National Grid 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

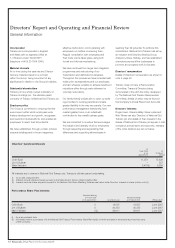

Financial review_continued

At 31 March 2004, Transco had £0.76 billion of

short-term (364 day) committed facilities (undrawn),

£0.58 billion of long term committed facilities

(undrawn); and £0.9 billion (undrawn) of

uncommitted borrowing facilities.

Treasury policy

The funding and treasury risk management of

the Group is carried out on its behalf by a central

department operating under policies and

guidelines approved by the Board of National

Grid Transco. The Finance Committee, a

committee of the Board of National Grid Transco,

is responsible for regular review and monitoring

of treasury activity and for approval of specific

transactions, the authority for which may be

delegated. The National Grid Transco group has

a Treasury function that raises all of the funding

for the National Grid Transco group and manages

interest rate and foreign exchange rate risk.

There is a separate financing programme for

Transco. All significant issues in relation to the

funding of Transco are approved by the Finance

Committees of both National Grid Transco and

Transco.

The Treasury function is not operated as a profit

centre. Debt and treasury positions are managed

in a non-speculative manner, such that all

transactions in financial instruments or products

are matched to an underlying current or

anticipated business requirement. The use of

derivative financial instruments is controlled by

policy guidelines set by the Board of National

Grid Transco. Derivatives entered into in respect

of gas commodities are used in support of the

business operational requirements and the policy

regarding their use is explained below.

Details of the maturity, currency and interest rate

profile of the Group’s borrowings as at 31 March

2004 are shown in note 17 to the accounts on

pages 28 to 30.

The Group’s financial position enables it

to borrow on the wholesale capital and money

markets and most of its borrowings are through

public bonds and commercial paper. These

borrowings contain no restrictive covenants.

The Group places surplus funds on the money

markets usually in the form of short term fixed

deposits which are invested with approved banks

and counterparties. Details of the Group’s short

term investments as at 31 March 2004 are

shown in note 17 to the accounts on page 29.

Transco plc has a credit rating of A2/A. It is a

condition of the regulatory ring-fence around

Transco plc that it uses reasonable endeavours

to maintain an investment grade credit rating.

This rating means that Transco should have ready

access to the capital and money markets for

future funding when necessary.

The main risks arising from the Group’s financing

activities are set out below. The Board of National

Grid Transco and the Finance Committee of that

Board reviews and agrees policies for managing

each risk and they are summarised below.

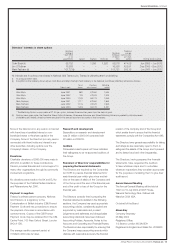

Refinancing risk management

The Board of National Grid Transco mainly controls

refinancing risk by limiting the amount of financing

obligations (both principal and interest) arising on

borrowings in any 12-month and 36-month period.

This policy restricts the Group from having an

excessively large amount of debt to refinance in

a given time-frame. During the year, a mixture of

short term debt and long term debt was issued.

Interest rate risk management

The interest rate exposure of the Group arising

from its borrowings and deposits is managed by

the use of fixed and floating rate debt, interest

rate swaps, swaptions and forward rate

agreements. The Group’s interest rate risk

management policy is to seek to minimise total

financing costs (ie interest costs and changes in

the market value of debt) subject to constraints

so that even with large movements in interest

rates, neither the interest cost nor the total

financing cost can exceed pre-set limits.

The performance of the Treasury function in

interest rate risk management is measured by

comparing the actual total financing costs of

its debt with those of a passively-managed

benchmark portfolio.

Foreign exchange risk management

The Group has a policy of hedging certain

contractually committed foreign exchange

transactions over a prescribed minimum size.

It covers 75% of such transactions expected to

occur up to six months in advance and 50% of

transactions in the 6 to 12 month period in

advance. Cover generally takes the form of forward

sale or purchase of foreign currencies and must

always relate to underlying operational cash flows.

Counterparty risk management

Counterparty risk arises from the investment of

surplus funds and from the use of derivative

instruments. The Finance Committee of the Board

of National Grid Transco has agreed a policy for

managing such risk, which is controlled through

credit limits, approvals and monitoring procedures.

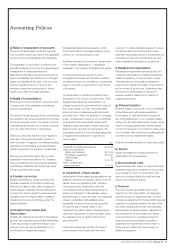

Derivative financial instruments held for

purposes other than trading

As part of its business operations, the Group is

exposed to risks arising from fluctuations in

interest rates and exchange rates. The Group

uses off-balance sheet derivative financial

instruments (derivatives) to manage exposures

of this type and, as such, they are a useful tool

in reducing risk. The Group’s policy is not to

use derivatives for trading purposes. Derivative

transactions can, to varying degrees, carry both

counterparty and market risk.

The Group enters into interest rate swaps to

manage the composition of floating and fixed rate

debt, and so hedge the exposure of borrowings

to interest rate movements. In addition the Group

enters into bought and written option contracts

on interest rate swaps. These transactions are

known as swaptions. The Group also enters into

foreign currency swaps to manage the currency

composition of borrowings and so hedge the

exposure to exchange rate movements. Certain

agreements are combined foreign currency and

interest rate swap transactions. Such agreements

are known as cross-currency swaps.

The Group enters into forward rate agreements

to hedge interest rate risk on short-term debt

and money market investments. Forward rate

agreements are commitments to fix an interest

rate that is to be paid or received on a notional

deposit of specified maturity, commencing at a

future specified date.

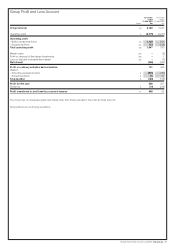

Valuation and sensitivity analysis

The Group calculates the fair value of debt and

derivative instruments by discounting all future

cash flows by the market yield curve at the

balance sheet date. The market yield curve for

each currency is obtained from the Reuters or

Bloomberg screen notes for interest and foreign

exchange rates. In the case of instruments with

optionality, the Black’s variation of the Black-

Scholes model is used to calculate fair value.

For debt and derivative instruments held, the

Group utilises a sensitivity analysis technique

Annual Report and Accounts 2003/04_Transco plc 9