National Grid 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial review_continued

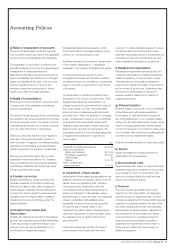

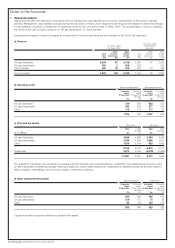

Tur nover

Turnover includes an assessment of transportation

services supplied to customers between the date

of the last meter reading and the year-end.

Changes to the estimate of the transportation

services supplied during this period would have an

impact on the reported results of the Group.

Turnover in respect of transportation services

supplied comprises amounts invoiced to shippers

plus an estimate for transportation services

supplied but not yet invoiced, which substantially

represents the transportation services supplied

in respect of the last month of the financial year.

The estimated element of turnover is determined

as the total of commodity services supplied,

calculated from the actual volume of gas

transported at estimated weighted average

prices, based on recent history and the value of

capacity services supplied, which are contracted

amounts. This estimate affects the UK gas

distribution and UK gas transmission segments.

Under UK GAAP, the Group is not permitted to

and has not recognised any liability for amounts

received or receivable from customers in excess

of the maximum amount allowed for the year

under regulatory agreements that will result in

an adjustment to future prices.

Pensions

The substantial majority of the Group’s

employees are members of the Lattice Group

Pension Scheme (the Scheme). The Group

recognises pension costs in its profit and loss

account as they are charged to the Group by

Lattice. The charge from Lattice comprises the

regular pension cost of the Group’s employees

and variations from the regular pension cost in

respect of the effect of any surplus or deficit

attributable to the Group.

A new UK accounting standard (FRS 17) will

replace existing GAAP. As the Group’s share of

the assets and liabilities of the Scheme cannot be

reasonably identified, the Scheme will be treated

as a defined contributions scheme for the

purposes of FRS 17. However, FRS 17 may

significantly change the amount of pension costs

charged to the Group by Lattice.

Pensions are inherently long term, and future

experience may differ from the actuarial

assumptions used to determine the net charge

for pensions.

Note 6 to the accounts on page 23 describes

the principal assumptions that have been used

to determine the pension charges in accordance

with current UK GAAP. The calculation of any

charge relating to pensions is clearly dependent

on the assumptions used, which reflects the

exercise of judgement. Management exercises

that judgement having regard to independent

actuarial advice.

Restructuring costs

The application of UK GAAP measurement

principles results in the recognition of restructuring

costs, mainly redundancy related, when the

Group is irrevocably committed to the

expenditure, with the main features of any

restructuring plan being communicated to affected

employees. If material, these costs are recognised

as exceptional. Restructuring costs recognised by

the Group are referred to in ‘Exceptional items’.

Derivative financial instruments

Derivatives are used by the Group to manage

its interest rate and foreign currency risks. All

such transactions are undertaken to provide

a commercial hedge of risks entered into by

the Group.

With the exception of indexed linked swap

contracts, UK GAAP applies a ‘historical cost’

and ‘hedge accounting’ model to these

‘derivatives’. Substantially, this model results in

gains and losses arising on derivatives being

recognised in the profit and loss account or

statement of total recognised gains and losses

at the same time as the gain or loss on the item

being hedged is recognised.

The application of a ‘fair value’ model would

result in derivatives being marked to market.

Gains or losses relating to these derivatives may

or may not be recognised in the profit and loss

account or statement of total recognised gains

and losses at the same time as any related gains

or losses on underlying economic exposures,

depending upon whether the derivatives are

deemed to have a hedging relationship.

Note 17 to the accounts on pages 28 to 30

gives a significant amount of detail relating to

the Group’s financial instruments. This includes

the identification of the difference between the

‘carrying value’ and ‘fair value’ of the Group’s

financial instruments, including ‘derivatives’.

Environmental liabilities

Provision is made for liabilities arising from

statutory decontamination costs of old gas

manufacturing sites owned by the Group. The

calculation of this provision is based on estimated

cash flows relating to those costs discounted at

an appropriate discount rate where the impact

of discounting is material. The total costs and the

timing of cash flows relating to environmental

liabilities are based on management estimates,

supported by the use of external consultants.

There may be variances from these amounts

that could materially affect future results.

Related party transactions

The Group provides services to and receives

services from its related parties. As a wholly

owned subsidiary undertaking of National Grid

Transco, which consolidates Transco within its

publicly available financial statements, Transco is

exempt from disclosing transactions with other

members of National Grid Transco group. There

were no other material related party transactions.

Changes and developments

Any significant changes and developments that

have occurred since 31 March 2004 have been

noted in this Annual Report and Accounts.

Otherwise, there have been no significant

changes or developments since 31 March 2004.

Going concern

Having made enquiries, the Directors consider

that the Company and the Group have adequate

resources to continue in business for the

foreseeable future and that it is therefore

appropriate to adopt the going concern basis in

preparing the accounts.

Annual Report and Accounts 2003/04_Transco plc 11