National Grid 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

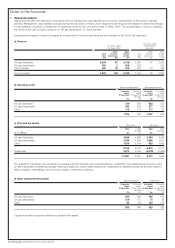

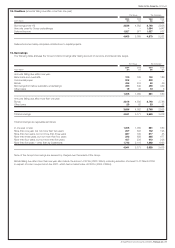

17. Financial instruments (continued)

Currency and interest rate composition of financial assets

The currency and interest rate composition of the Group’s financial assets are shown in the table below after taking account of currency and interest

rate swaps.

Fixed rate assets

Weighted

average

Weighted period

Non-interest average for which

Total bearing Fixed rate interest rate rate is fixed

At 31 March 2004 £m £m £m % Years

Sterling 72 – 72 3.7 0

US dollars 2 – 2 1.1 0

Other currencies 1 – 1 2.0 0

Cash and investments 75 – 75 – –

Other financial assets (sterling) 2,544 2,544 – – –

2,619 2,544 75 – –

At 31 March 2003

Sterling 3 – 3 4.0 0

US dollars 2 – 2 1.1 0

Other currencies 2 – 2 2.5 0

Cash and investments 7 – 7 – –

Other financial assets (sterling) 2,241 2,241 – – –

2,248 2,241 7 – –

Other financial assets comprises amounts owed by Transco’s immediate parent company, Transco Holdings plc.

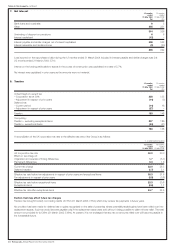

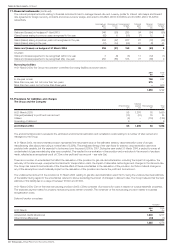

The maturity profile of the Group’s financial liabilities and assets are shown in the tables below after taking into account currency and interest rate

swaps.

2004 2003

Maturity of financial liabilities at 31 March £m £m

In one year or less 1,305 1,093

More than one year, but not more than two years 260 647

More than two years, but not more than three years 887 203

More than three years, but not more than four years 293 892

More than four years, but not more than five years 457 240

More than five years 1,742 2,116

4,944 5,191

2004 2003

Maturity of financial assets at 31 March £m £m

In one year or less 75 7

No maturity date 2,544 2,241

2,619 2,248

Financial assets with no maturity date comprise amounts owed by Transco’s immediate parent company, Transco Holdings plc.

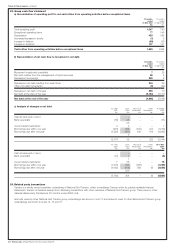

Fair values of financial instruments at 31 March 2004 2003

Book value Fair value Book value Fair value

£m £m £m £m

Financial instruments held or issued to finance the Group’s operations:

Short-term borrowings (1,305) (1,267) (1,089) (1,093)

Long-term borrowings (3,578) (4,079) (4,174) (4,677)

Financial assets 2,619 2,619 2,248 2,248

Financial instruments held to manage the interest rate and currency profile:

Interest rate swaps –14 – 62

Forward foreign currency contracts and cross currency swaps (58) 90 92 313

Market values, where available, have been used to determine fair values. Where market values are not available, fair values have been calculated

by discounting future cash flows at prevailing interest rates.

Notes to the Accounts_continued

Annual Report and Accounts 2003/04_Transco plc 29