NEC 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 NEC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nevertheless, the business environment

surrounding NEC became even more challenging

than initially anticipated. For this reason, NEC

finished fiscal 2012 on a disappointing note in terms

of business results. Operating income fell short of

our initial ¥90 billion target, mainly reflecting the lack

of competitiveness in smartphones, and the impact

of the flooding in Thailand. Furthermore, we

reviewed deferred tax assets in light of Japan’s tax

reforms and our business results for fiscal 2012.

Consequently, for the second straight year, NEC

recorded a net loss and decided to pay no annual

dividend. As the president of NEC, I deeply regret

these results.

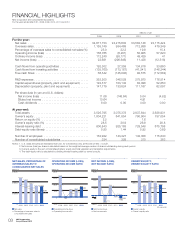

(Billion ¥)

FY2010/3 FY2011/3 FY2012/3

Results Results Initial plan Results

Net sales 3,583.1 3,115.4 3,300.0 3,036.8

Overseas sales 712.9 479.3 481.5

Overseas sales ratio 19.9%* 15.4% 15.9%

Operating income 50.9 57.8 90.0 73.7

Operating income ratio 1.4% 1.9% 2.7% 2.4%

Net income (loss) 11.4 –12.5 15.0 –110.3

Return on equity (ROE) 1.6% – –

* 15.6% excluding the semiconductor business

NEC has so far striven to drive business expansion

with the view to achieving its net sales target of ¥4

trillion in fiscal 2013. However, in light of the strong

yen and other market factors and no likelihood of

any sharp recovery in the economic environment or

business conditions, we have decided to change

our management policy. We are now making every

effort to transform NEC into an enterprise that can

generate stable operating income of more than

¥100 billion even with the current level of net sales

of ¥3 trillion. In line with this, in fiscal 2012, NEC

recorded an extraordinary loss of ¥40.5 billion for

business structure improvement expenses,

including personnel reductions.

NEC will first implement personnel reductions as

part of structural reforms aimed at making NEC a

solidly profitable enterprise. At the same time, NEC

will press ahead with structural reforms of

challenged business areas, such as the mobile

phone business and the platform business.

NEC plans to reduce personnel by approximately

10,000 by the end of September 2012. These

personnel should consist of around 7,000 staff

members in Japan, including external contractors,

and approximately 3,000 staff members overseas.

NEC will consider far-reaching structural reforms

of its mobile phone business, such as outsourcing

part of its domestic development and production to

overseas companies. In the platform business, NEC

will promote alliances and collaboration with other

companies particularly in the fields of hardware

including servers, with the aim of establishing a

globally competitive business, while streamlining the

NEC Group’s development and production

operations.

As a result of implementing cost reductions in

addition to these structural reforms, NEC is

projecting a positive impact of ¥40.0 billion on

operating income in fiscal 2013, compared with

fiscal 2012.

2. Structural Reforms

09 NEC Corporation

Annual Report 2012