NEC 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 NEC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008

25.0%

22.2%

19.9%

15.9%

15.4%

2009

4,617.2

2010

4,215.6

2011

3,583.1

3,115.4

3,036.8

2012

6,000.0

4,000.0

2,000.0

0

200.0

150.0

50.0

100.0

0

3.4%

–0.1%

1.4%

1.9%

156.8

–6.2

50.9 57.8

–50.0 2008 2009 2010 2011 2012

73.72.4%

0.5%

–7.0%

0.3%

–0.4%

22.7

–296.6

11.4

2008 2009 2010 2011 2012

–110.3

–3.6%

–300.0

0

10.0

20.0

30.0

–12.5

2008 2009 2010 2011 2012

0

400.0

800.0

1,200.0

28.5%

20.9%

26.9% 28.8%

1,004.2

641.7

790.9 757.1

25.7%

657.0

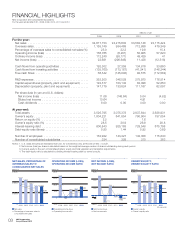

FINANCIAL HIGHLIGHTS

NEC Corporation and Consolidated Subsidiaries

For the years ended March 31, 2008, 2009, 2010, 2011 and 2012

Millions of yen

2008 2009 2010 2011

For the year:

Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥4,617,153 ¥4,215,603 ¥3,583,148 ¥3,115,424

Overseas sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,155,749 934,469 712,886 479,349

Percentage of overseas sales to consolidated net sales (%) 25.0 22.2 19.9 15.4

Operating income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . 156,765 (6,201) 50,905 57,820

Ordinary income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112,240 (93,171) 49,429 41

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,681 (296,646) 11,428 (12,518)

Cash flows from operating activities . . . . . . . . . . . . . . . . . . 192,302 27,359 134,816 33,660

Cash flows from investing activities . . . . . . . . . . . . . . . . . . (135,760) (173,167) (41,241) (146,244)

Free cash flows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56,542 (145,808) 93,575 (112,584)

R&D expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 352,200 346,529 275,970 176,514

Capital expenditures (property, plant and equipment) . . . . . 122,577 103,142 83,098 52,850

Depreciation (property, plant and equipment) . . . . . . . . . . . 147,779 133,624 111,167 62,097

Per share data (in yen and U.S. dollars):

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.06 (146.64) 5.04 (4.82)

Diluted net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.64 – 4.91 –

Cash dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.00 0.00 4.00 0.00

At year-end:

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,526,795 3,075,378 2,937,644 2,628,931

Owner’s equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,004,221 641,654 790,904 757,054

Return on equity (%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.2 – 1.6 –

Owner’s equity ratio (%) . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.5 20.9 26.9 28.8

Interest-bearing debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 800,843 925,163 729,548 675,798

Debt-equity ratio (times) . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.80 1.44 0.92 0.89

Number of employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . 152,922 143,327 142,358 115,840

Number of consolidated subsidiaries . . . . . . . . . . . . . . . . . 334 328 310 283

Notes: 1. U.S. dollar amounts are translated from yen, for convenience only, at the rate of ¥82 = U.S.$1.

2. Net income (loss) per share is calculated based on the weighted-average number of shares outstanding during each period.

3. Owner’s equity is the sum of total shareholders’ equity and total valuation and translation adjustments.

4. The debt-equity ratio is calculated by dividing interest-bearing debt by owner’s equity.

Net sales

Percentage of overseas sales to

consolidated net sales

Net income (loss)

Net income ratio

OWNER’S EQUITY,

OWNER’S EQUITY RATIO

(Billion ¥)

Owner’s equity

Owner’s equity ratio

(At year-end)

Operating income (loss)

Operating income ratio

NET SALES, PERCENTAGE OF

OVERSEAS SALES TO

CONSOLIDATED NET SALES

(Billion ¥)

OPERATING INCOME (LOSS),

OPERATING INCOME RATIO

(Billion ¥)

NET INCOME (LOSS),

NET INCOME RATIO

(Billion ¥)

03 NEC Corporation

Annual Report 2012