 118,227$ 94,144$ 201,978$

(in thousands) 2006 2005

Beginning balance, April 1, 1,960,624$ 1,947,572$

Actual return on plan assets 257,055 134,990

Employer contributions 134,916 140,369

Benefit payments (204,985) (261,249)

Settlements - (1,058)

Ending balance, March 31, 2,147,610$ 1,960,624$

(in thousands) 2006 2005

Accumulated benefit obligation 2,470,161$ 2,520,588$

Beginning balance, April 1, 2,808,396$ 2,723,921$

Service cost 55,412 51,346

Interest cost 155,779 150,249

Actuarial (gains)/losses (66,136) 113,983

Plan amendments - 31,201

Benefit payments (204,985) (261,249)

Settlements - (1,058)

Ending balance, March 31, 2,748,466$ 2,808,393$