National Grid 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

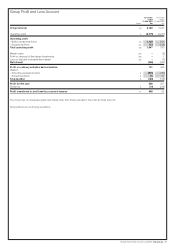

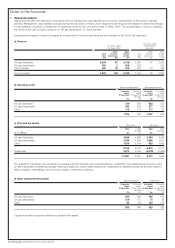

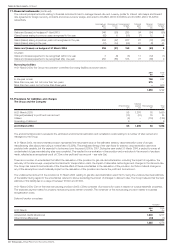

7. Net interest

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

£m £m

Bank loans and overdrafts 95

Other 305 331

314 336

Unwinding of discount on provisions 66

Interest capitalised (12) –

Interest payable and similar charges net of interest capitalised 308 342

Interest receivable and similar income (2) (20)

306 322

Loss incurred on the repurchase of debt during the 12 months ended 31 March 2004 included in interest payable and similar charges was £nil

(12 months ended 31 March 2003: £7m).

Interest on the funding attributable to assets in the course of construction was capitalised at a rate of 5.7%.

No interest was capitalised in prior years as the amounts were not material.

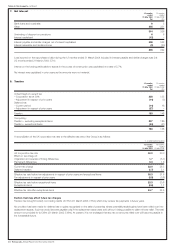

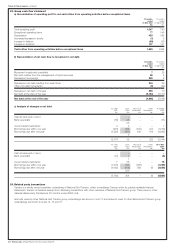

8. Taxation

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

£m £m

United Kingdom current tax

– Corporation tax at 30% 238 135

– Adjustment in respect of prior years (14) (5)

Deferred tax

– Current period (14) 18

– Adjustment in respect of prior years (27) –

Taxation 183 148

Comprising:

Taxation – excluding exceptional items 207 189

Taxation – exceptional items (24) (41)

183 148

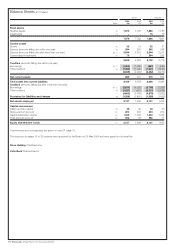

A reconciliation of the UK corporation tax rate to the effective tax rate of the Group is as follows:

% of profit before taxation

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

UK corporation tax rate 30.0 30.0

Effect on tax charge of:

Origination and reversal of timing differences 1.7 (3.1)

Permanent differences 0.3 1.6

Current tax charge 32.0 28.5

Deferred taxation (1.7) 3.1

Effective tax rate before tax adjustments in respect of prior years and exceptional items 30.3 31.6

Tax adjustments in respect of prior years (5.0) (0.8)

Effective tax rate before exceptional items 25.3 30.8

Exceptional items (0.6) 1.7

Effective tax rate after exceptional items 24.7 32.5

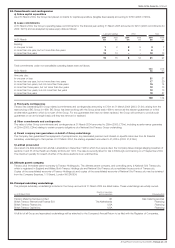

Factors that may affect future tax charges

Transco has brought forward non-trading debits of £75m (31 March 2003: £75m) which may reduce tax payments in future years.

No provision has been made for deferred tax on gains recognised on the sale of properties where potentially taxable gains have been rolled over into

replacement assets. Such tax would become payable only if the replacement asset were sold without it being possible to claim roll-over relief. The total

amount not provided for is £46m (31 March 2003: £46m). At present, it is not envisaged that any tax on amounts rolled over will become payable in

the foreseeable future.

24 Transco plc_Annual Report and Accounts 2003/04

Notes to the Accounts_continued