National Grid 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RESULTS OF OPERATIONS

The following discussion and analysis highlights items that significantly affected the Company’s

operations during the fiscal years ended March 31, 2006 and 2005.

EARNINGS

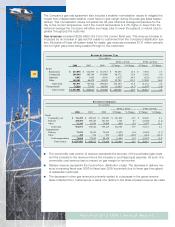

Net income for the fiscal year ended March 31, 2006 increased approximately $8 million (2%) as

compared to the prior fiscal year and increased approximately $288 million (108%) for the fiscal

year ended March 31, 2005 as compared to the prior fiscal year. The increases are primarily due

to the following:

For further discussion regarding each of the respective amounts identified above, please refer to

the appropriate sections of this report that follow.

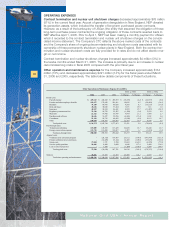

ELECTRIC

The Company’s electricity business encompasses the transmission, distribution, and delivery

of electricity including stranded cost recoveries. The Company’s distribution subsidiaries

(Massachusetts Electric, Narragansett Electric, Granite State Electric and Nantucket Electric) are

responsible for the distribution and sale of electricity to customers while NEP is responsible for the

transmission of electricity. Niagara Mohawk is responsible for the transmission, distribution, and

sale of electricity.

The Company is no longer in the business of electricity generation and has divested its formerly

owned generation assets (the Company still retains a nine percent joint ownership interest in the

Wyman #4 generating unit in Maine, which the Company is attempting to sell). Since deregulation,

electricity customers have the ability to choose an alternative supplier of their electricity other than

the retail distribution company serving that customer’s region. For customers who have not cho-

sen an alternative supplier, the Company procures power on their behalf. These energy procure-

ment costs (i.e., purchased electricity expenses) are recoverable from customers and do not

impact the Company’s electric margin or net income.

12

National Grid USA / Annual Report

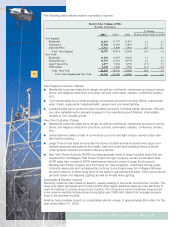

Notes 2006 2005

Prior year net income 553,698$ 266,084$

Changes in:

Electric margin 112,783 1,953

Gas margin (1,623) 1,406

Other operation and maintenance (a) (87,757) 248,996

Depreciation and amortization (11,091) (6,763)

Other taxes (b) (6,251) 11,854

Income taxes (9,823) (36,562)

Other income and deductions (10,431) 26,760

Interest 19,522 38,530

Gridcom (c) 3,038 1,440

Total changes 8,367 287,614

Current year net income 562,065$ 553,698$

Notes to table:

(a) Amounts exclude Gridcom expenses and pass through items which are included

in the electric margin calculation.

(b) Amounts exclude gross receipts taxes which are included

in the electric and gas margin calculations.

(c) Amounts represent the change in revenue and operating expenses in the Company's

non-regulated telecommunications businesses.

Fiscal year ended March 31,